Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

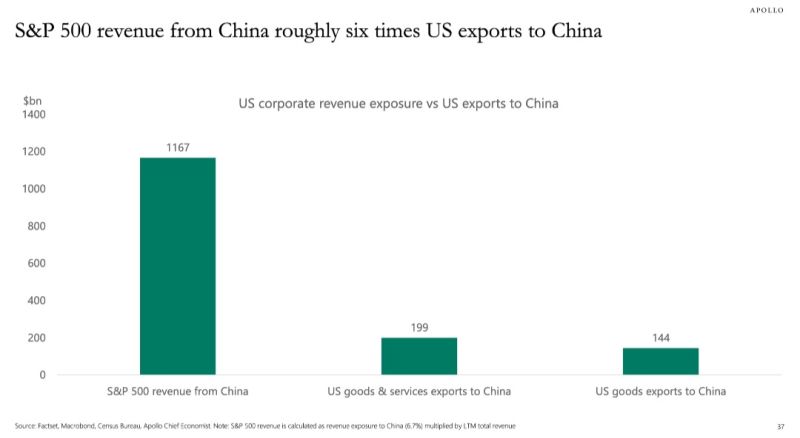

SP500 revenue from China are roughly six times US exports to China

From Torsten Slok, Apollo

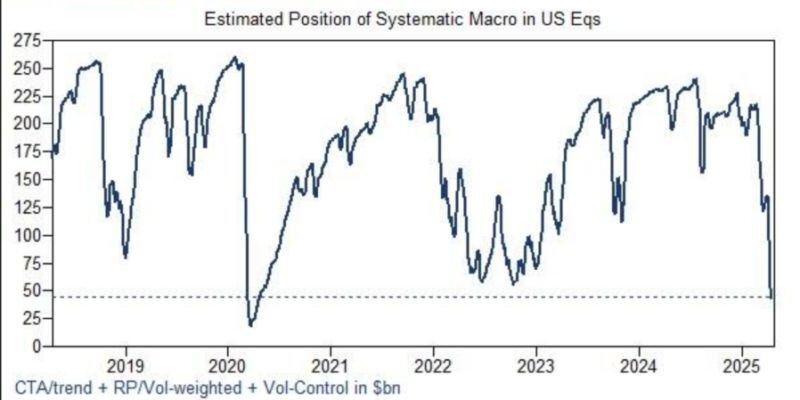

Wow. Systematic macro hedge funds have reduced exposure to US equities to levels not seen since the COVID crash.

They sure have a lot of buying to do if the market stays bid. Chart: Goldman Sachs thru Markets & Mayhem

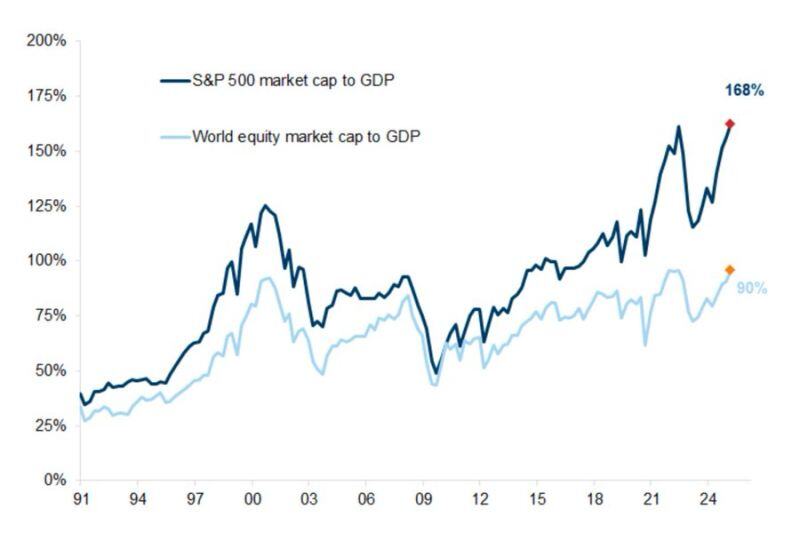

Warren Buffett looks at market cap-to-GDP as one indicator for how frothy or cheap the markets may be.

The S&P 500 recently traded around 168% market cap-to-GDP vs the global equity markets at around 90%. That suggests US stocks are .. exceptionally expensive. Chart: Goldman, Markets & Mayhem

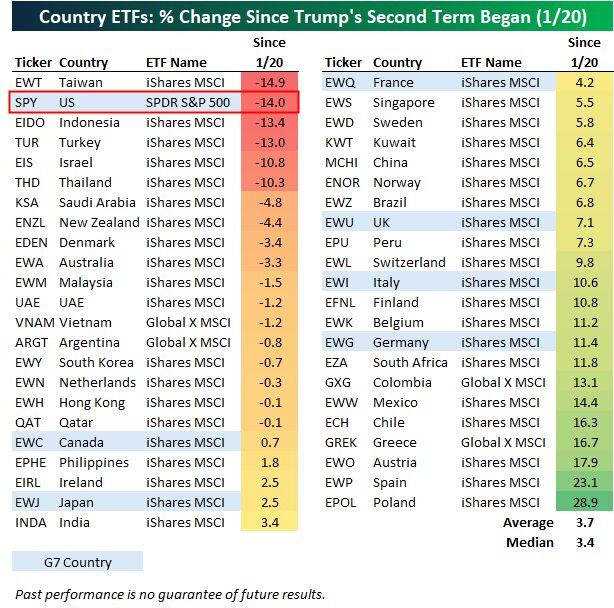

🚨The US stock market $SPY is now the 2nd worst out of 45 country ETFs since President Trump's term began in January.

The US is down 14% versus the average country that's up 3.7%. Germany $EWG is outperforming the US by 25 percentage points.🚨 Source: Bespoke

Here's how every stock in the SP500 has performed so far in 2025 Wall Street 2025 Performance:

🔴 $DIA is down 8% 🔴 $SPY 500 is down 10.1% 🔴 $QQQ is down 15.6% 🔴 $IWM 2000 is down 15.7% 🟢 $VIX is up 70.9% Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks