Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

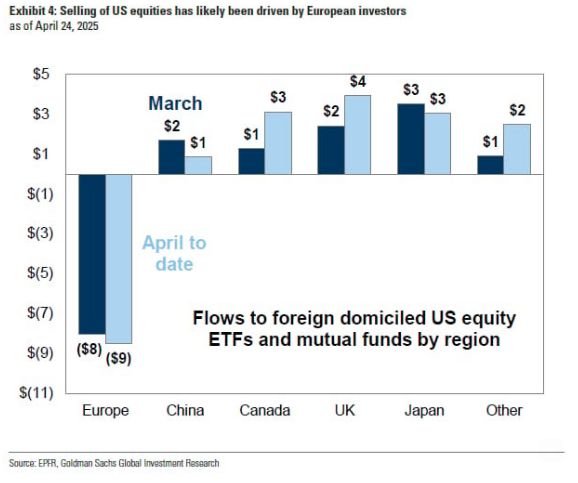

Only European Investors have been dumping U.S. Stocks 🚨

The rest of the world, including China, are buying 📈📈 Source: Barchart, Goldman Sachs, EPFR

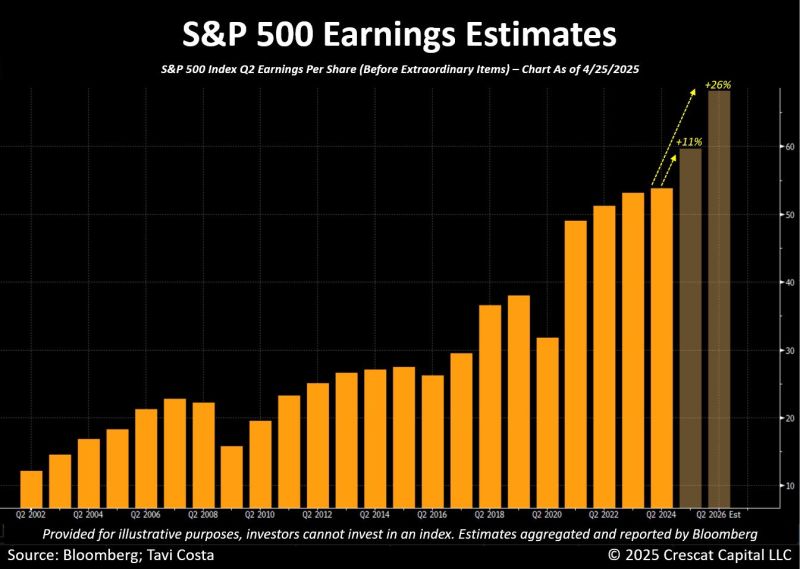

S&P 500 earnings are expected to grow 11% this quarter and another 26% next year.

This probably assumes no recession, because if there is one, a sharp downgrade in earnings estimates is likely. Source. Bloomberg, Tavi Costa

If you bought European Stocks in 2000, you finally broke even after 25 years 🥳🍾🫂

And now you're praying that you didn't double top 🙏 Source: Barchart @Barchart

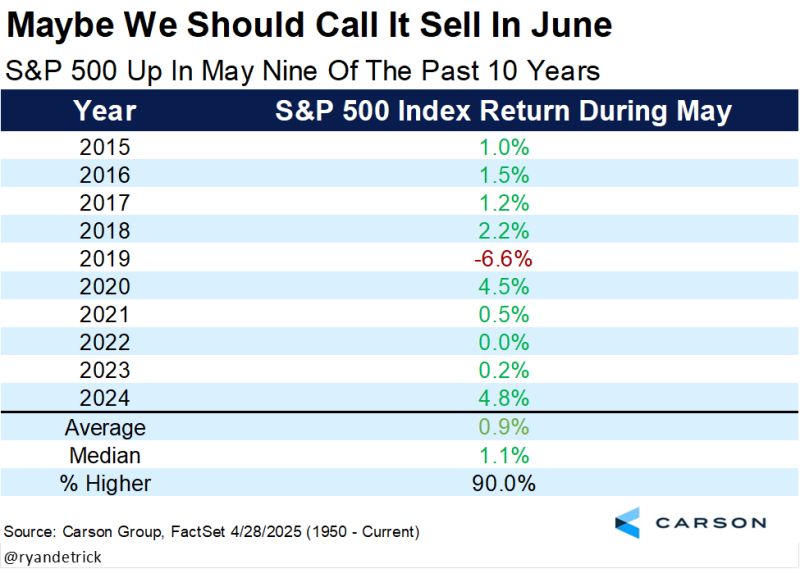

President Trump’s first 100 days in office is the worst for the stock market since Richard Nixon’s presidency...

Source: Stocktwits

Trump’s first 100 days: the biggest stock winners and losers.

🚀 Winners: $PLTR | Palantir +57% $PM | Philip Morris +39% $DG | Dollar General +36% $VRSN | Verisign +31% $NEM | Newmont +30% $NFLX | Netflix +29% 😨 Losers: $DECK | Deckers Outdoor -48% $TER | Teradyne -44% $ZBRA | Zebra -40% $ALB | Albemarle -40% $DAL | Delta Airlines -36% $UAL | United Airlines -36% Source: The Future Investors

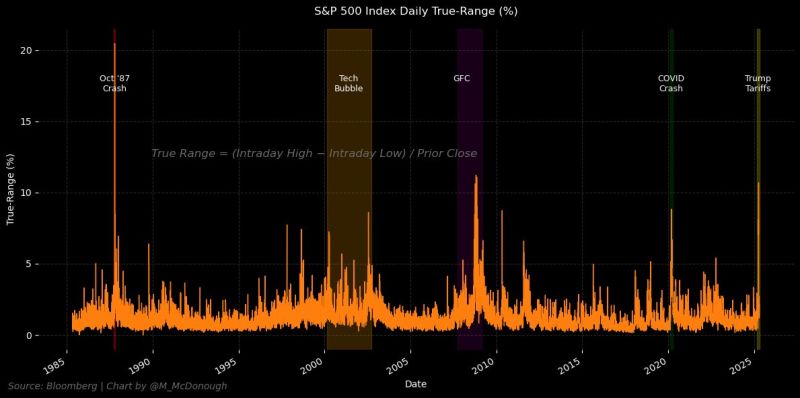

S&P 500 Index Size of Intraday Swings Since 1985

Source: Michael McDonough @M_McDonough, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks