Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

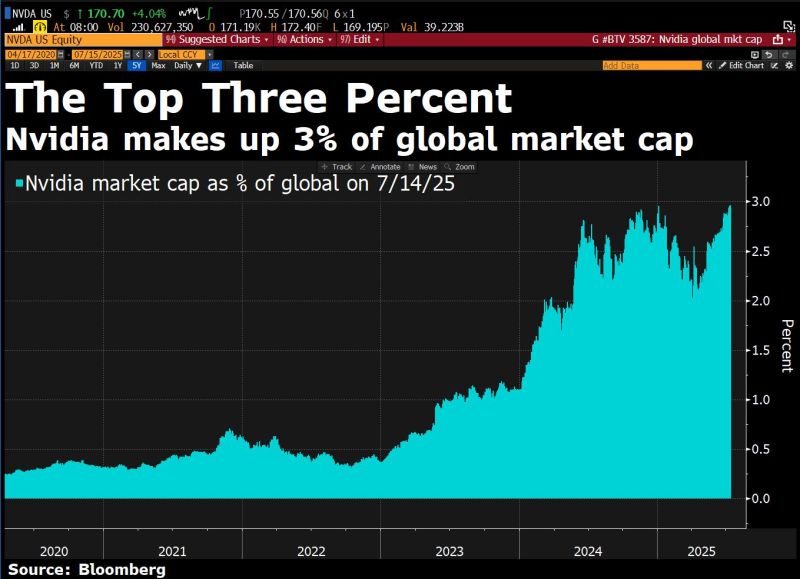

Nvidia is 3% of global market cap. The other 82,292 stocks (Bloomberg-tracked primary listings) make up the other 97%.

Source: David Ingles, Bloomberg

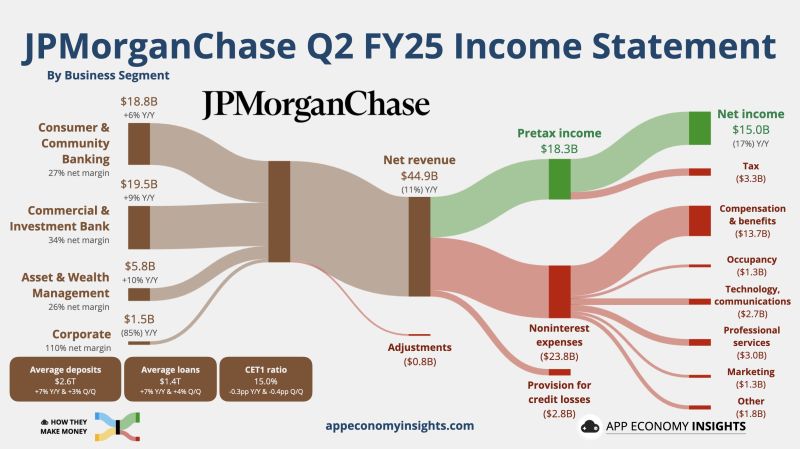

⚠️ JPMorgan Chase on Tuesday topped analysts’ estimates on better-than-expected revenue from fixed income trading and investment banking.

▶️ The bank said that second-quarter earnings fell 17% to $14.9 billion, or $5.24 a share, from the year-earlier period, when it had a $7.9 billion gain on Visa shares. But even when backing out a $774 million income tax benefit that boosted per share earnings by 28 cents, JPMorgan topped estimates for the quarter. 🔴 $JPM JPMorganChase Q2 FY25. • Net revenue -11% Y/Y to $44.9B ($1.7B beat). • Net Income -17% Y/Y to $15.0B. • EPS: $4.96 ($0.48 beat). • FY25 NII ~$95.5B ($1.0B raise). Source: App Economy Insights, CNBC

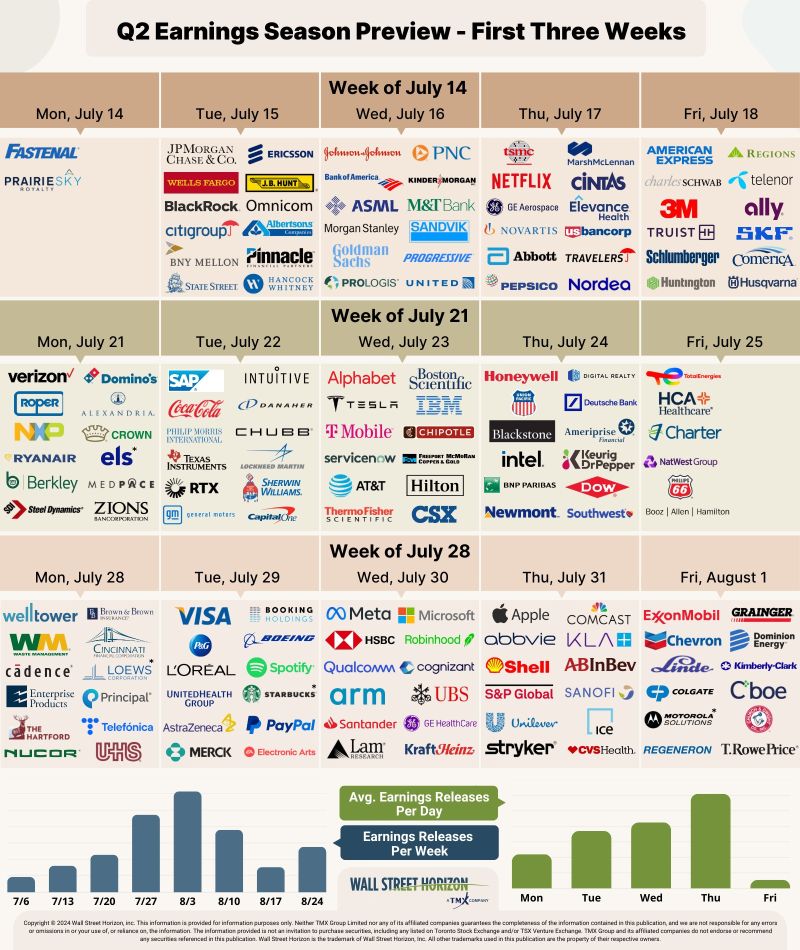

The Q2 2025 earnings season begins this week, with analysts forecasting modest S&P 500 EPS growth of 4.8%, the lowest rate since Q4 2023.

Early reports have already painted a mixed picture, showing strong AI and travel demand ( $MU, $DAL ) but softness in consumer goods and shipping ( $NKE, $FDX). The spotlight is now on the big banks, with $JPM, $C, $WFC, and others reporting Tuesday and Wednesday. In their reports, we'll be watching for commentary on three key themes: credit quality, a potential recovery in investment banking, and the expected plateau in net interest income. Source: Wall Street Horizon

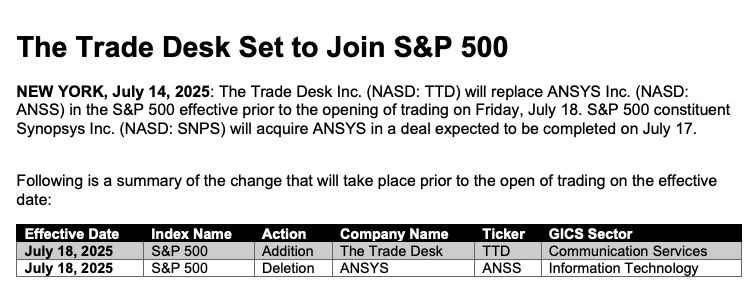

TRADE DESK IS JOINING THE S&P 500

Trade Desk $TTD will replace ANSYS in the S&P 500 before the markets open on July 18th.

The electrification theme in 4 charts

Platinum, palladium, copper, uranium. Four key metals in the electrification of everything. As highlighted by @DimitryFarberov on X, their quarterly charts are starting to come alive. • Copper just broke out of a 15+ year base • Platinum finally cleared its downtrend • Palladium trying to bottom at major support • Uranium still in its handle, consolidating after a huge move Different charts, same theme.

Oops... Jim Cramer just coined a new acronym PARC

Palantir $PLTR AppLovin $APP Robinhood $HOOD Coinbase $COIN Is it the end of the party for these 4 high flying stocks? Source: Evan on X

Gold now outperforming the U.S. Stock Market (dividends included) over the last 25 years.

Incredible! Source: Barchart

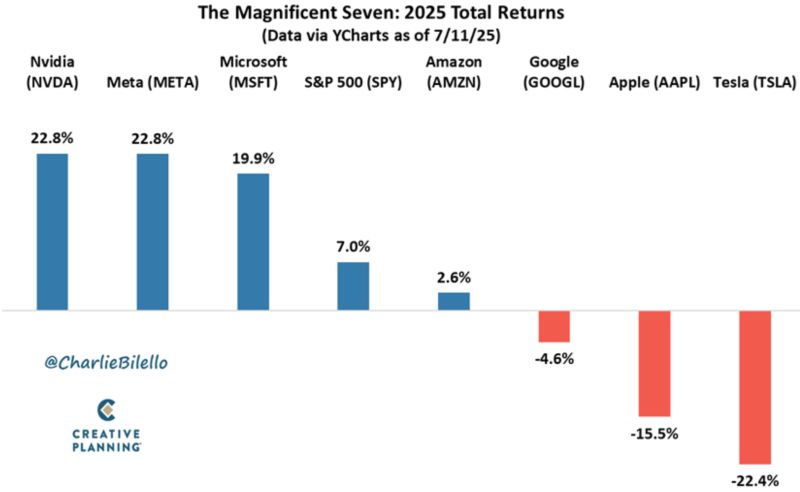

Wide dispersion among the Mag 7 so far this year

-Nvidia/Meta/Microsoft outperforming -Amazon/Google/Apple/Tesla underperforming Big shift from the previous few years when they all moved in tandem. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks