Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

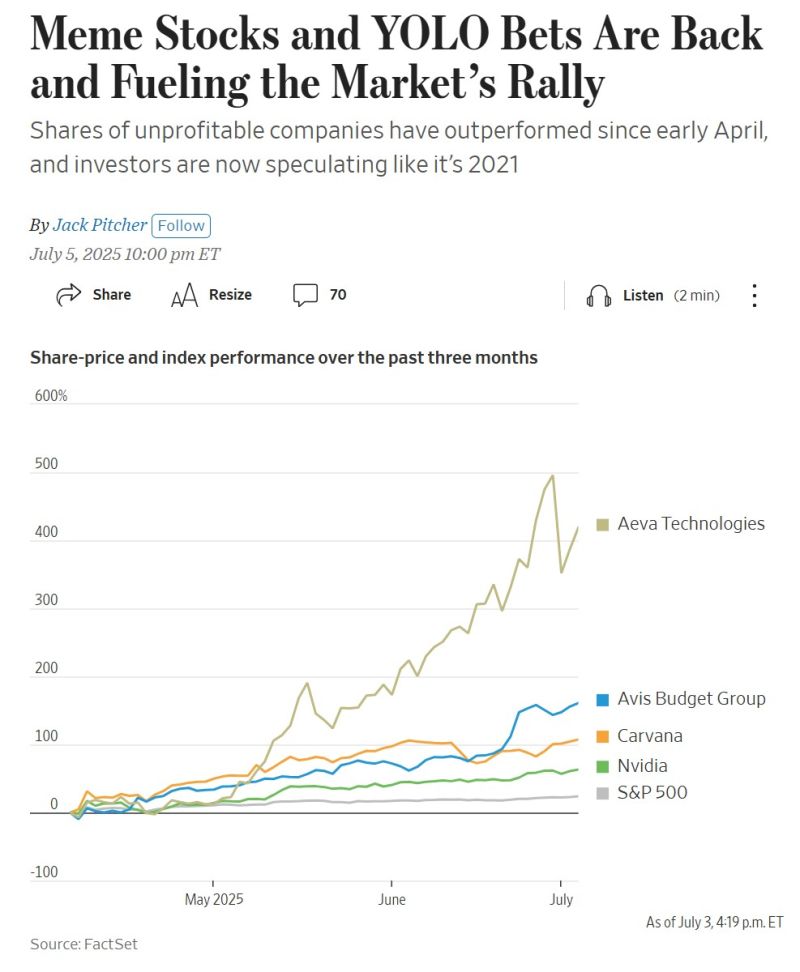

Everybody knows about the Mag7. But have you heard about the "Unprofitable 858" ???

Meme stocks and YOLO bets are back and fuelling the market’s rally. Shares of unprofitable companies have outperformed since April, and investors are now speculating like it’s 2021 again... Source: HolgerZ, WSJ

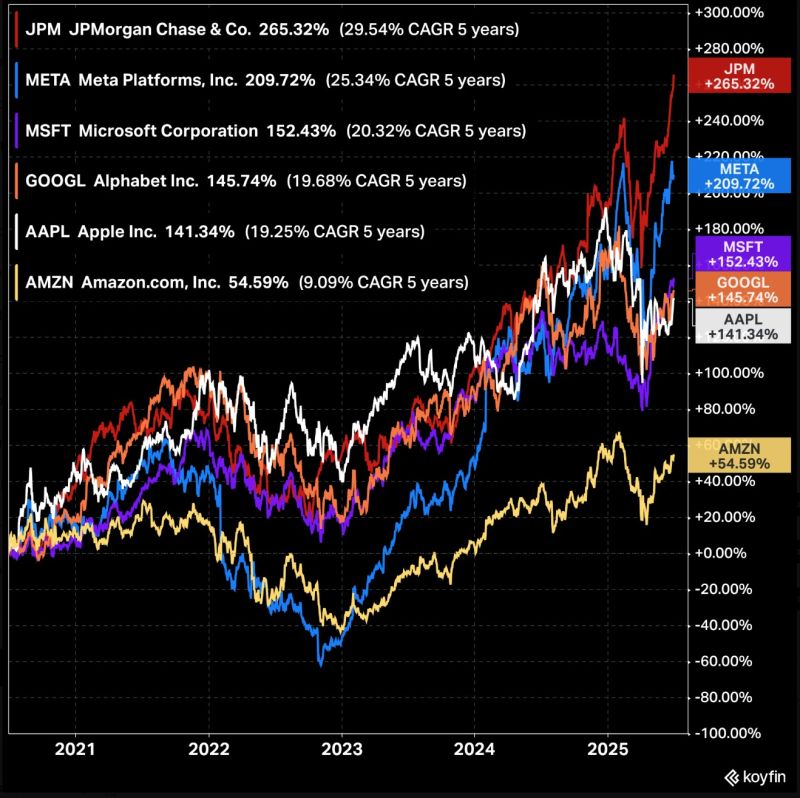

$JPM JPMorgan has outperformed 5 of the Magnificent 7 over the last 5 years.

Source: Koyfin

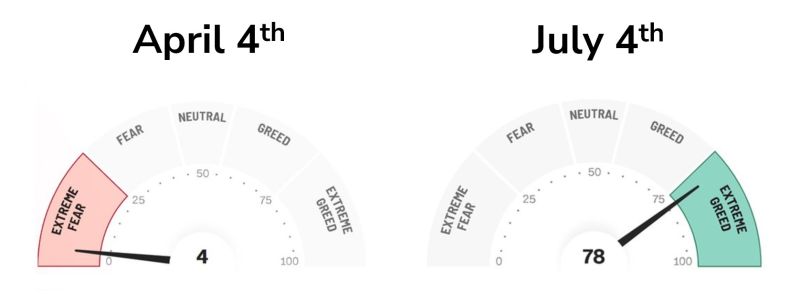

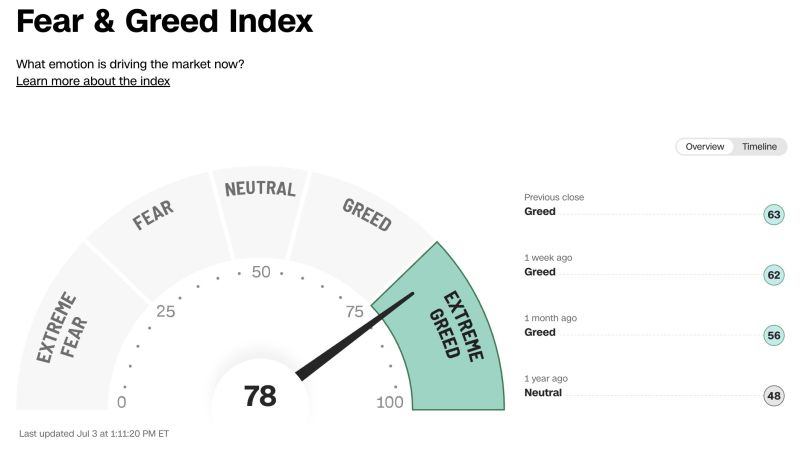

JUST IN 🚨: EXTREME GREED RETURNS to the Stock Market for the first time this year 🥳🤑

This is the highest reading since March 2024! Congrats everyone, we did it ! Source: Barchart

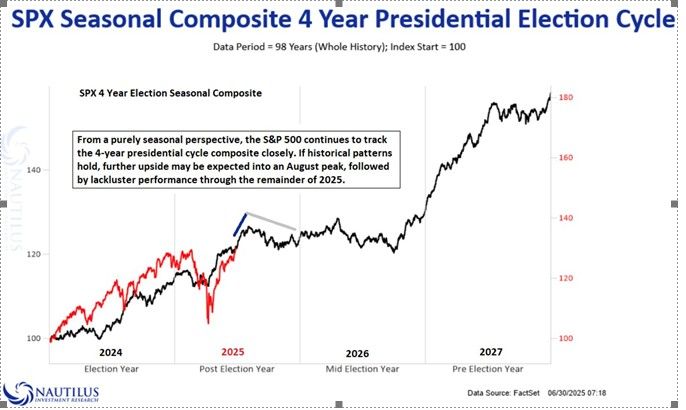

If you follow and believe in the Presidential Cycle..

Source: Nautilus Research through RBC

‼️ New listing volume in Hong Kong Stock Exchange jumped around eight times to $14 billion in the first half of this year.

▶️ The frenzy came after years of lackluster IPO activity in the city. ▶️The renewed interest is fueled by a confluence of factors, including Beijing’s regulatory tailwinds, lackluster A-share listings and delisting fears in U.S. markets. https://lnkd.in/eK4PnfUQ Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks