Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

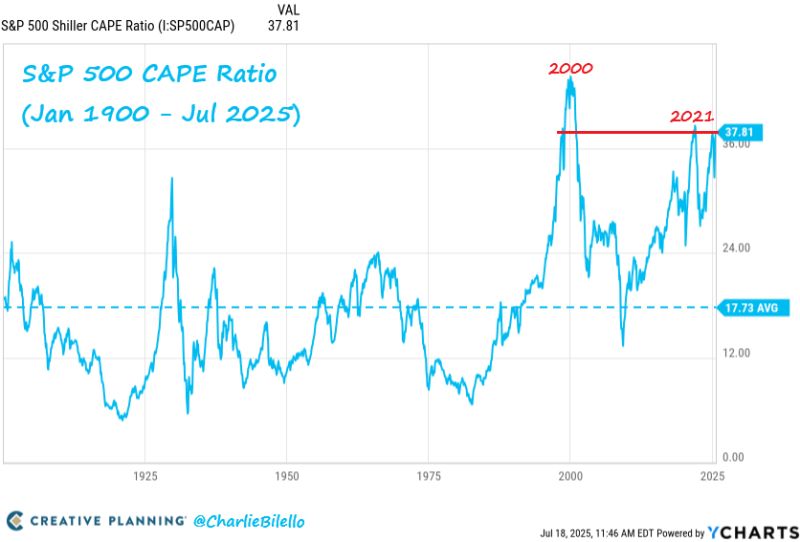

The SP500's CAPE Ratio is about to cross above 38 for the 3rd time in history, now higher than 98% of historical valuations. $SPX

Source: Charlie Bilello

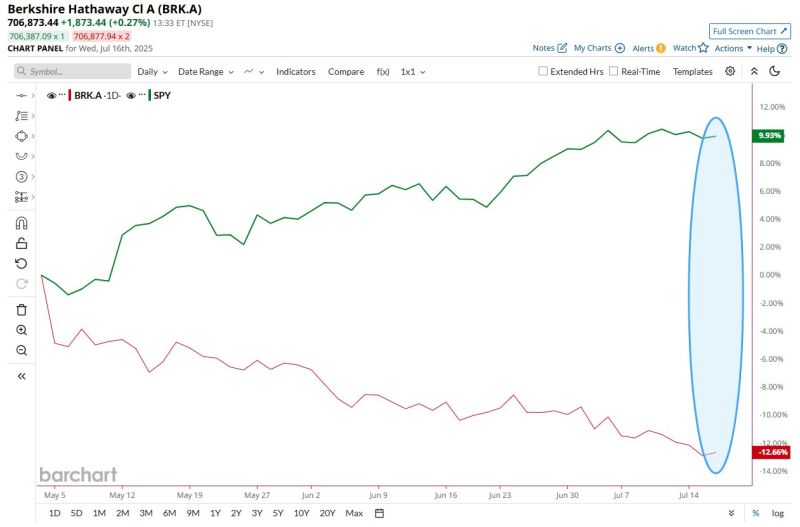

Berkshire Hathaway is now underperforming the S&P 500 by almost 23 percentage points since Warren Buffett announced his retirement 📉📉

Source: Barchart

S&P 500 earnings have recently seen multiple sharp upward revisions.

This comes after 15 consecutive weeks of downside earnings revisions fueled by tariff fears. Overall, it seems that US corporations are actually coming out on the other side of these fears stronger. This is a tailwind for the stock market. Source: Bravos research

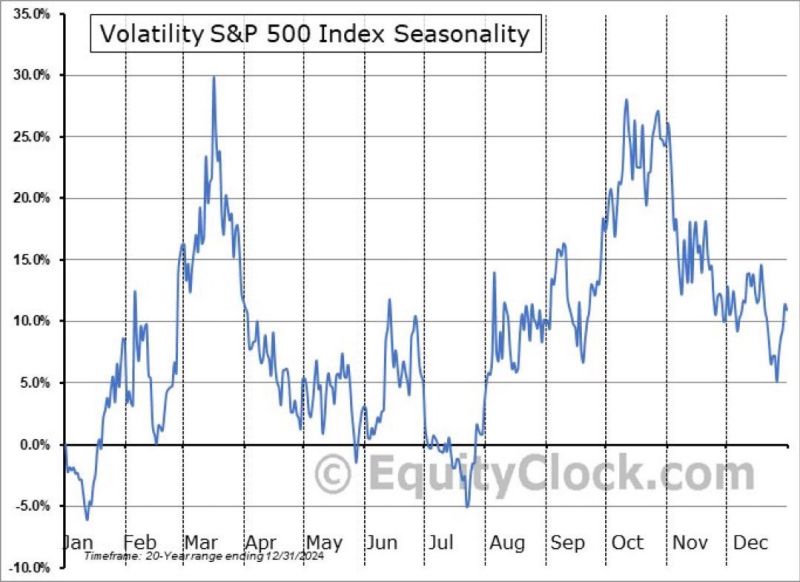

$VIX seasonality last 20 years.

If we are to see a spike, should be any day now. Just simply basing off seasonality. Source: Heisenberg @Mr_Derivatives

Investing with intelligence

Our latest research, commentary and market outlooks