Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

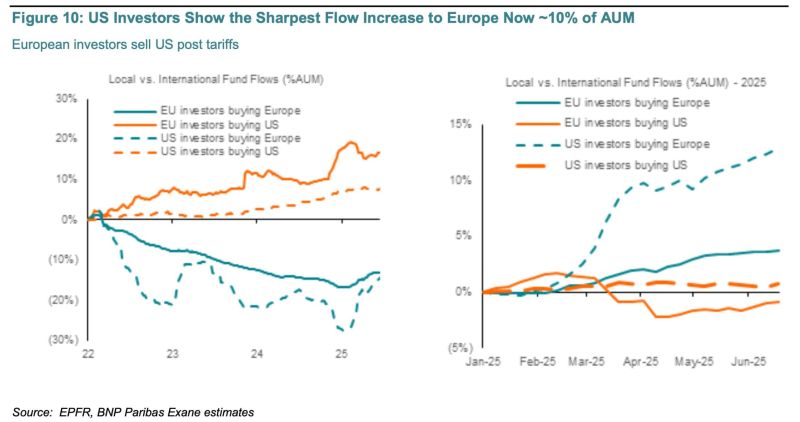

This chart from, BNP / EPFR indicates that the strong outperformance of European stocks this year was primarily driven by US investors shifting their investments into Europe.

In contrast, European investors made only modest shifts. Source: HolgerZ

The top 3 country equity ETFs so far in 2025:

1) Poland $EPOL: +54.5% 2) Greece $GREK: +52.2% 3) Austria $EWO: +42.6% Source: Charlie Bilello

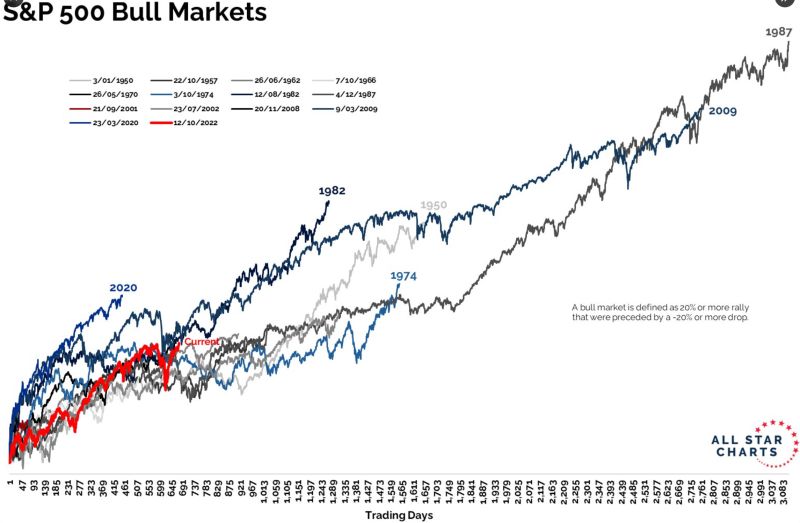

Current SP500 bull market vs. history by Grant Hawkridge on X

The S&P 500 is up 72.6% over 678 trading days since the 2022 low, below the average bull market gain of 153.7% over 1,145 days. We’re now in year 3, a phase that’s historically flat and choppy. This bull isn’t young, but it’s not stretched either. History still favors more upside… just not in a straight line.

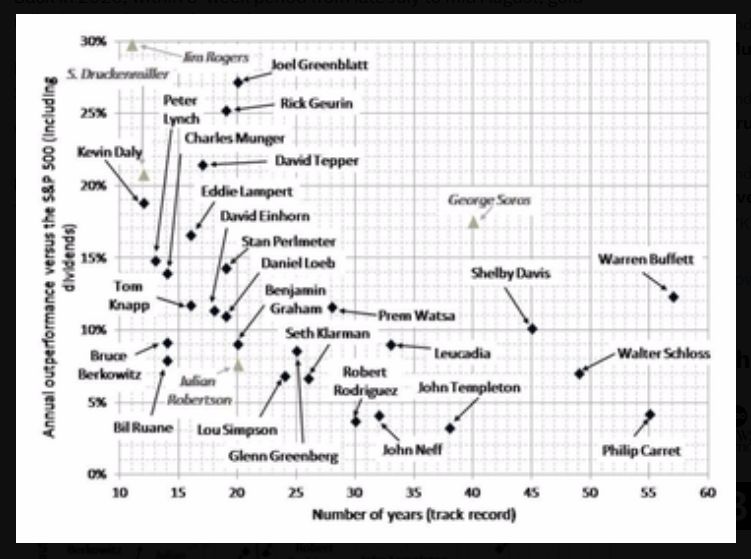

The GOATs of investing

Annual outperformance vs. sp500 / number of years (track record)

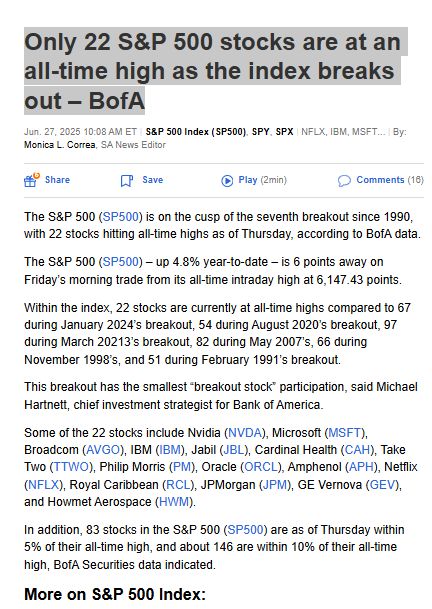

It would be great to see more new all-time-highs at the stock level. It would be great to see more new all-time-highs at the stock level.

Market breadth should confirm market action at the headline level

Investing with intelligence

Our latest research, commentary and market outlooks