Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

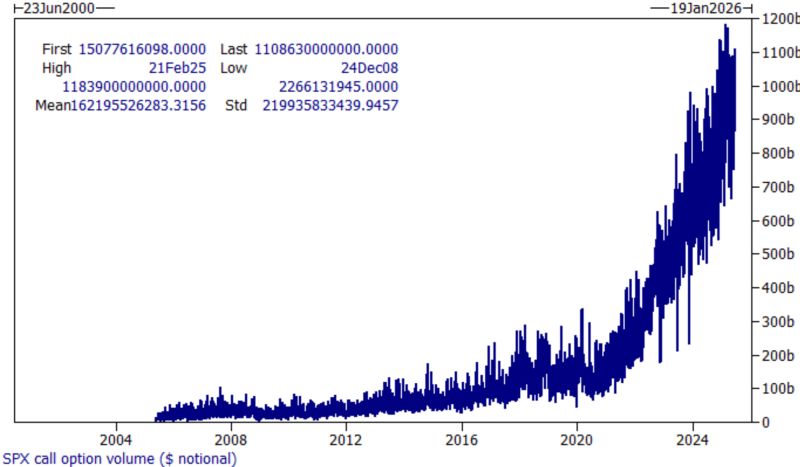

$SPX call option volume has surged to completely unprecedented heights over the last four years.

We see over $1.2 trillion in notional trading daily, with over 50% of that expiring the same day, and 75-80% within a week. Short-dated flows have a BIG influence on the market. Source: Markets & Mayhem

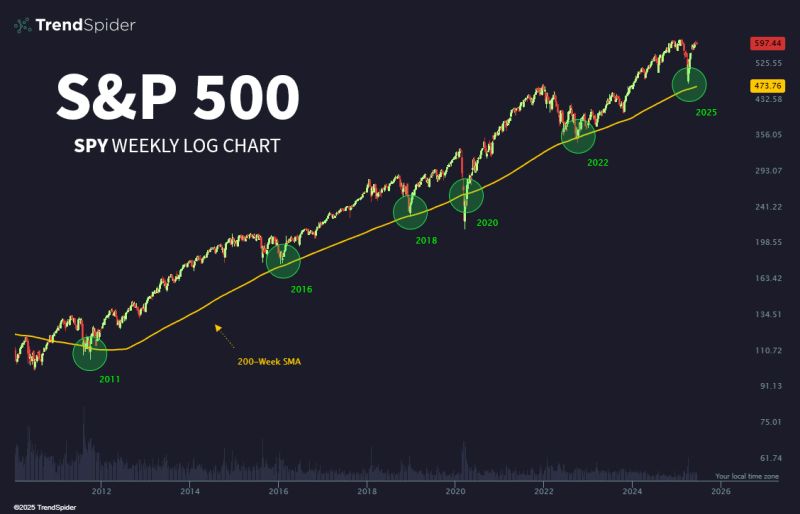

Long-term investing cheat code

Buying SP500 $SPY near the 200-week has basically been free money for 15 years. Wild. Source: Trend Spider

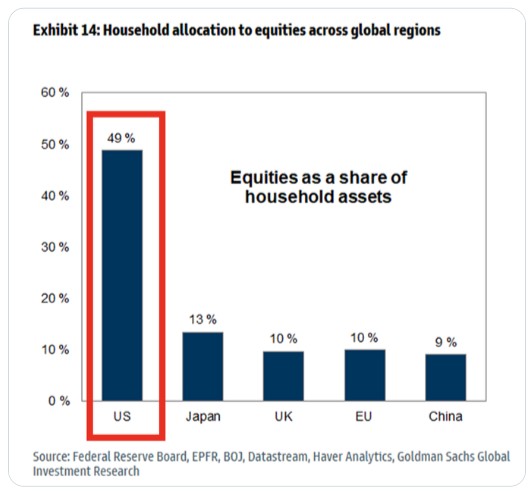

US households own WAY more stocks than in other major markets: US household allocation to equities sits at ~49%.

Source: @GlobalMktObserv

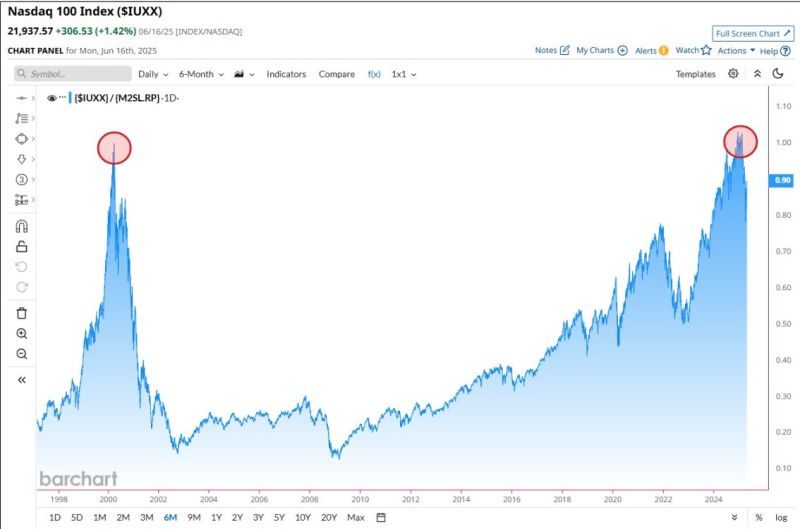

Tech Stocks relative to M2 Money Supply Dot Com Bubble vs. Now

source : barchart

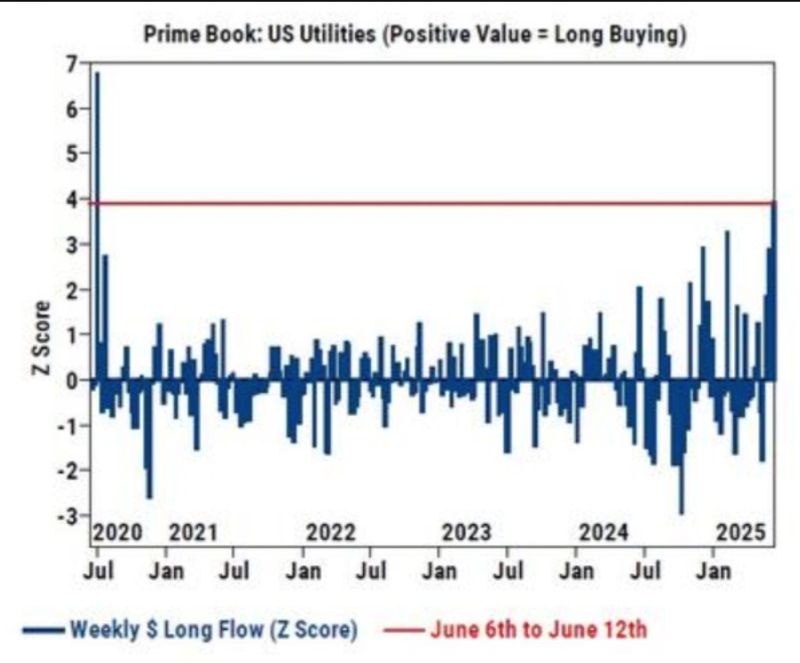

Hedge Funds are loading up on Utility Stocks at the fastest pace in 5 years

source : barchart

Investing with intelligence

Our latest research, commentary and market outlooks