Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The story of yesterday >>>

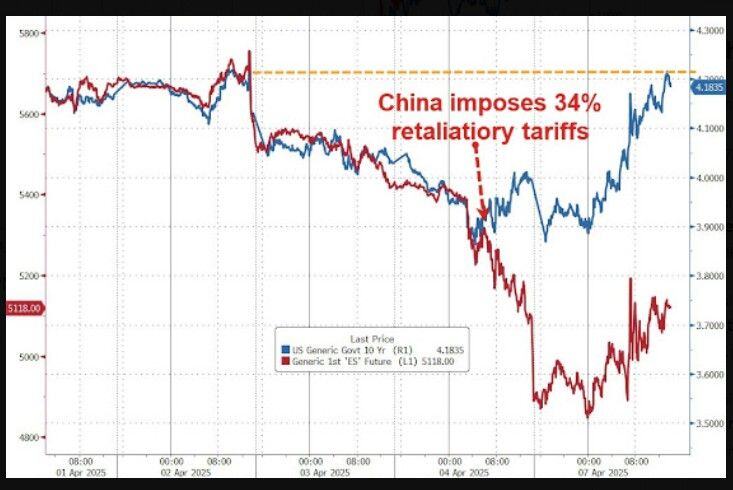

US 10 year yields are back to Liberation Day while stocks are 10% lower...Are US Treasuries losing their safe have status? Or was it related to China dumping more treasuries as part of their retaliation plan? As Goldman's Mike Washington writes, there were lot of client questions on what is behind the higher yields; GS rates specialist Mike Cassell writes, “A lot of supply coming up in 10s and 30s later this week...and we are seeing increasing numbers of clients worried about stagflation + fiscal expansion+ lack of sponsorship of issuance. On the stagflation note, we had FOMC Kugler out earlier today saying inflation more an urgent issue than growth...this is a toxic mix if so. Flow wise we have seen HF paying the belly in swap and large selloff/steepening on futures flows.” And of course, China may well be selling in retaliation to Trump's tariffs; we'll know soon enough. Source: www.zerohedge.com, Bloomberg

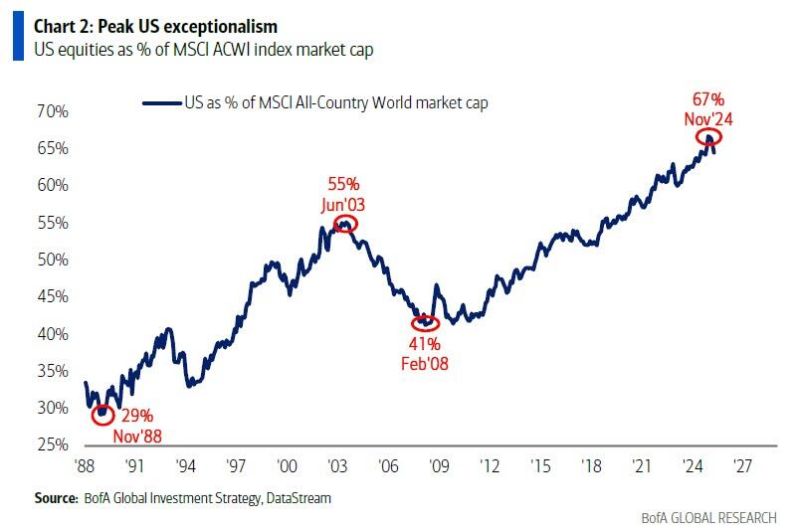

Has a new secular BEAR MARKET begun in the US?

The US share in the global stock market has fallen 3-4 percentage points since its November 2024 peak of 67%. This comes as the US has significantly underperformed other markets this year. Many investors are not ready for this.. Source: BofA, Global Markets Investor

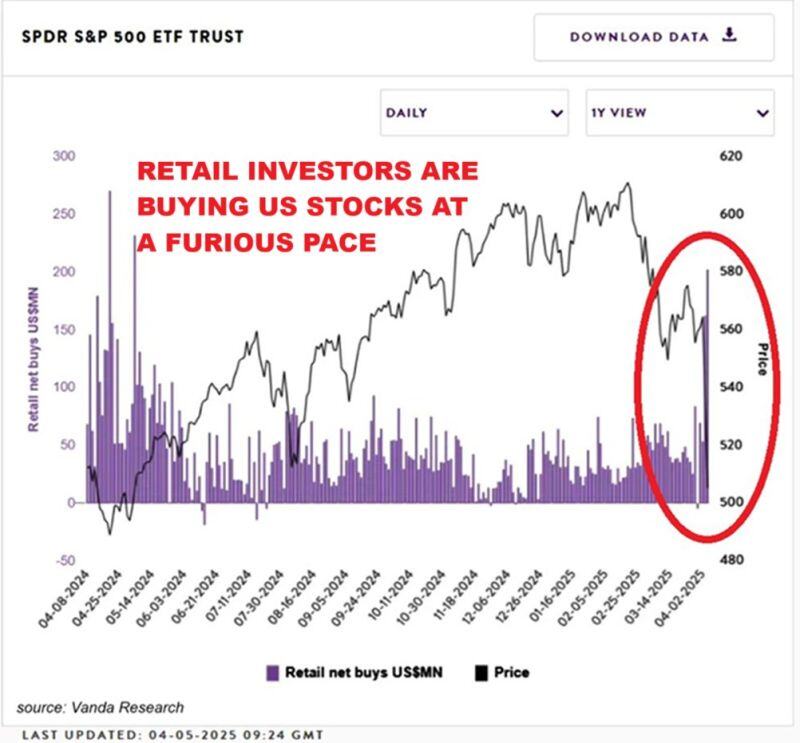

⚠️No major CAPITULATION from retail investors YET:

Net retail buying of the S&P 500 ETF, $SPY, hit over $200 BILLION on Friday, the most in 13 months. Mom-and-pop investors were also the net buyers of NVIDIA, $NVDA, Tesla, $TSLA, and Amazon, $AMZN, among others. Source: Global Markets Investor

US small caps russell 2000 is officially in bear market

First time since 2022

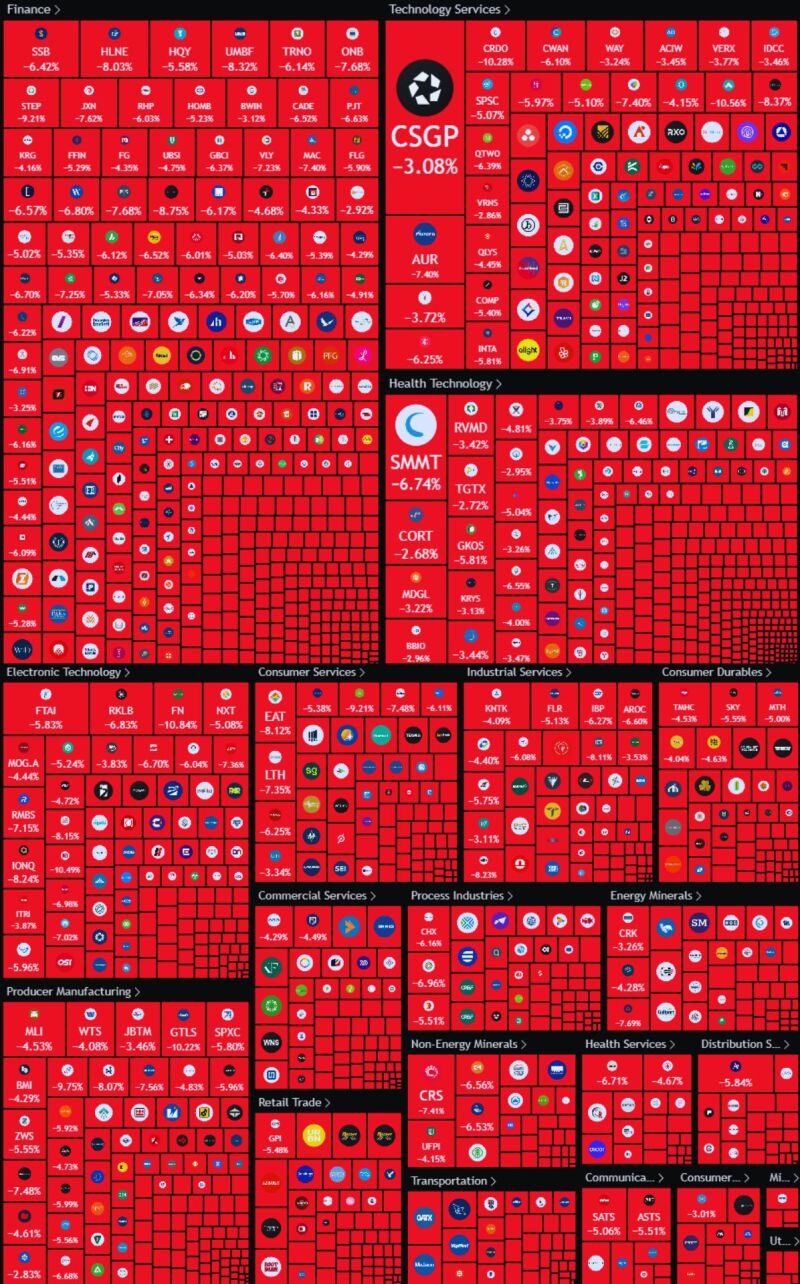

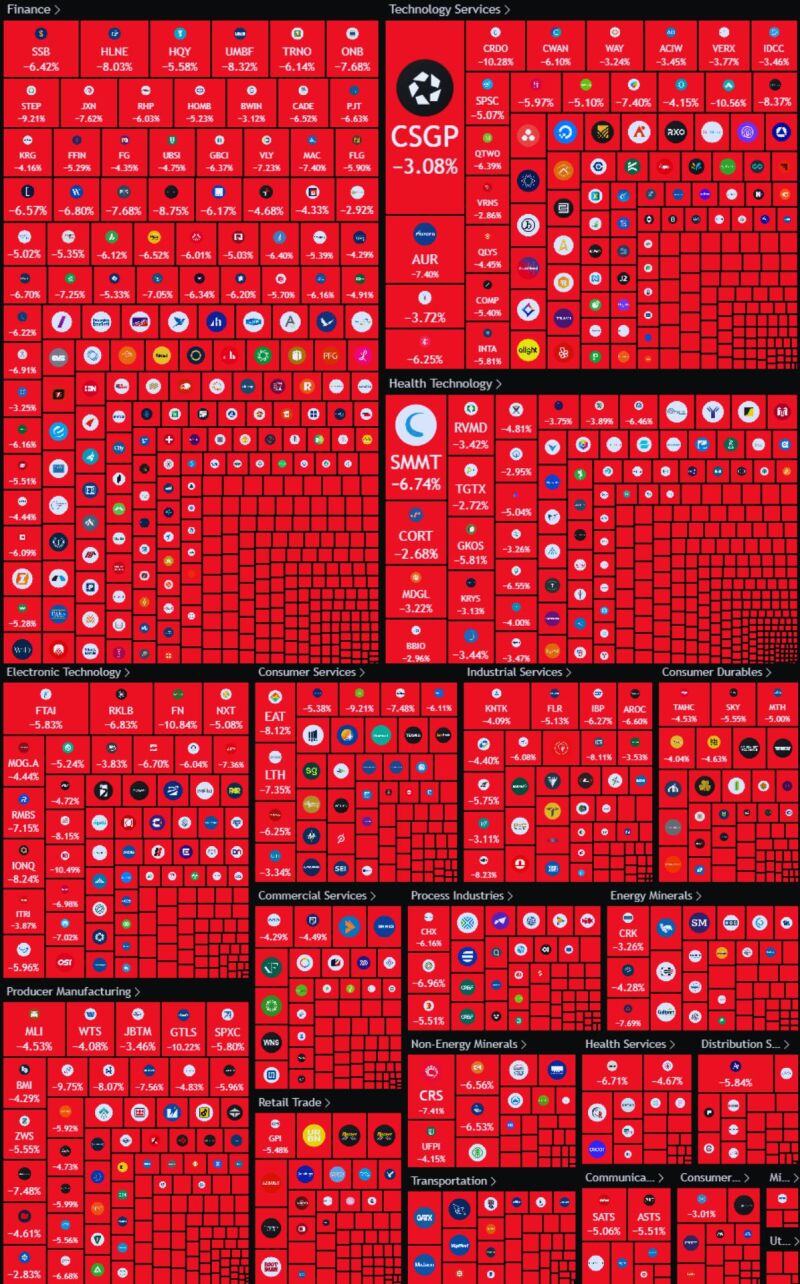

The S&P500 had yesterday its worst day since 2020

Source: Blossom @meetblossomapp

US smallcaps #Russell2000 is officially in bear market

First time since 2022

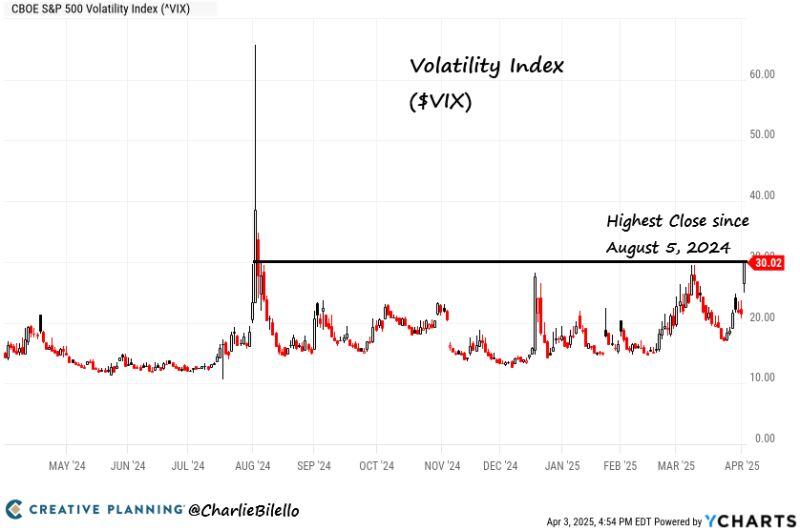

The $VIX ended the day at 30, its highest close since August 5, 2024.

Fear is on the rise and stocks are on sale, providing more opportunities for long-term investors. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks