Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

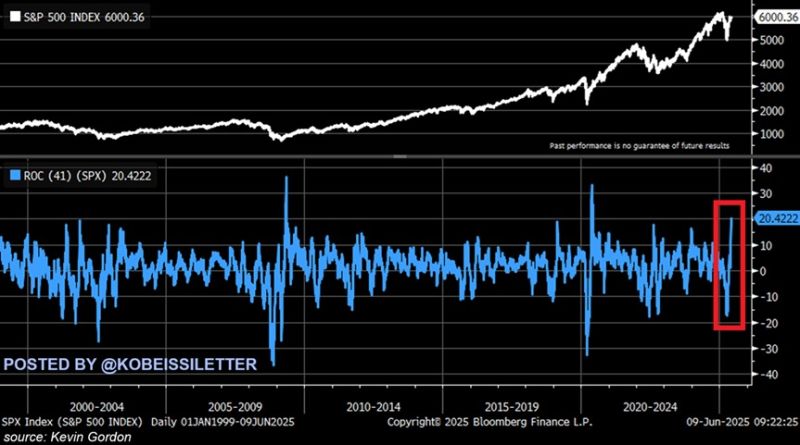

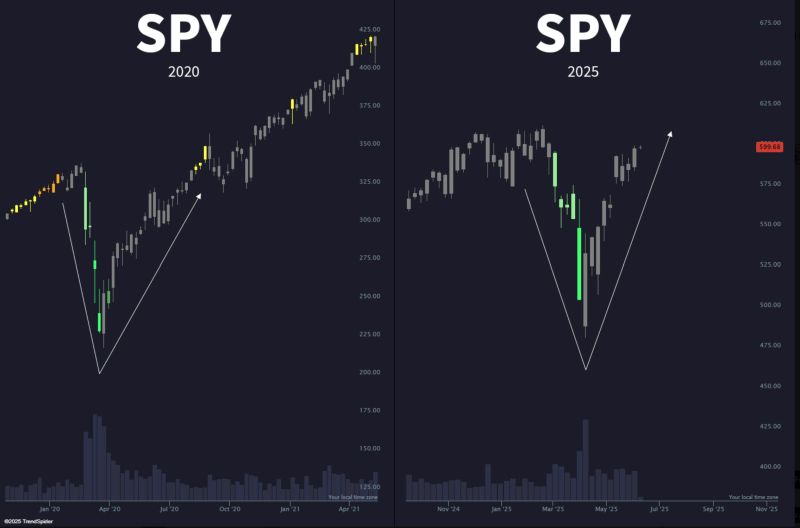

The market's recovery has been truly historic:

The S&P 500 has rallied +20.4% over the last 41 trading sessions, its third-best run this century. During the same period, the Nasdaq 100 has risen +27.3%, its third-biggest rally since 2002. Only 2020 and 2008 haven seen such sharp recoveries over the last two decades. As a result, the S&P 500 and the Nasdaq 100 are now trading just 2.1% and 1.8% from their all-time highs. We have gone from a historically weak to a historically strong market in a matter of days. Source: The Kobeissi Letter, Bloomberg

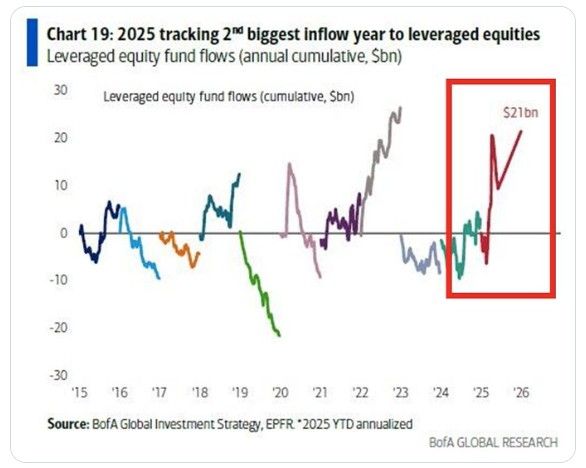

Market speculation is back with a vengeance...

Leveraged equity fund flows are on track for annual net inflows of $21 BILLION. This is almost in line with the 2022 record. Meanwhile, US leveraged equity ETFs currently hold near a RECORD $100BN in assets under management. Source: BofA, Global Markets Investor

Tesla stock $TSLA, surges over +5% as President Trump says he is not getting rid of his Tesla.

Trump also called Starlink a “good service” and say he wishes Elon well. Global Pulse on X: “Despite rising tensions, the Trump Vs Musk conflict will cool down in the coming days till next election. Both are high-stakes players, and neither wants to risk their empires”. Source image: Not Jerome Powell on X

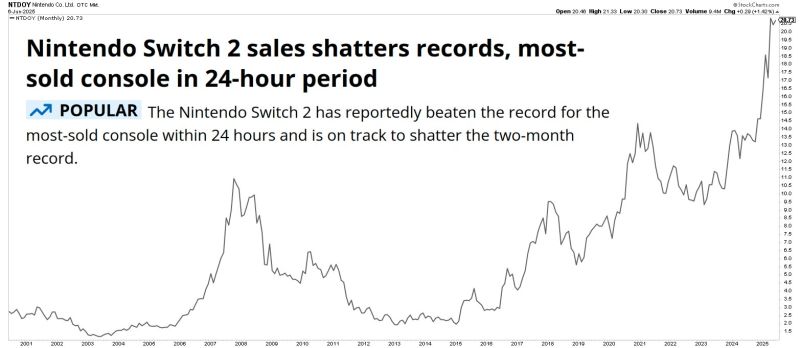

The Nintendo Switch 2 launch absolutely blew away expectations.

Below the monthly chart of Nintendo stock $NTDOY (7974.T-JP:Tokyo Stock Exchange) Source: Markets & Mayhem

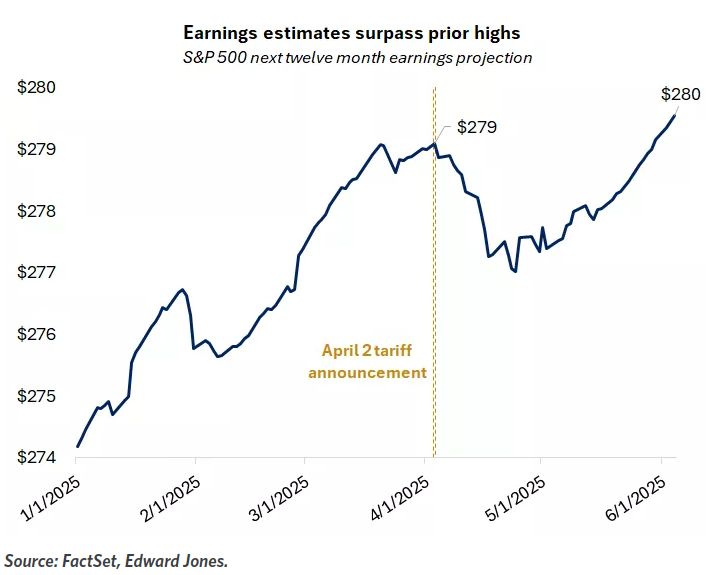

S&P 500 earnings estimates are now surpassing the prior high, which happened just before 'Liberation Day'.

First-quarter earnings season wraps up, underscoring corporate strength. S&P 500 companies grew profits 12.5% y-o-y, the third quarter of double-digit growth in the past four. While earnings growth estimates for 2025 have been revised down from 14% to 8.5%, the 2026 outlook remains steady, pointing to the potential for reacceleration. Notably, the forward 12-month earnings estimate has recently reached a new high, providing a fundamental anchor for rising equity markets. While valuations have undoubtedly contributed to the recent gains, earnings appear to have also played an important role as well. Source: Edward Jones

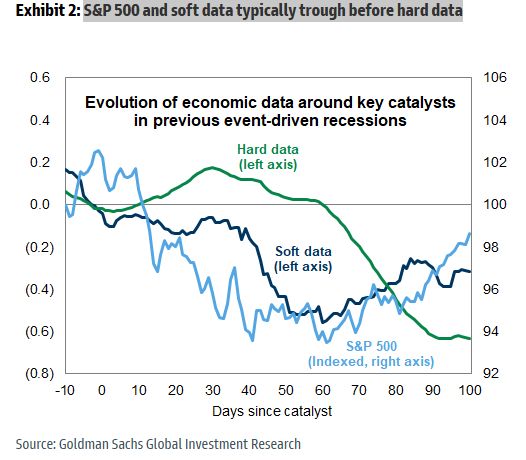

GS: S&P 500 and soft data typically trough before hard data

Source: Goldman Sachs, Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks