Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

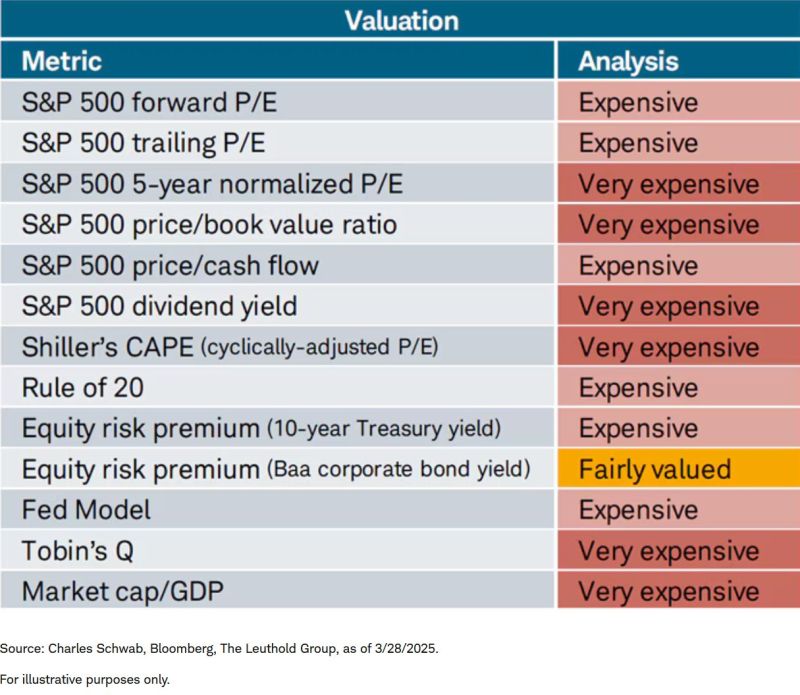

Despite the pullback, the S&P 500 is still NOT cheap:

As shown below, the US stock market is expensive or very expensive on 12 out of 13 valuation indicators, according to Charles Schwab analysis. Metrics like 5-year normalized P/E, P/B or Shiller's CAPE are still historically elevated despite the sell-off. Source: Charles Schwab, The Leuthold Group, Bloomberg thru Global Markets Investor

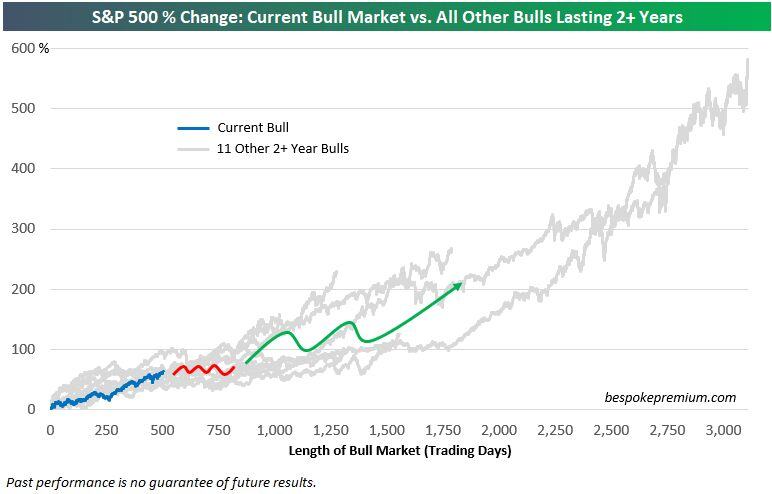

Bull markets that make it past the two-year mark have typically consolidated in year three before heading higher again.

Source: Bespoke

Germany is the european country the most sensitive to global trade according to Goldman - see chart below

According to Goldman Sachs, the Dax and MDax have a beta of 1.9 to world trade growth — meaning they tend to move almost twice as strongly w/changes in global trade. That’s much higher than the US market, which has a beta of 1.4. In contrast, the UK’s FTSE 100 is less exposed to global trade, thanks to its defensive sector mix and the UK’s services-driven economy. The Swiss SMI is similarly more insulated. It’s also a defensive index, and Swiss exports are generally less sensitive to global demand, as they often consist of high-tech, specialized products. Source: HolgerZ, Goldman Sachs

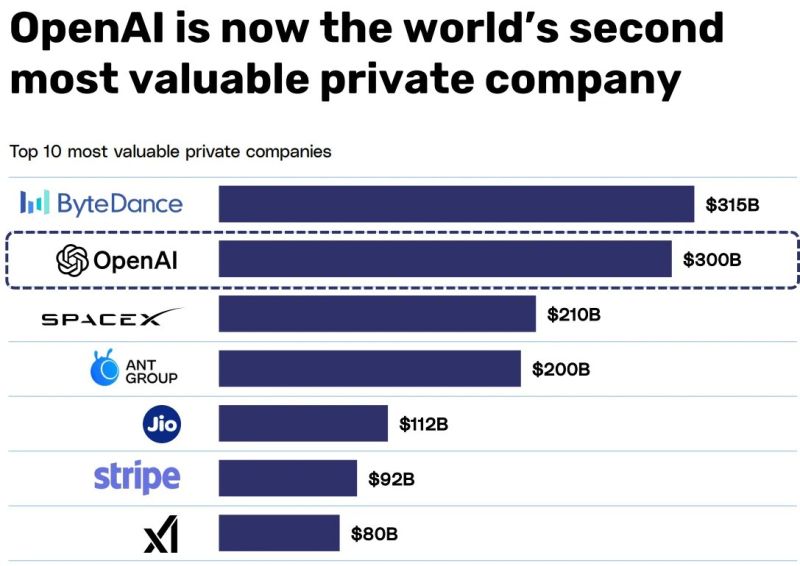

OpenAI is now the world's second most valuable private company

Source: Markets & Mayhem @Mayhem4Markets

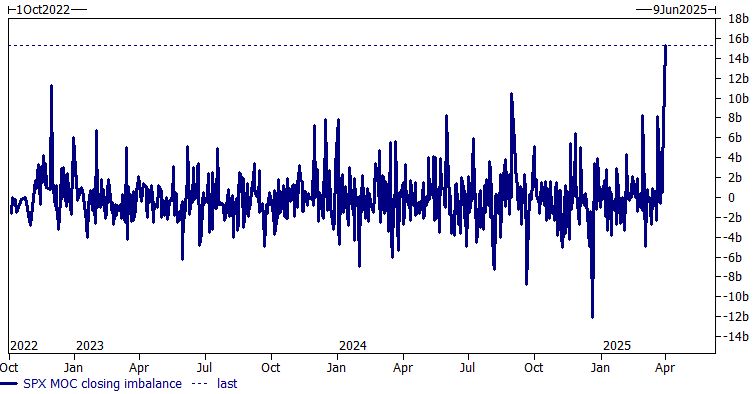

The SP500 clawed back earlier losses on Monday to end the session higher after briefly touching six-month low.

However, the tape wasn't all that bullish despite the big reversal. Indeed, Tech completed a top relative to $SPY while defensive stocks completed a bottom. Not the kind of risk appetite you want to see on a rally. Source: Steven Strazza

Investing with intelligence

Our latest research, commentary and market outlooks