Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

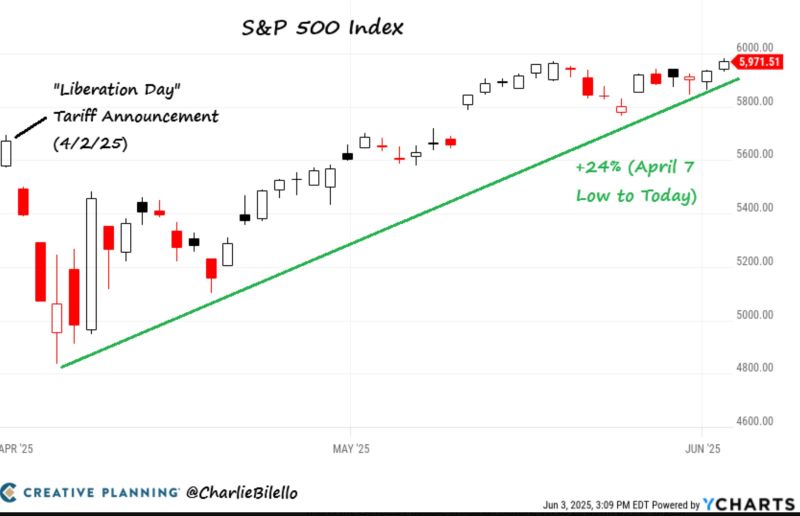

After a 24% rally from the April lows, the S&P 500 is now up 5% since the "Liberation Day" tariff announcement.

$SPX Source: Charlie Bilello

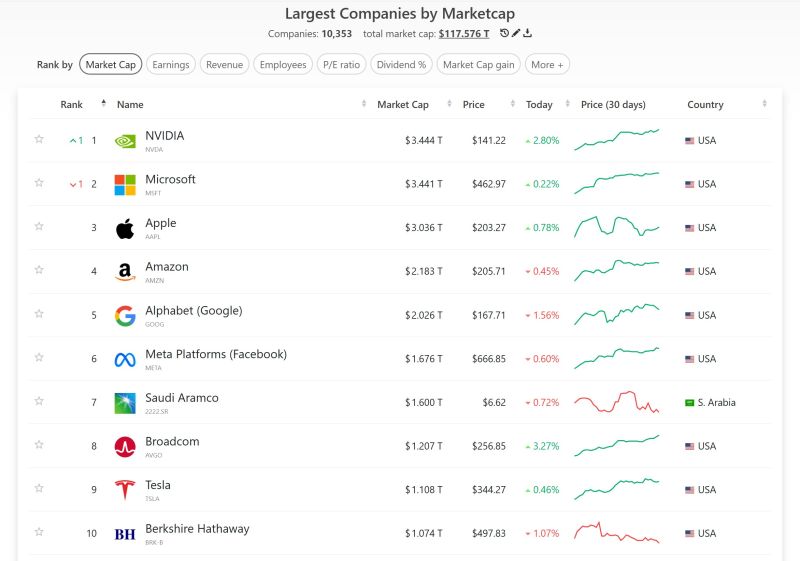

Yesterday, Nvidia $NVDA became the world's most valuable company at $3.444 Trillion, surpassing Microsoft $MSFT

Source: Companies Market Cap

In case you missed it... The MSCI All Country World Index (iShares MSCI ACWI ETF) hit an ALL-TIME HIGH yesterday...

#taco #tuesday Source: Mike Zaccardi, CFA, CMT, MBA

Credit Card debt at all-time highs? Party on.

#visa #mastercard $V $MA Source: Trendspider

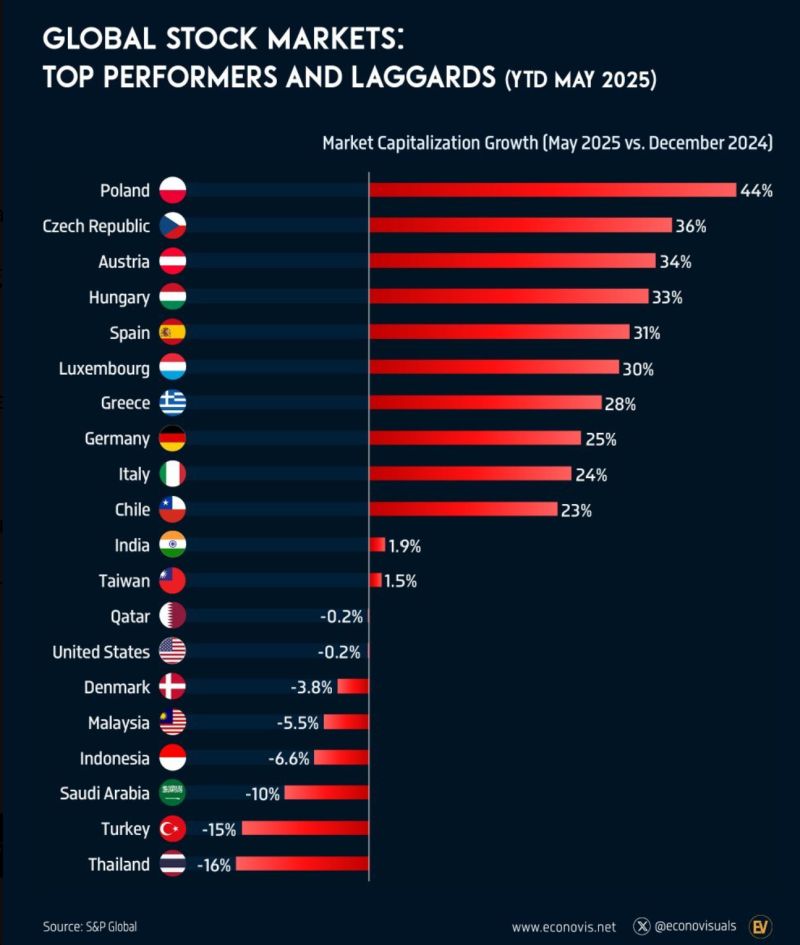

European markets have outperformed the US this year.

Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat. Source: Global Markets Investor

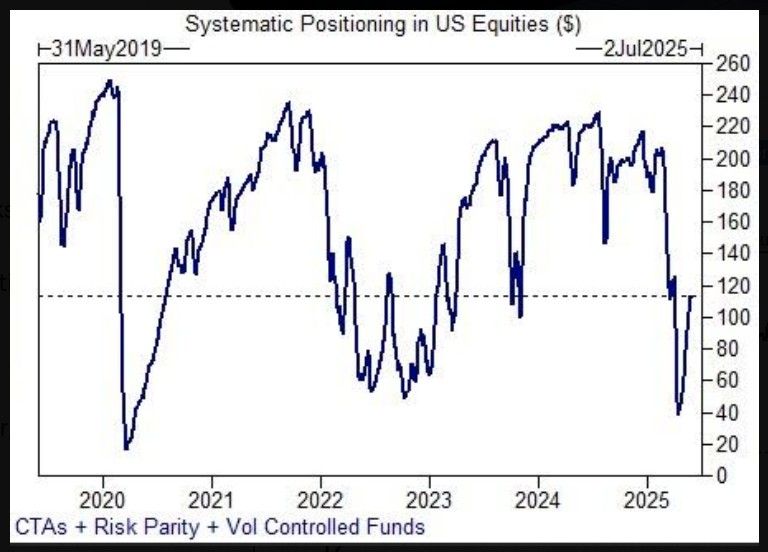

Systematic US equity exposure remains low, according to data from Goldman Sachs, i,.e they will be forced buyers if the rally continues 🚀

Source: Markets & Mayhem @Mayhem4Markets on X, Goldman Sachs

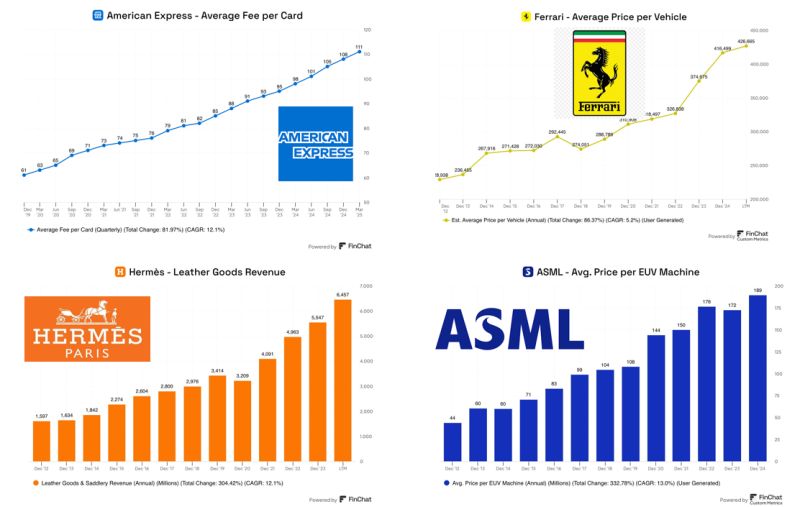

Companies with major pricing power

NB: These are NOT investment recommendations

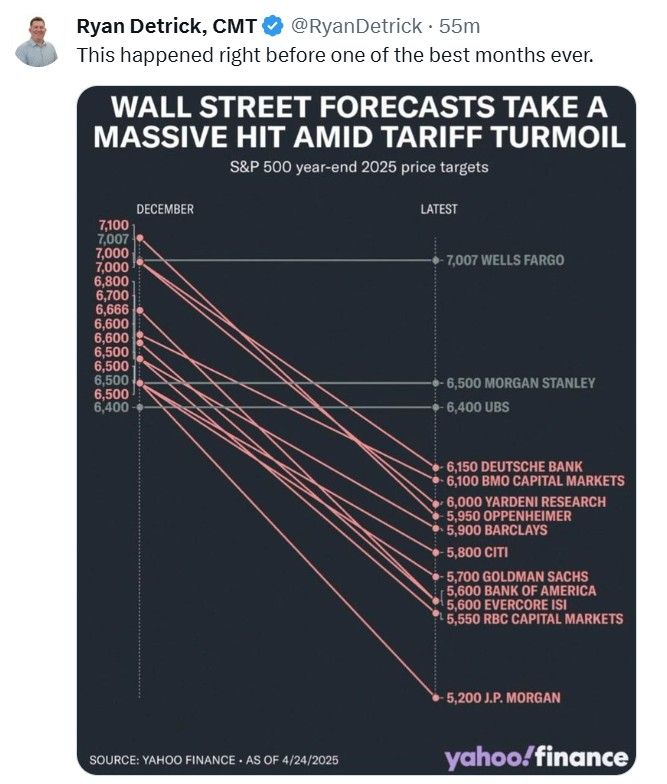

Do you remember when the vast majority of investment banks cut aggressively their year-end target on the S&P500?

This was right BEFORE one of the best month ever for the S&P 500...

Investing with intelligence

Our latest research, commentary and market outlooks