Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Our Global M2 proxy continues to point to supportive liquidity dynamics for risk assets in the weeks ahead, even if the charts suggest a potential pause in the upward trend for the short-run.

➡️ Liquidity continues to be injected, not only in the US (with M2 reaching a new all-time high in May), but also in Europe and China, and the USD weakness is supportive of global liquidity conditions. ➡️ The link between our Global M2 proxy and the Bitcoin, but also the S&P500 and the MSCI World, continues to hold quite well! This is NOT an investment recommendation. Many factors influence the price of assets. Do your own research. Source: Adrien Pichoud

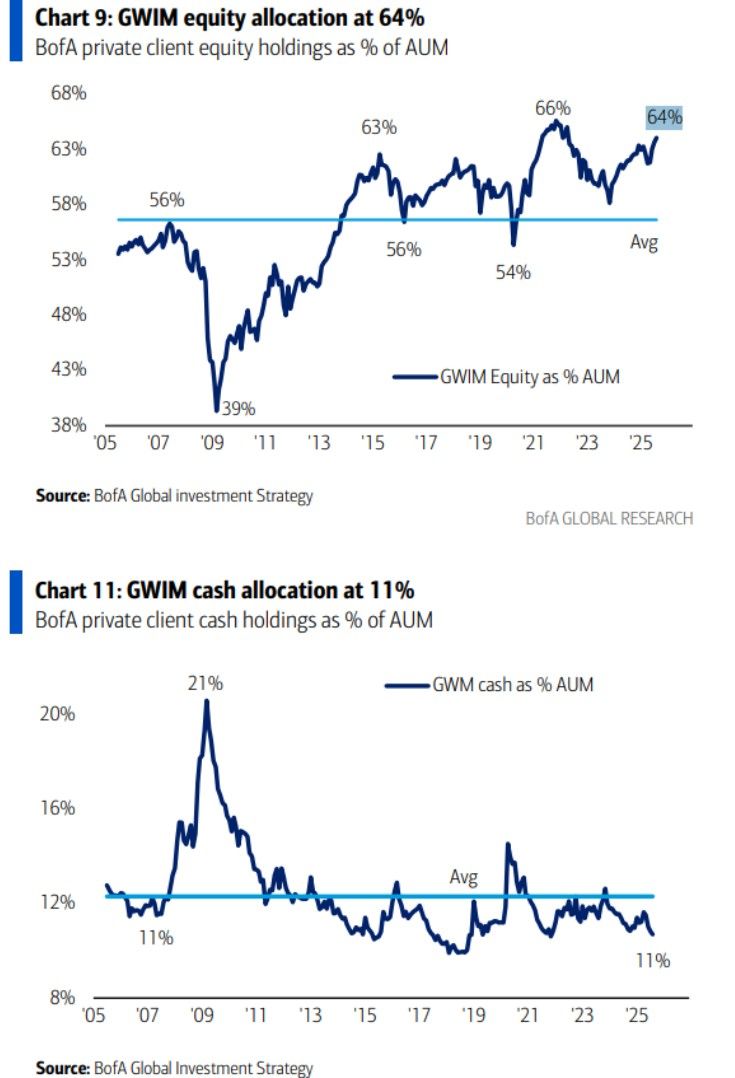

BofA private clients: 64% stocks, highest since March 2022

10.7% cash, lowest since October 2021 (Hartnett) Source: Mike Zaccardi, CFA, CMT, MBA

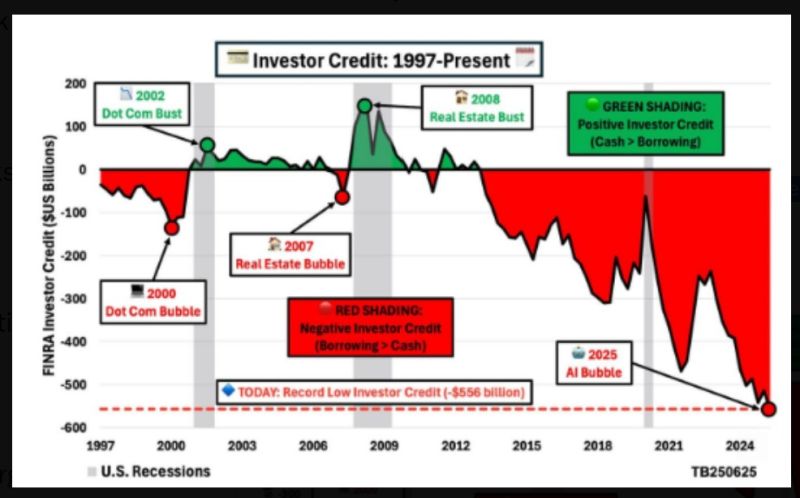

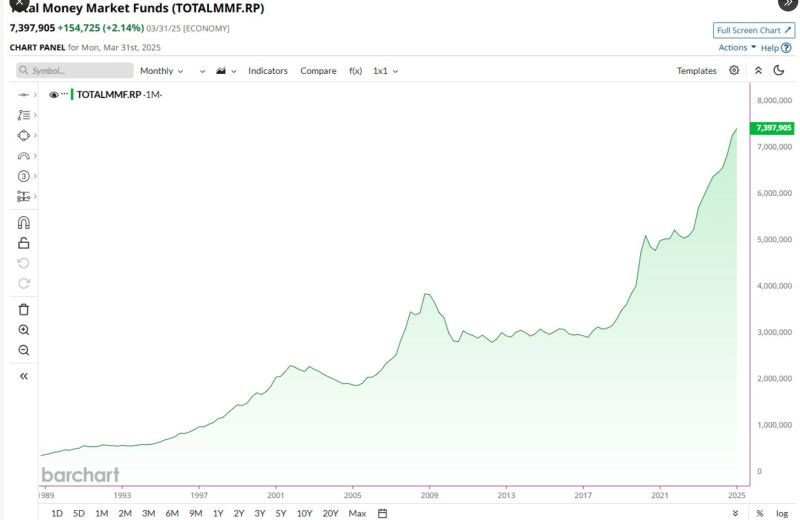

Investors are now buying stocks on margin at levels never seen before in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks