Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

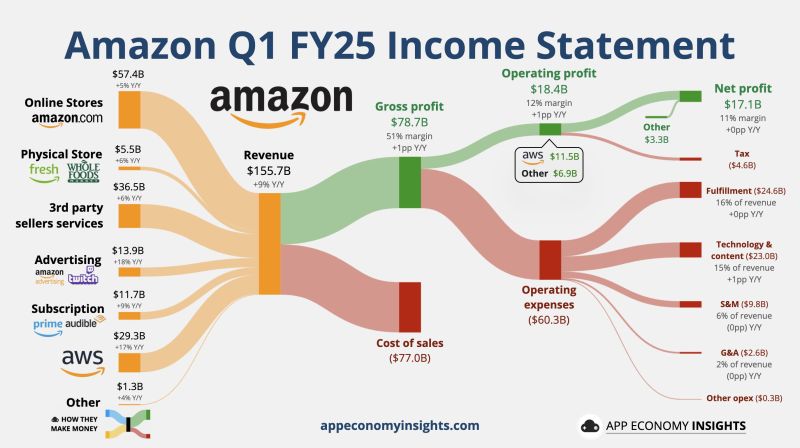

Amazon (AMZN) reported its first quarter earnings after the bell on Thursday beating on the top and bottom lines but offered lighter than anticipated guidance for its Q2 operating income.

The stock is down -4% after-hours ➡️ For the quarter, Amazon saw earnings per share (EPS) of $1.59 on revenue of $155.7 billion. Wall Street was anticipating EPS of $1.36 and revenue of $155.1 billion, according to Bloomberg consensus estimates. The company reported EPS of $0.98 and revenue of $143.3 billion in Q1 last year. AWS revenue came in at $29.2 billion versus expectations of $29.3 billion. ➡️ For the second quarter, Amazon said it anticipates operating income of between $13 billion and $17.5 billion. Analysts were expecting $17.8 billion. The company saw operating income of $14.7 billion in Q2 2024. ➡️ The company also said it anticipates a 10-basis point impact to its Q2 sales. ➡️ Amazon shares fell more than 4% following the report. ➡️ $AMZN Amazon Q1 FY25: • Revenue +9% Y/Y to $155.7B ($0.6B beat). • Operating margin 12% (+1pp Y/Y). • EPS $1.59 ($0.23 beat). • Q2 Guidance: ~$161.5B ($0.4B beat). ☁️ AWS: • Revenue +17% Y/Y to $29.3B. • Operating margin 39% (+2pp Y/Y). Source: App Economy Insights, Yahoo Finance

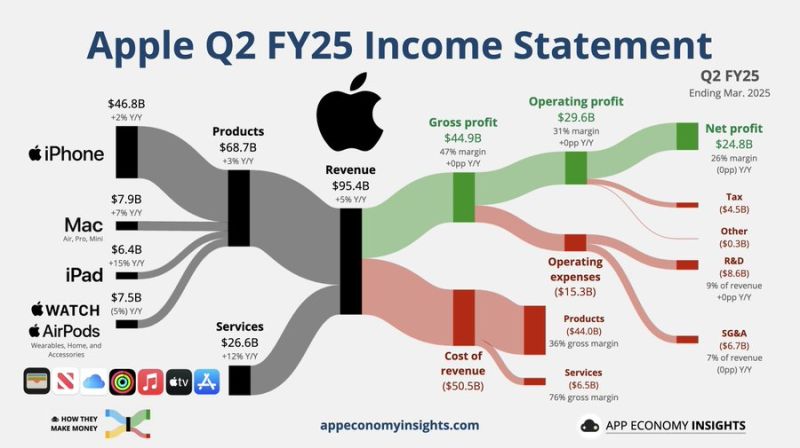

Apple reported second fiscal-quarter earnings Thursday that beat Wall Street expectations, but the company’s closely-watched Services division came up light versus estimates.

➡️ $AAPL Apple Q2 FY25 (March quarter): Services +12% Y/Y to $26.6B. Products +3% Y/Y to $68.7B. • Revenue +5% Y/Y to $95.4B ($0.8B beat). • Operating margin 31% (+0pp Y/Y). • EPS $1.65 ($0.03 beat). Source: App Economy Insights

Nasdaq $QQQ has now fully recovered from the losses sustained after Liberation Day

Source: Barchart

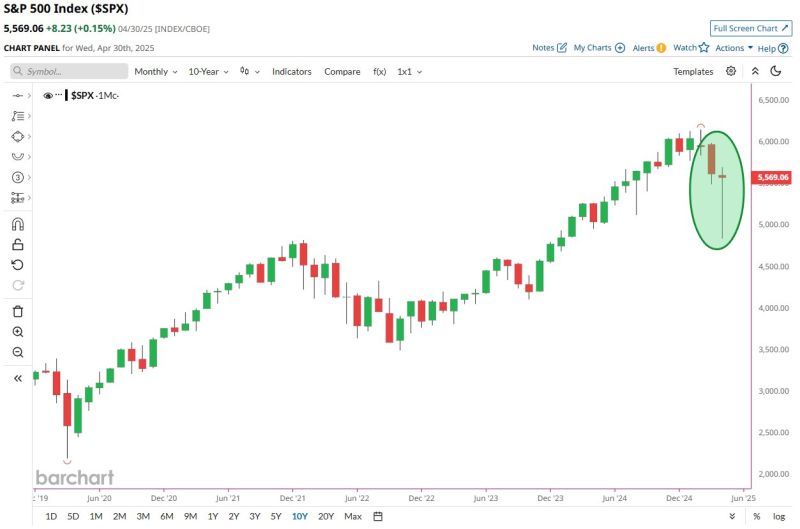

The S&P 500 just formed a bullish hammer pattern on the monthly chart 🚀

▶️ What is a bullish hammer? "The hammer candlestick is a bullish trading pattern that suggests a stock/index has found its bottom and is poised for a trend reversal. It means that sellers entered the market and drove the price down but were eventually outnumbered by purchasers, who drove the asset price up". Source: Barchart

If you'd taken the month of April off, you'd never know the world faced an existential crisis (the end of US exceptionalism etc...)

It is indeed hard to believe but the $QQQ Nasdaq 100 ended the month in the green and tagged its 50 day moving average... April has been a rollercoaster ride for traders: a 16% peak to trough drawdown in the first week of the month, followed by a ~18% rally the last few weeks… only to ‘fail’ at the 50-dma yesterday. Source: www.zerohedge.com, Bloomberg

As we head into May, a big question for markets is of course whether the US is on a path to a recession or not.

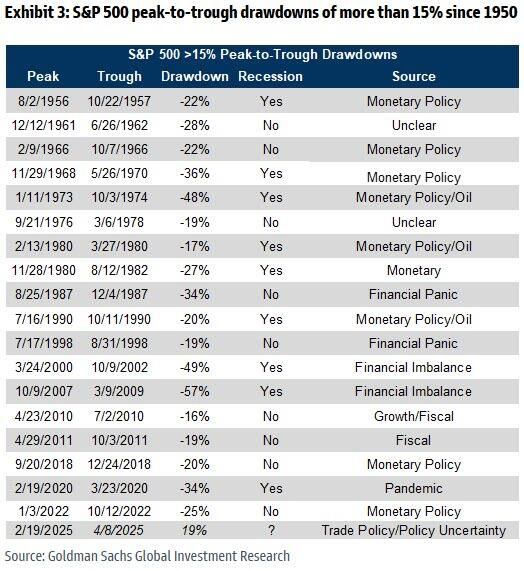

On the positive side, we have not seen a meaningfully consistent erosion of activity yet. Hard data have been doing ok, earnings are resilient, spreads are tightening again, etc. On the negative side, US has not spiked its tariffs this high since the 1940s. It is thus not an easy question to answer. And as shown by the table below by Goldman, market's ability to predict a recession is not that good... It is actually a toss coin Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks