Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️ The IBM revival. The stock has doubled over the past 18 months, breaking through its historic ~$250bn market cap ceiling from 1999 and 2012.

So how can we explain such a comeback for this iconic company? It is primarily due to its successful transformation into a leader in enterprise artificial intelligence (AI) and hybrid cloud solutions, which has driven strong financial performance and investor confidence. Key factors behind this surge include: ▶️ Strong AI and Cloud Growth: IBM's AI business bookings have surged to over $5 billion, growing nearly $2 billion quarter-over-quarter, and its Red Hat subsidiary, a major hybrid cloud platform, grew 17% in a recent quarter and is expected to contribute $3 billion in revenue this year. This software-led strategy and expanding AI capabilities have been pivotal. ▶️Robust Financial Results: IBM reported solid earnings beats and a bullish 2025 forecast with expected revenue growth exceeding 5% and free cash flow growing even faster, targeting about $13 billion in free cash flow.

A golden cross for the S&P 500 (the S&P 500's 50d moving average has crossed above its 200d moving average).

Source: Bloomberg, Kevin Gordon

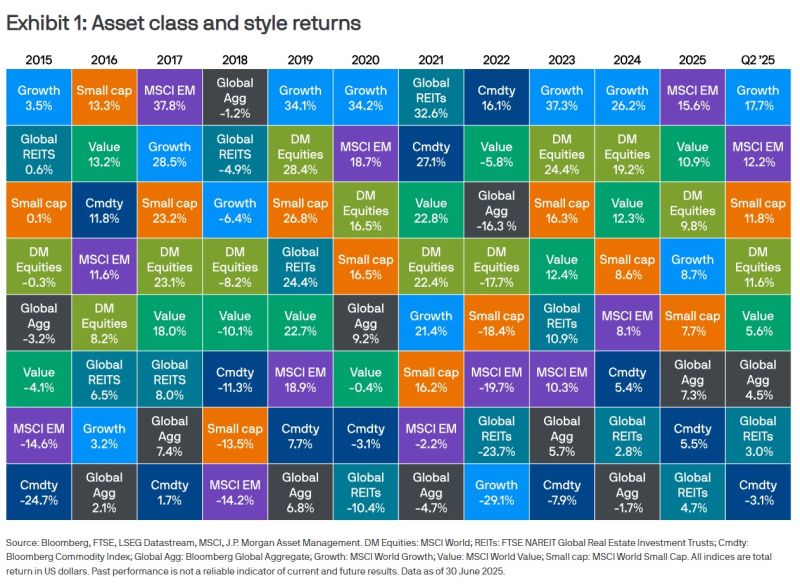

The usual quarterly review by JP Morgan

"The second quarter of 2025 saw significant volatility across markets as investors grappled with tariff policy uncertainty and war in the Middle East. In both cases, investors’ worst fears ultimately proved unfounded and in the absence of a meaningful weakening in the hard data, most major asset classes delivered positive returns over the quarter. The liberation day tariff announcement on 2 April caused a sharp selloff across markets. The reciprocal tariff package was larger than expected and both stock and bond markets reacted quickly. The S&P 500 fell 12% over the following week, while US 10-year Treasury yields rose 50 basis points between the 4 and 11 April. The US administration responded to market volatility and moved to soften its trade policy, pausing reciprocal tariffs for 90 days and agreeing the principles of a trade deal with China. This mollified investors and risk assets quickly recovered, with developed market equities delivering total returns of 11.6% over the quarter. A combination of renewed investor confidence, and a strong earnings season helped boost mega-cap tech stocks. After underperforming in the first quarter of 2025, the ‘Magnificent 7’ delivered price returns of 18.6% over the second, outperforming the remainder of the S&P 500 by 14 percentage points. This helped global growth stocks deliver total returns of 17.7% over the quarter to end the period as the top performing asset class.

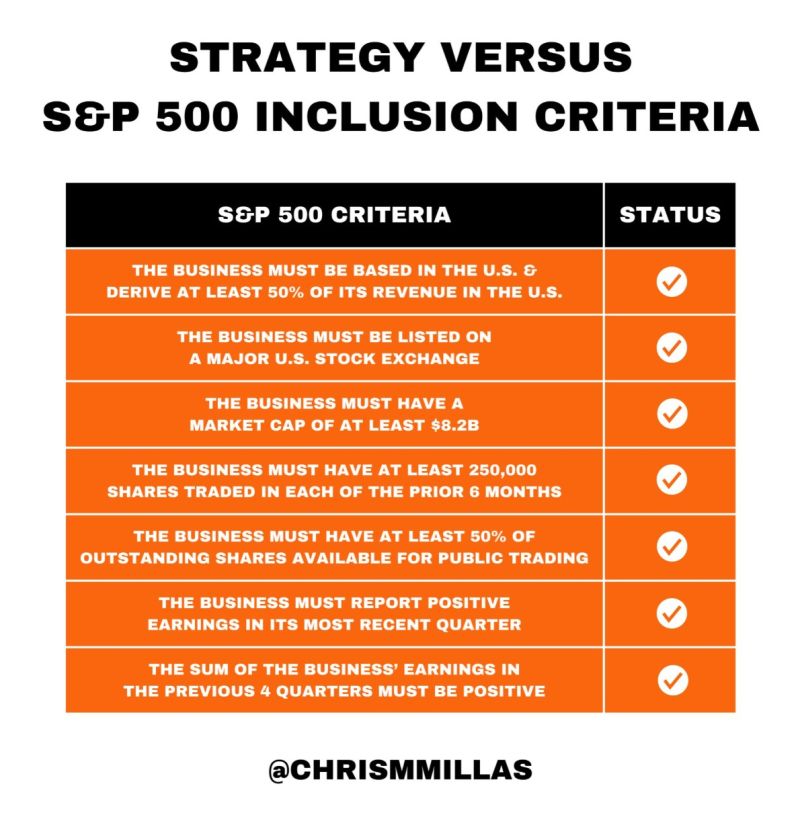

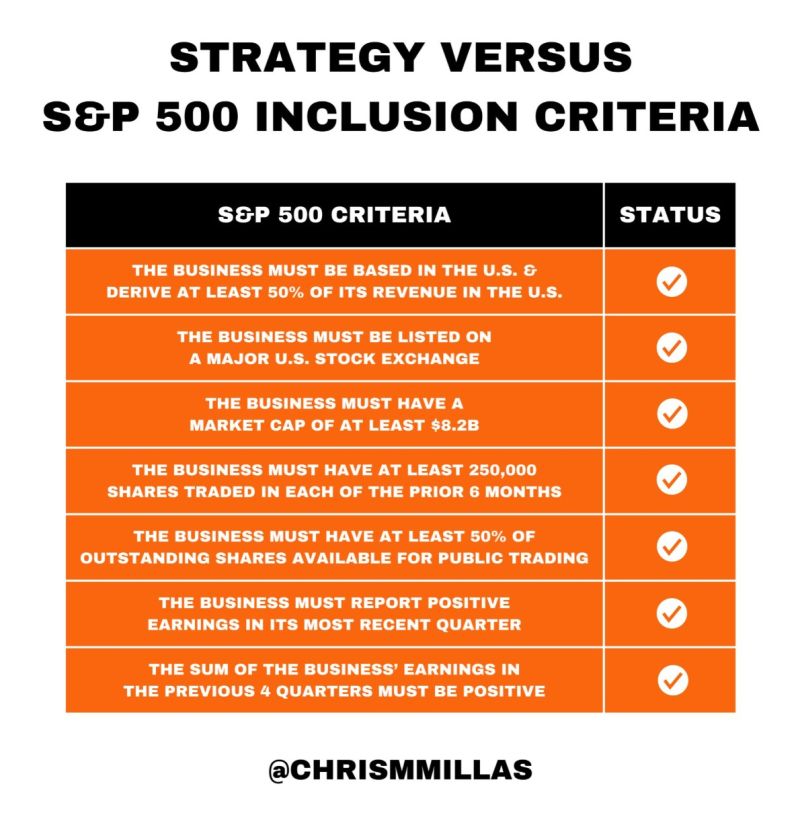

Strategy now satisfies all SP500 inclusion criteria. $MSTR

Source: Chris Millas @ChrisMMillas

JPMORGAN $JPM JUST ANNOUNCED A NEW $50 BILLION SHARE BUYBACK PROGRAM

JPMORGAN JUST INCREASED ITS QUARTERLY DIVIDEND OF $1.50 PER SHARE UP FROM $1.40 Source: Evan on X

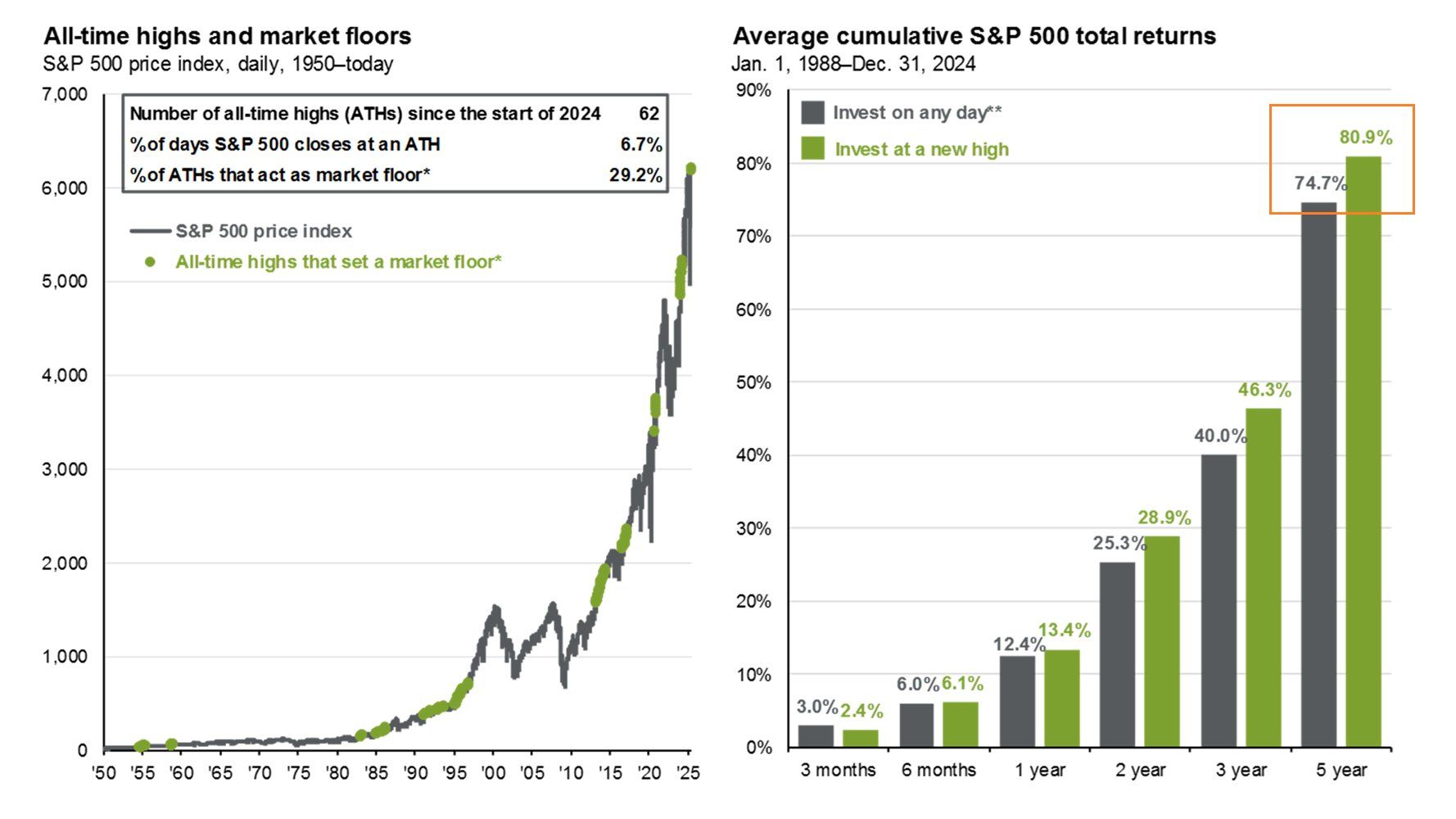

This is counterintuitive: It's safer to invest when the sp500 is at an all-time high...

Source: @MikeZaccardi on X

Investing with intelligence

Our latest research, commentary and market outlooks