Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Hermes $RMS Q1 2025

"Despite a high comparison basis in the first quarter, the group achieved solid growth in sales, thanks to the trust of its customers and the commitment of the teams, whom I thank warmly." – Axel Dumas, CEO Revenue growth by business line: Source: Quartr

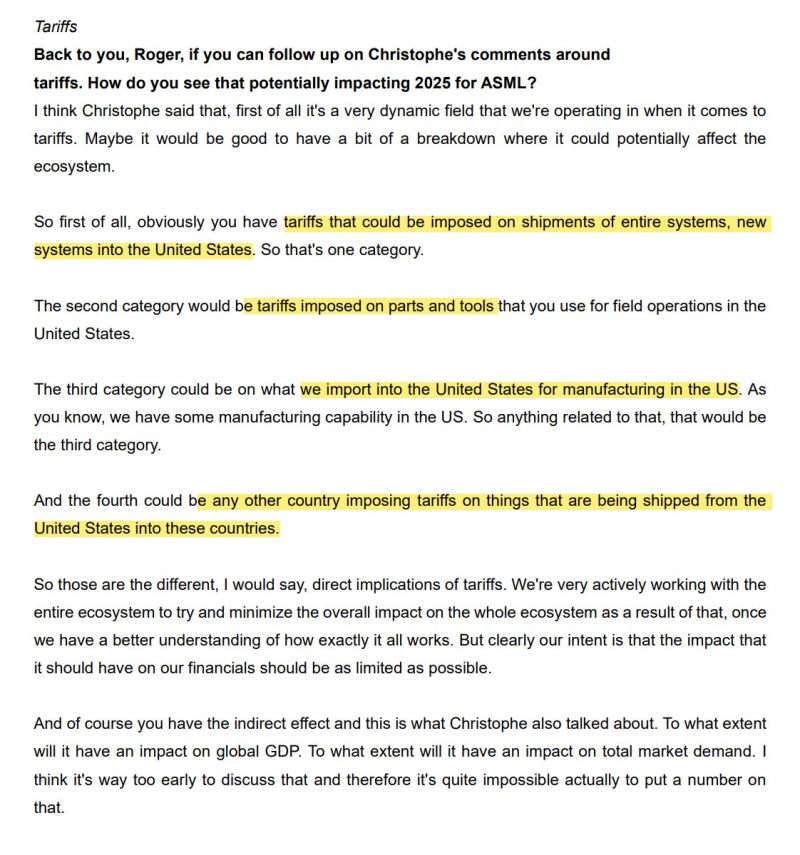

$ASML CFO on the potential impact of tariffs:

—Tariffs could impact ASML across 4 critical supply chain categories —Actively working to mitigate tariff-related risks across its ecosystem —Timing & magnitude of Tariff-induced demand shocks are still too early to quantify Source: The Transcript @TheTranscript

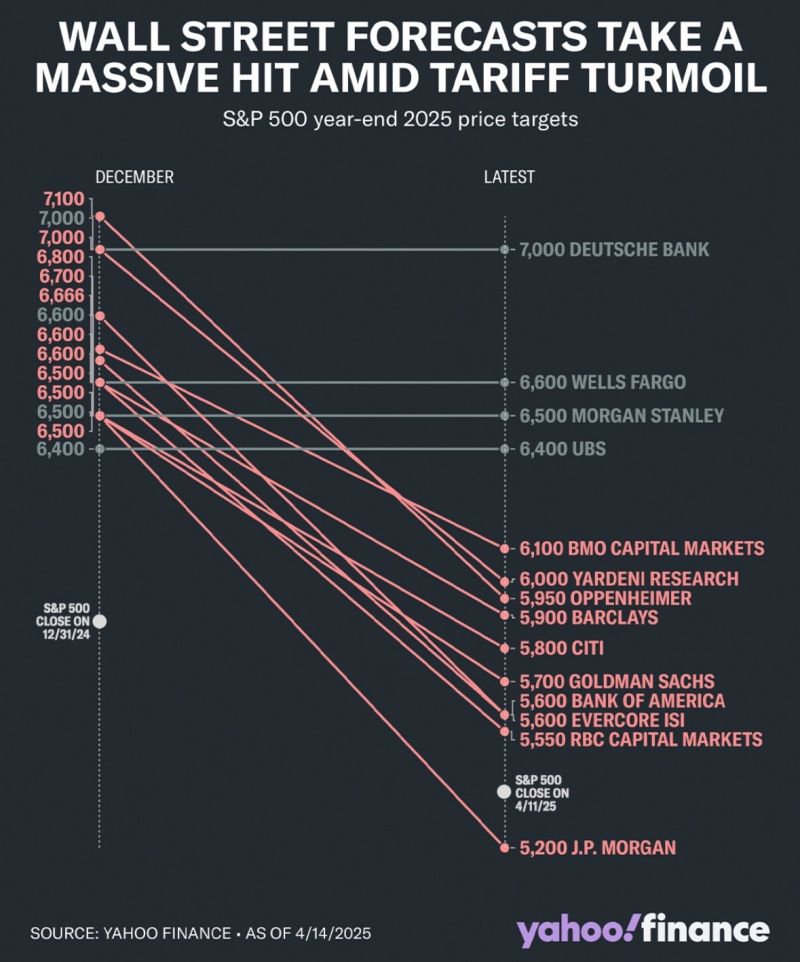

Here’s how Wall Street’s year end 2025 targets for the S&P 500 have changed

Source: Blossom @meetblossomapp, Yahoo Finance

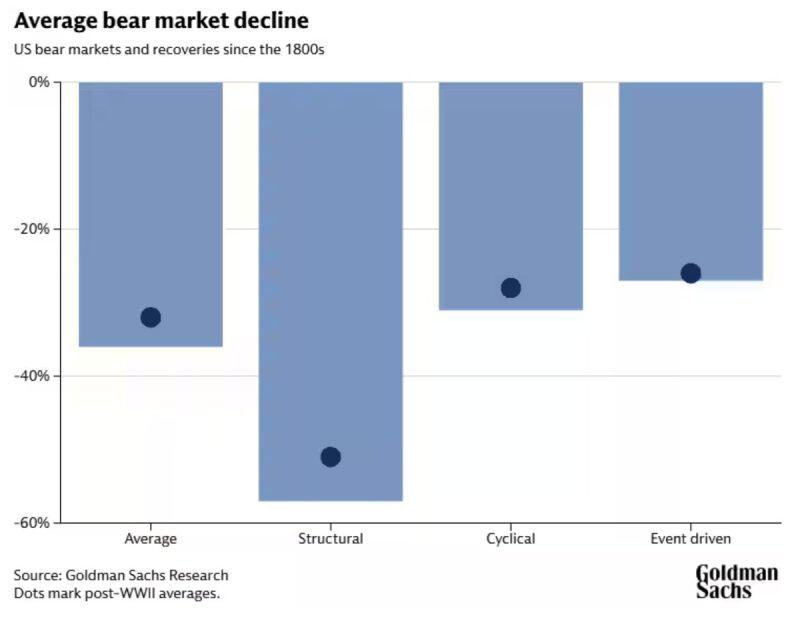

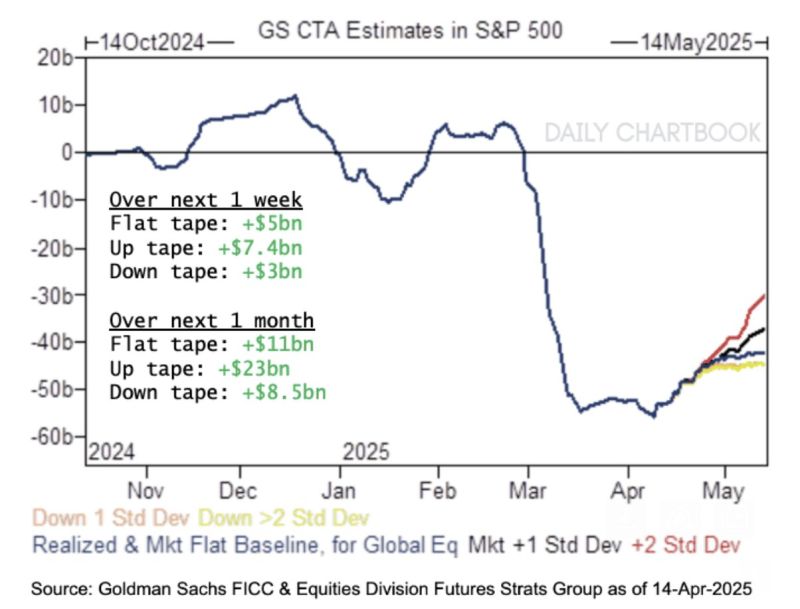

"There are three distinct categories of bear market."

- Goldman Sachs Source: Daily Chartbook @dailychartbook

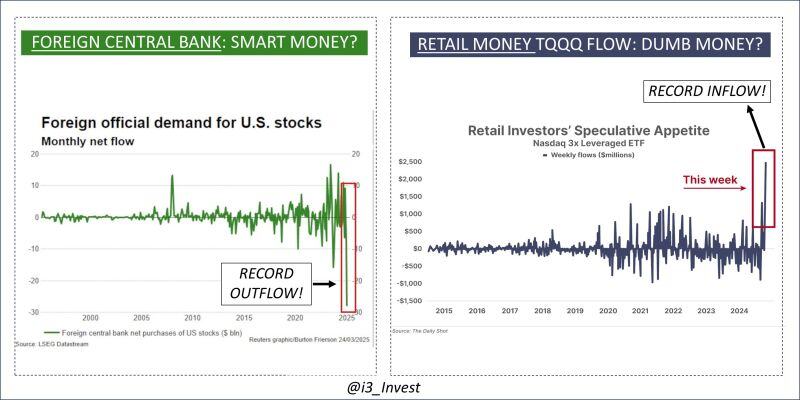

Who do you think is smarter here?

Source: Guilherme Tavares @i3_invest

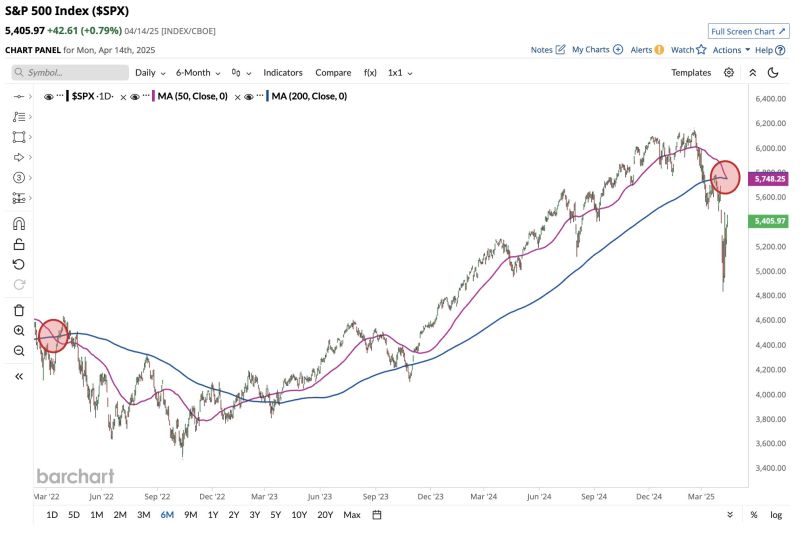

JUST IN 🚨: S&P 500 forms Death Cross ☠️ for the first time since March 2022

Source: Barchart

Extreme anti-US sentiment or just the start of a trend?

Source: Barchart

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31.

Per Reuters, the results were well below analysts’ expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown. The group’s key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH’s overall profit. Elsewhere, the company’s wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant. The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump’s tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year. Source: Quartr, Hypebeast

Investing with intelligence

Our latest research, commentary and market outlooks