Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

SP500 200-day reclaim. Clean retest. Strong bounce.

Shorts are sweating. $SPY 🥵 Source: Trend Spider

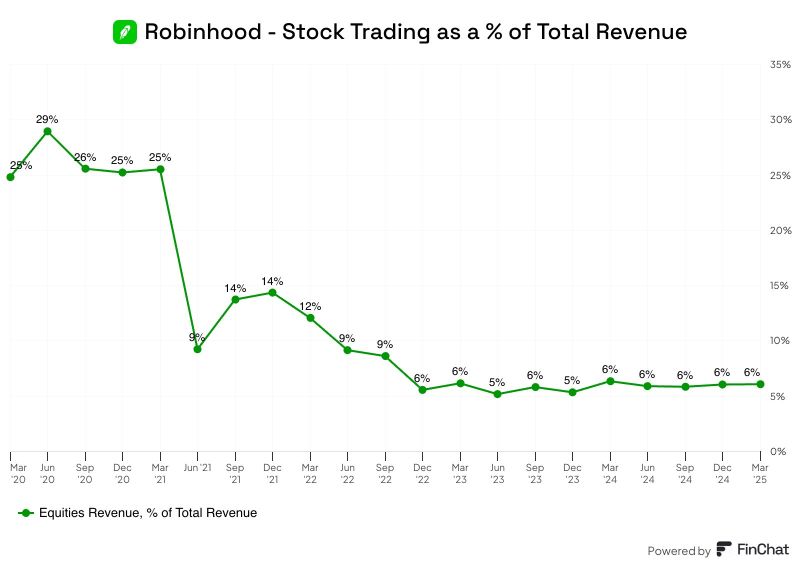

Only 6% of Robinhood's revenue from stock trading, down from 25% five years ago.

The remainder comes from: Interest Revenue: 31% Cryptocurrency: 27% Options: 26% Other: 10% $HOOD Source: FinChat @finchat_io

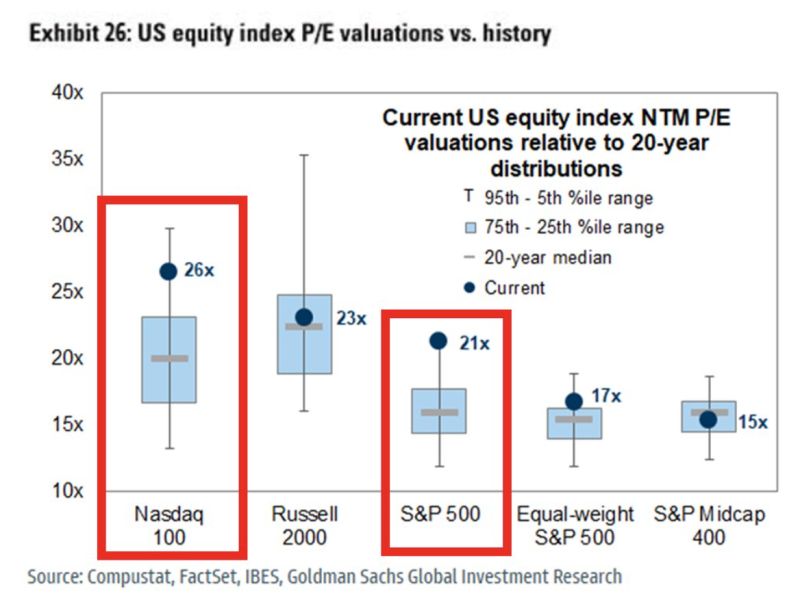

🚨We've seen a HUGE reversion to the mean so far this year with Eurozone stocks UP 24% and International stocks overall are UP 14% while the S&P 500 is DOWN 1%.

This comes after 16+ years of US outperformance, the longest run in history. Source: Charlie Bilello

Right smack in the middle of a 5 year channel...

Which side gets tested next? Source: Trend Spider

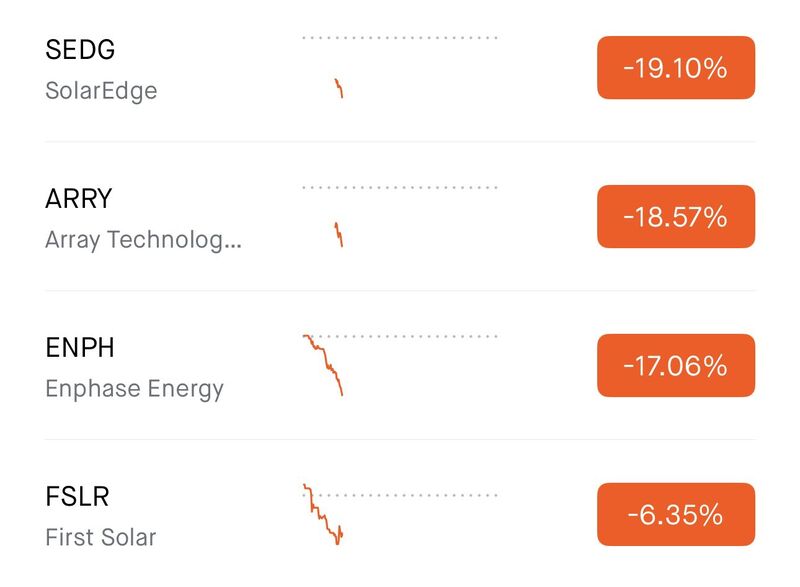

SOLAR STOCKS CRASH AFTER HOUSE PASSES TRUMP TAX BILL ENDING 30% ROOFTOP CREDIT

$SEDG -19%, $ARRY -19%, $ENPH -17%, $FSLR -6% 😳 Source: Shay Boloor @StockSavvyShay

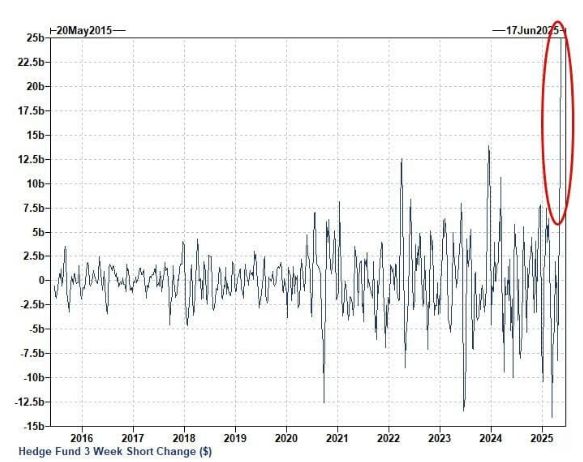

HedgeFunds have added $25 Billion of short equity futures exposure over the last 3 COT reports, the largest increase AT LEAST the last decade 🚨🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks