Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

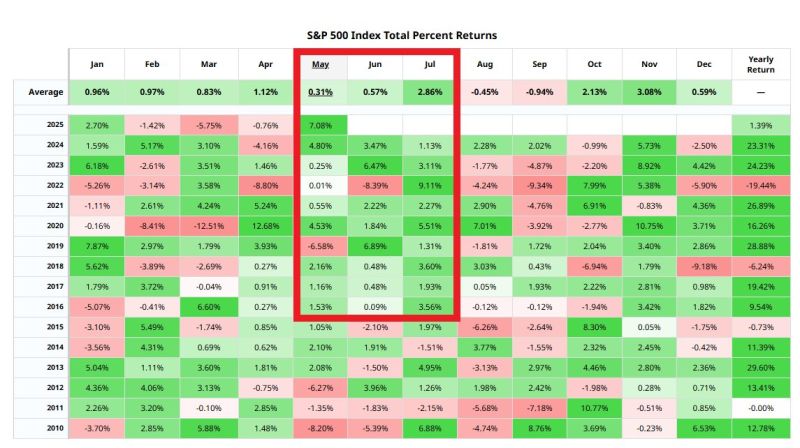

Since 2016, S&P 500 has only had 2 red months during the May-July period 📈📈📈

Source: barchart

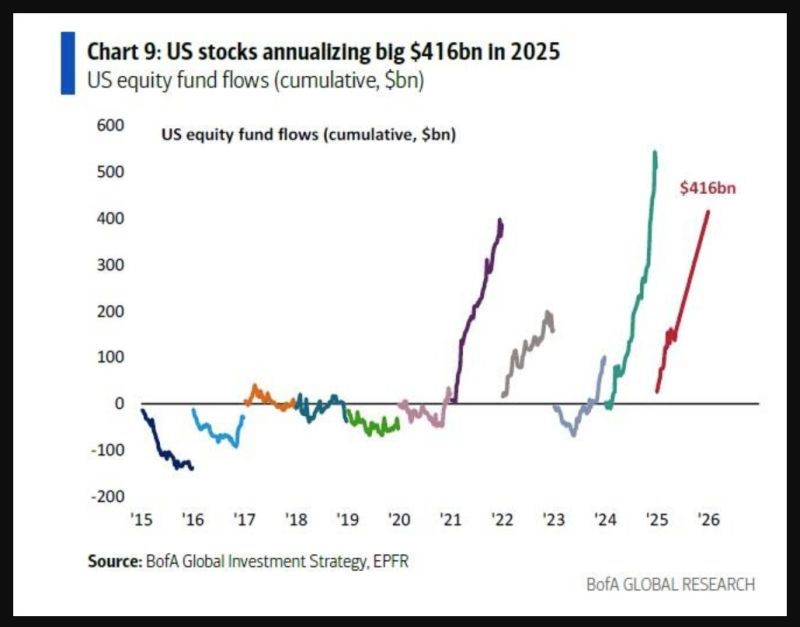

Yes, 2025 is likely to be a record year for EU equities funds inflows (according to BofA/EPFR, +$110bn inflow annualized, which will be the biggest since '15).

But despite all the US bashing, it could be a very strong year for US equities inflows as well. Indeed, US equities funds are on course for $416bn inflow, the 2nd biggest year ever... Source: BofA, EPFR

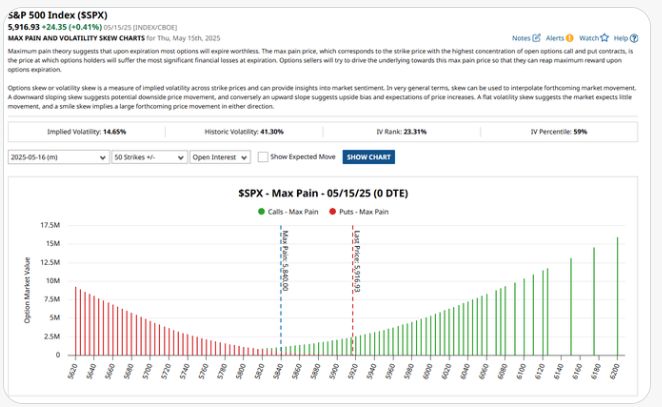

$1.2 Trillion of S&P 500 $SPX notional options exposure is set to expire on Friday with a max pain price currently sitting at 5,840

Source: Barchart

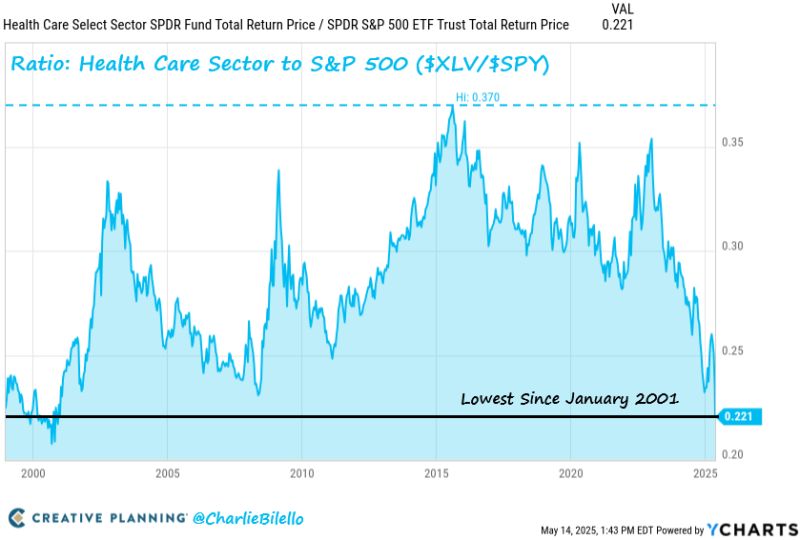

The ratio of the US Health Care sector to the S&P 500 is at its lowest level since January 2001.

The Health Care Sector is down 9% over the past year while the S&P 500 is up 14%. $XLV $SPY Source: Charlie Bilello

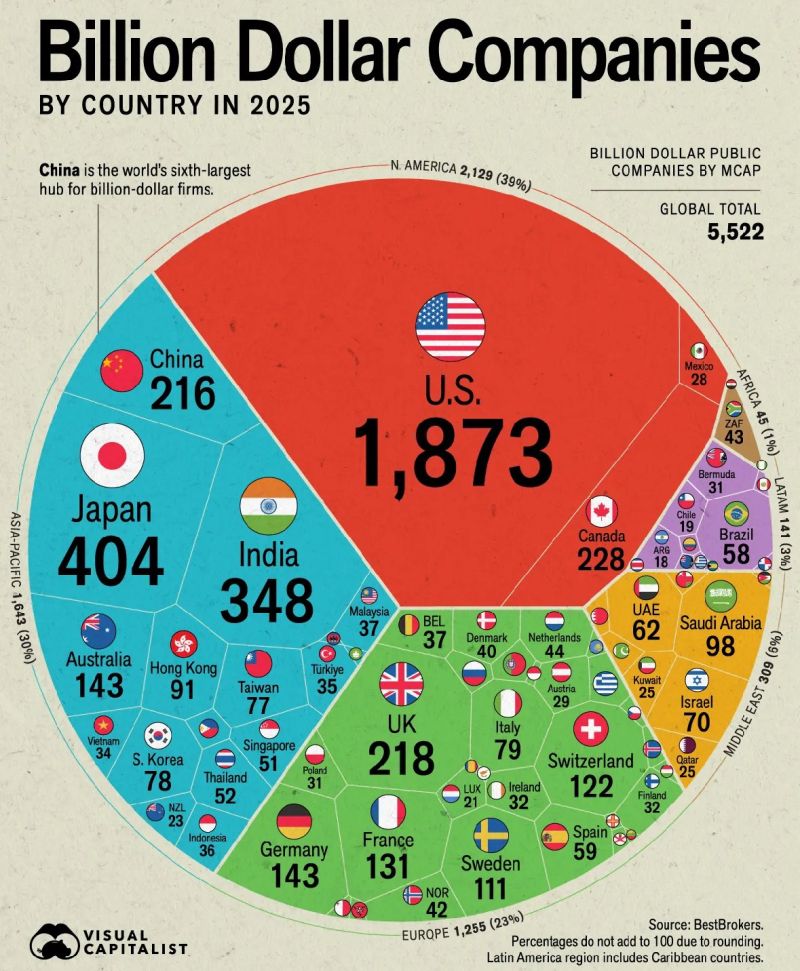

Here’s how many billion dollar companies there are in different countries around the world

Source: Blossom @meetblossomapp

Investing with intelligence

Our latest research, commentary and market outlooks