Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

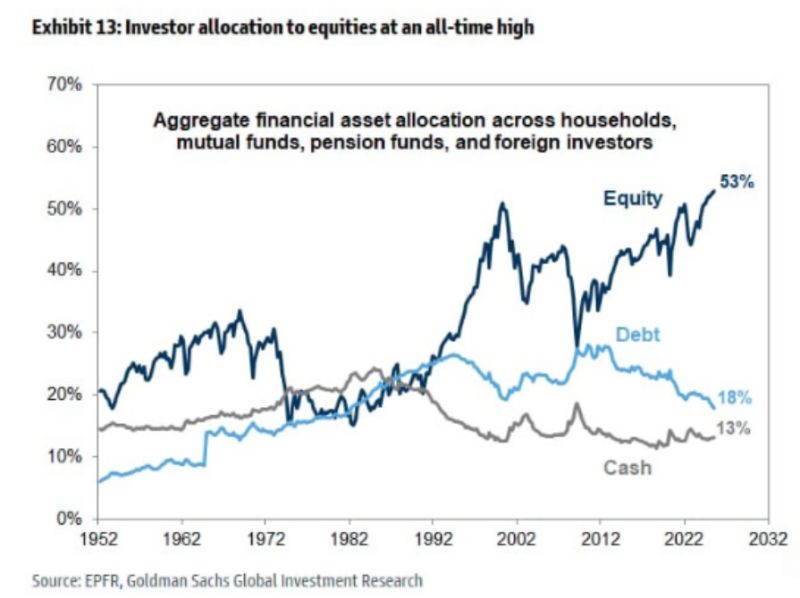

Investors are now “all-in” on equities — with the highest stock allocation on record.

The only time it came close? Right before the Dot-Com bubble burst. 👀 source : goldman sachs, barchart

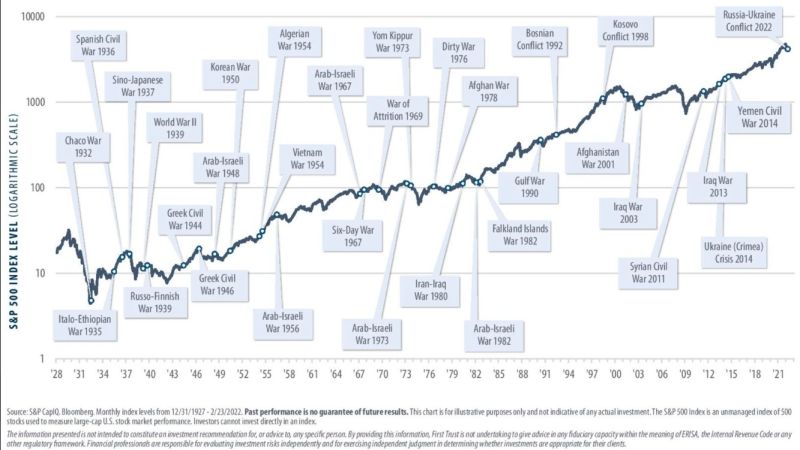

The long-term story of the S&P 500 — through the war, the fear, the crisis

source : s&p, bloomberg

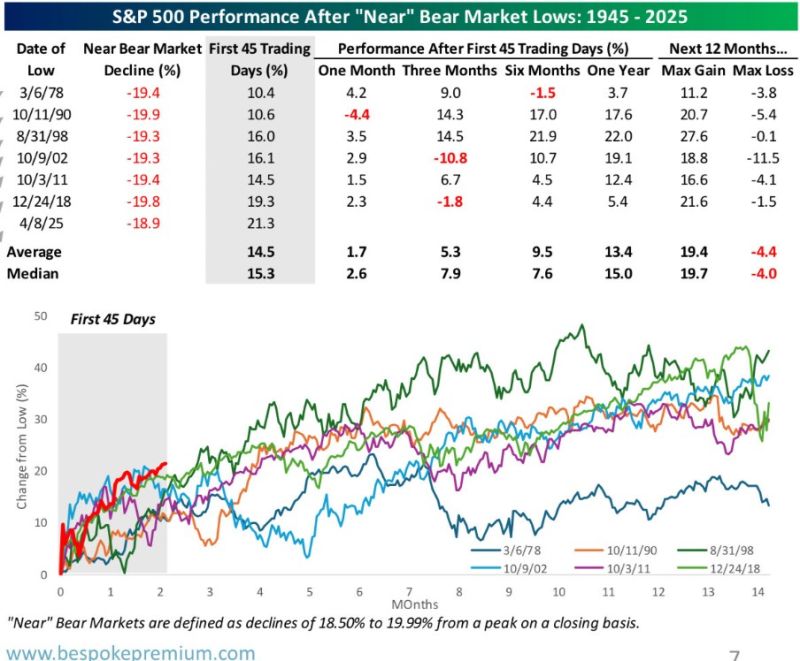

The S&P 500 recently saw its 7th “near” bear market since WWII, dropping 18.9%.

Historically, after the previous six similar declines, the market rebounded every time — with an average gain of 13.4% over the following year. History doesn’t repeat, but it often rhymes… source : bespoke

This is what typically has happened in the past to the SP500 after major conflicts have arisen.

Source: fxevolution @fxevolution

nuclear energy stocks are on fire 🔥

🟢 Oklo ($OKLO) shares surged 29% on Wednesday after the company was named the intended awardee for a Department of Defense project to deliver clean energy to Eielson Air Force Base in Alaska. The Defense Logistics Agency Energy issued a Notice of Intent to Award (NOITA), designating Oklo as the preferred provider following a competitive evaluation process. Under the proposed agreement, Oklo will design, build, own, and operate an Aurora powerhouse—a microreactor that provides both electricity and heat—at the remote military base. ➡️ Oklo Inc. is an advanced nuclear technology company headquartered in Santa Clara, California, founded in 2013 by Jacob DeWitte and Caroline Cochran, both MIT graduates. The company focuses on designing and deploying compact fast reactors, aiming to provide clean, safe, and affordable energy at a global scale. Oklo’s flagship product is the Aurora powerhouse, a small, liquid metal-cooled fast reactor designed to generate between 15 and 75 megawatts of electrical power (MWe). This reactor can operate for up to 10 years without refueling and is intended for off-grid applications such as data centers, artificial intelligence infrastructure, remote communities, industrial sites, and military bases.

Investing with intelligence

Our latest research, commentary and market outlooks