Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The S&P500 is flat on the year and less than 5% away from new all-time highs.

Congrats to those who stuck with their plan. Source: Ryan Detrick, CMT

The S&P 500 just sprinted through 200-day moving average as Wall Street cheers the rollback of tariffs.

Skeptical strategists saw that level as a potential ceiling on the market rebound Source. Bloomberg, HolgerZ

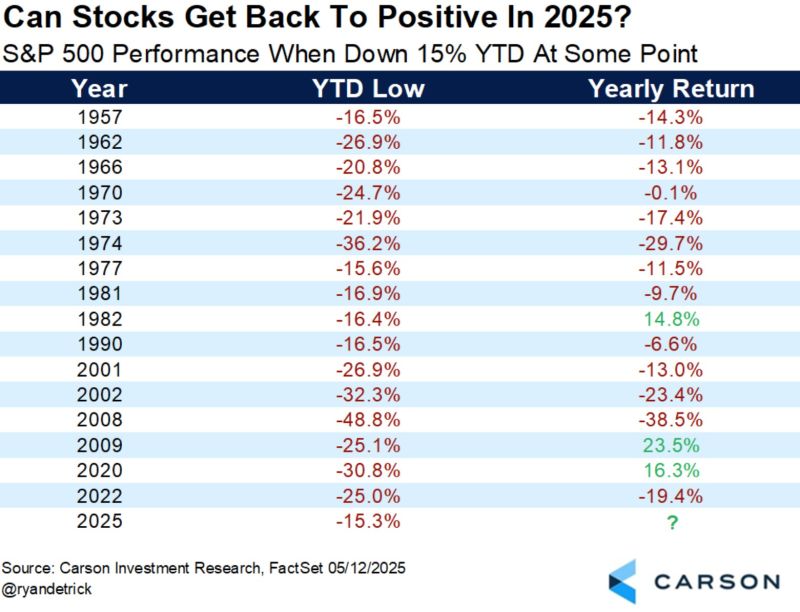

Only three times in history has the S&P 500 been down at least 15% YTD and moved back to positive by the end of the year.

Could this year will be number four? Source: Ryan Detrick

‼️The S&P 500 is trading at a MASSIVE technical level:

The S&P 500 has recovered some losses and broken above its 50-day moving average for the first time since February. However, it is still trading below its key 200-day moving average, a level smart money is watching. Will progress on US-China tariffs help the market break key resistance levels? Source: Bloomberg, Global Markets Investor

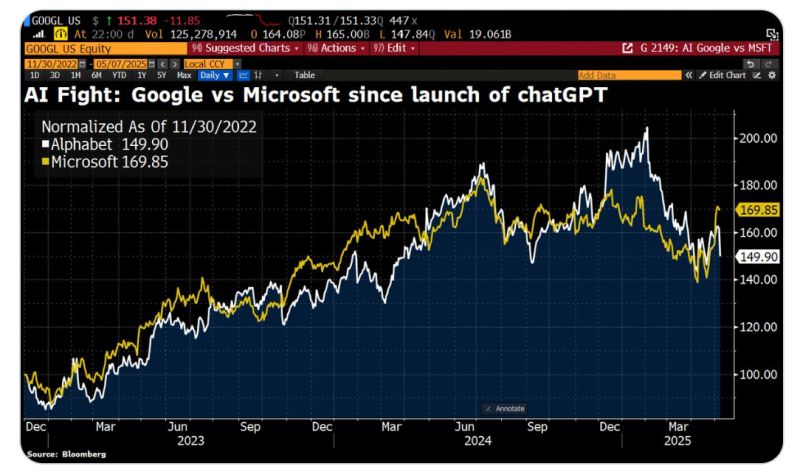

Alphabet shares tumble >7% on vibes.

Alphabet could be the next Eastman Kodak. Apple executive Eddy Cue revealed that the iPhone maker is exploring adding AI-powered search to its browser, after search activity in Safari declined for the first time ever in April. Apple is now considering alternatives to Google—including OpenAI, Perplexity, and Anthropic. "Today could mark a historic turning point in sentiment toward Alphabet," says Melius’s Reitzes. Source: HolgerZ, Bloomberg

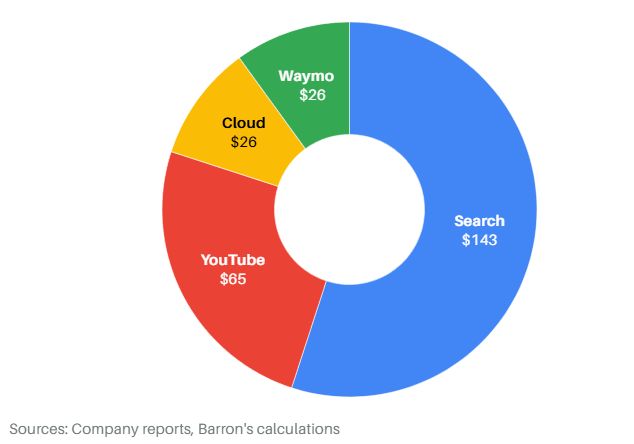

Alphabet is worth $260 per share according to Barron's ! This is 75% higher than current price ‼️

See below the key takeaways from their article "What an Alphabet Breakup Would Mean for Shareholders 👉 https://lnkd.in/eBx4EZiE As mentioned above, they end up with a "breakup value / sum of the parts" of $260. Even if they take off 50% of the Search value, they end up with $182 per share, or 20% HIGHER than the current price! Here's how they calculated it 👇 ➡️ Google Search: 17x EBITDA for 2025 The valuation would be $1.76T or $143/share. ➡️ YouTube:" 22x EBITDA for 2025 The valuation would be $800B or $65/share. ➡️ Google Cloud: 16x EBITDA for 2025 The valuation would be $320 billion or $26/share. ➡️ Waymo: Valuing Waymo is more complex. Uber is valued at $150B, while Tesla exceeds $1T (as of October 2024) The valuation would be 325B or $26/share. $GOOGL Source: Patient Investor on X

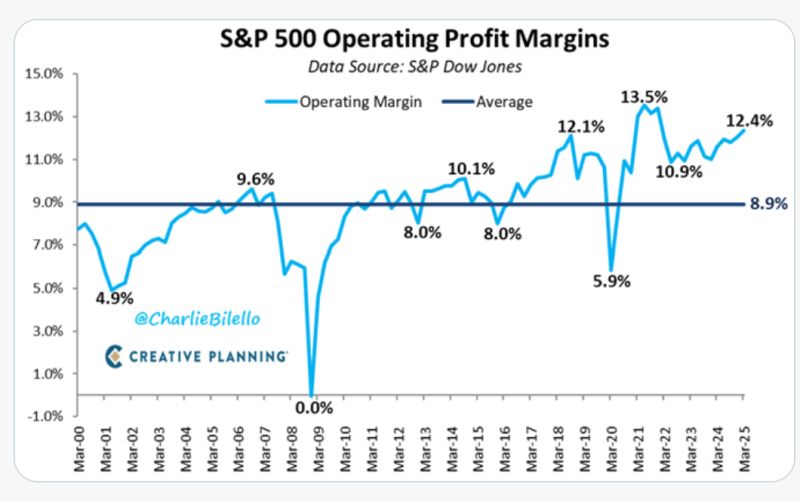

S&P 500 operating profit margins expanded to 12.4% in Q1, their highest level since Q4 2021.

$SPX Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks