Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

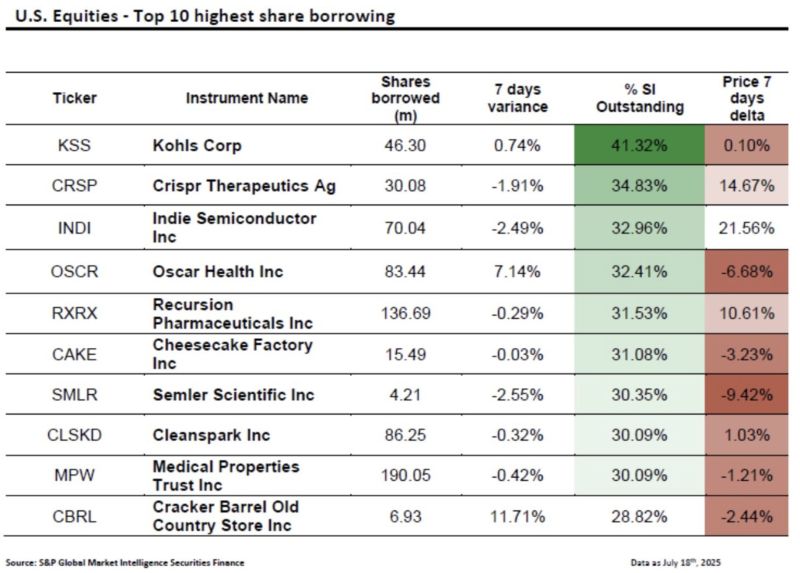

The meme stock frenzy is making a comeback.

Retail investors seem to be targeting the most shorted stocks again — one by one. Kohls is the new darling Source: HolgerZ, S&P Global

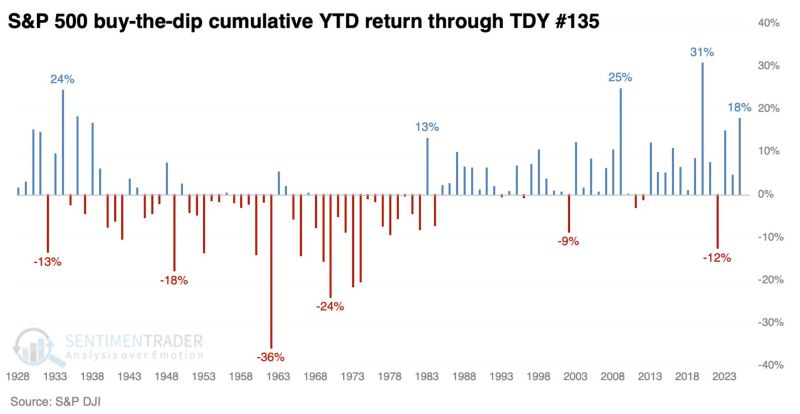

'Buy the Dip' mentality remains strong.

So far this year, the cumulative gain by buying a down day in the S&P 500 and holding it only for the next session is +18% ... tied for the fourth-highest since 1948 Source: Kevin Gordon @KevRGordon

Opendoor is the market’s latest Meme Stock w/insane trading volumes.

Shares of the San Francisco-based tech group that focuses on the stagnant real estate sector have nearly tripled in value over the past week. The rally appears to have been sparked by a prominent investor discussing the stock on social media, which drew the attention of retail traders. The company has struggled since peaking at a $20.6bn valuation in February 2021, shortly after merging with the SPAC (special purpose acquisition company) Social Capital Hedosophia Holdings Corp II, led by Chamath Palihapitiya. That decline isn’t surprising: Opendoor’s core business is in the "instant buyer" market, where it aims to make home sales faster and bypass traditional realtor fees—an idea that has faced serious challenges in a cooling housing market. Yesterday was a roller-coaster, with the stock declining -40% in the last hour of trading after being up more than 67% intraday... Source: HolgerZ

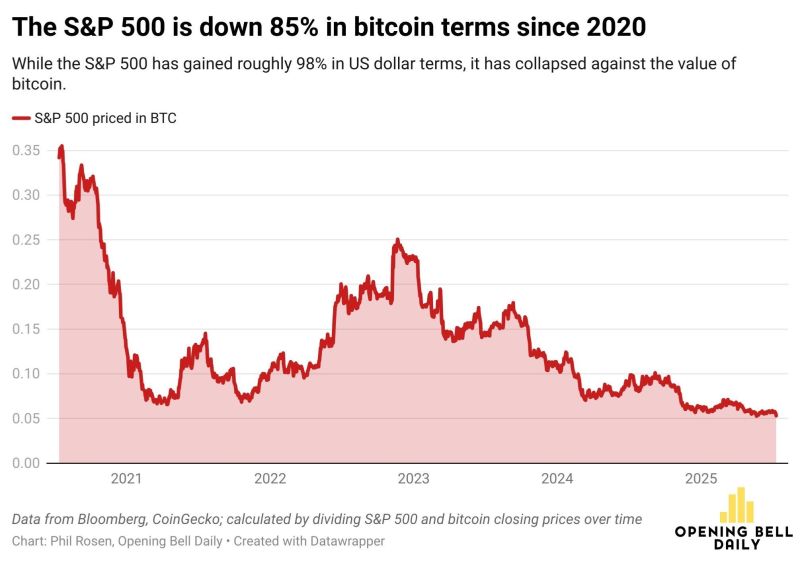

BREAKING: The S&P 500 is down 85% in Bitcoin terms since 2020.

Source: Bitcoin Archive @BTC_Archive

⚠️Corporate executives are EXTREMELY bearish:

11.1% of S&P 500 firms with the recent insider activity saw more buying than selling by corporate officers and directors, the LOWEST share EVER. 10 of the 11 sectors saw negative activity in all company sizes including large-cap. Source: Global Markets Investor

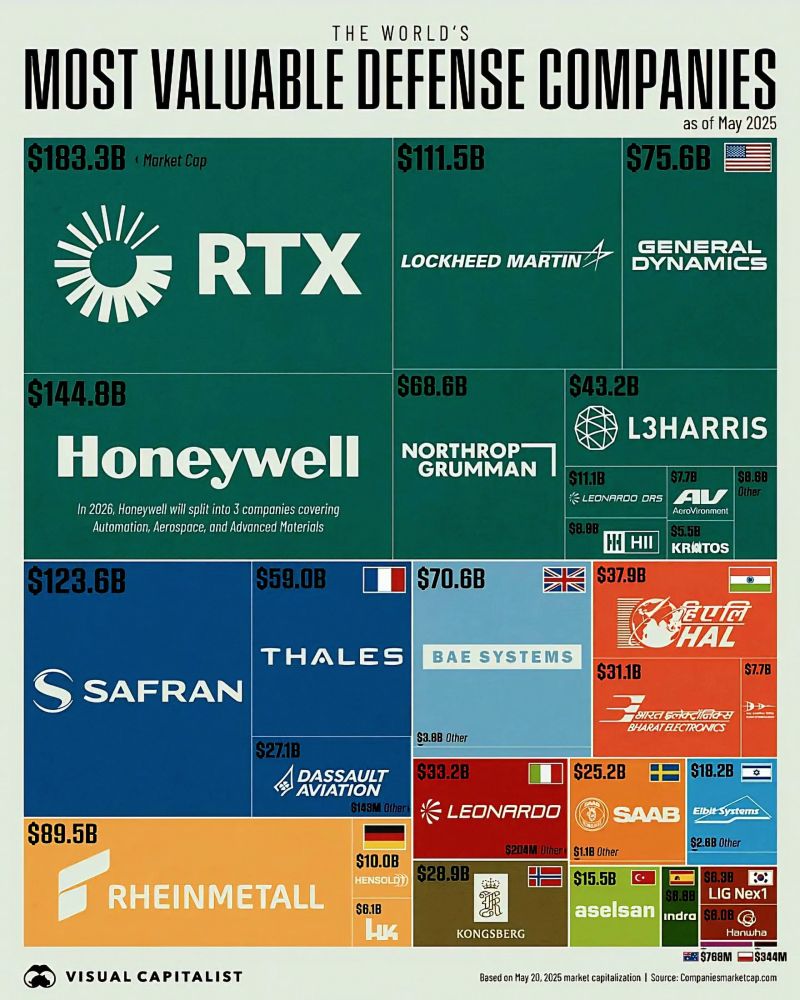

World's Most Valuable Defense Companies

Source: Global Statistics

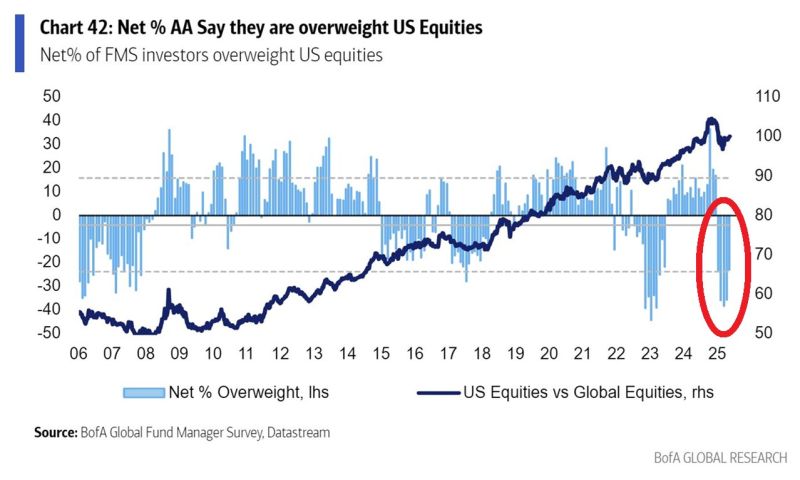

⚠️ Global fund managers are under invested in US stocks:

▶️ Professional investors have remained UNDERWEIGHT US equities versus global stocks for the 5th consecutive month. 👉 Meanwhile, the MSCI World Ex. USA index is up 17% year-to-date, beating the S&P 500 gain of 7%. Source: Global Markets Investor, BofA

Investing with intelligence

Our latest research, commentary and market outlooks