Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

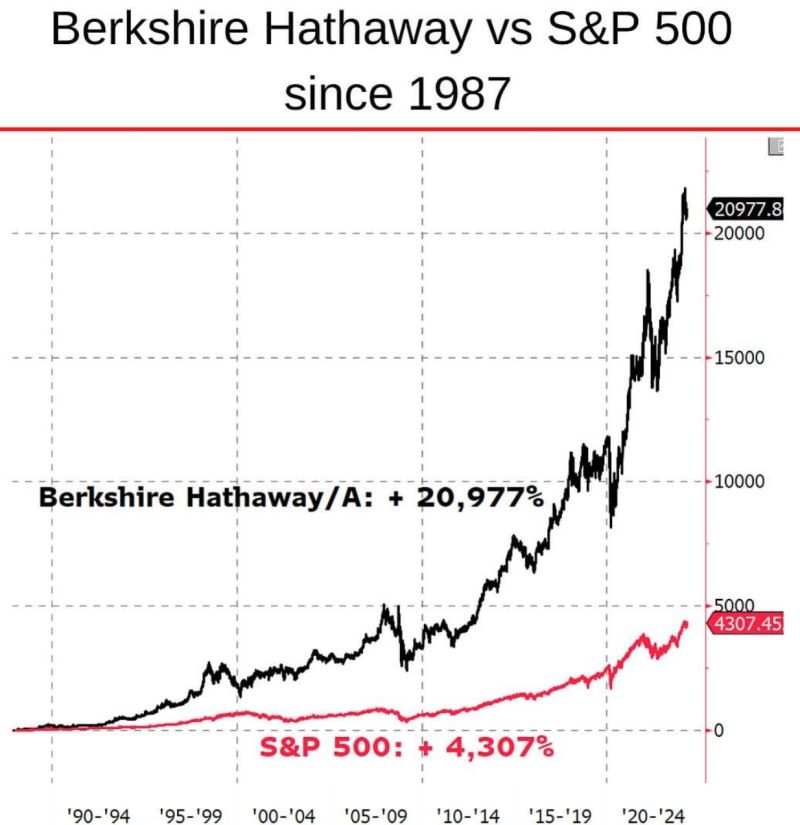

Don't stop investing.

Drawdowns and crashes are the best period to invest Source: Personal Finance Club

Here are the current largest holdings in the NASDAQ 100 $QQQ

source : evan, finchat

Foreign investors withdrew ~$6 BILLION from US equity funds last week.

This is the the 3rd largest amount on record and in-line with levels seen during March 2020. source : BofA, kobeissiletter

"Nothing good happens below the 200-day moving average."

— Paul Tudor Jones Source: Tavi Costa on X

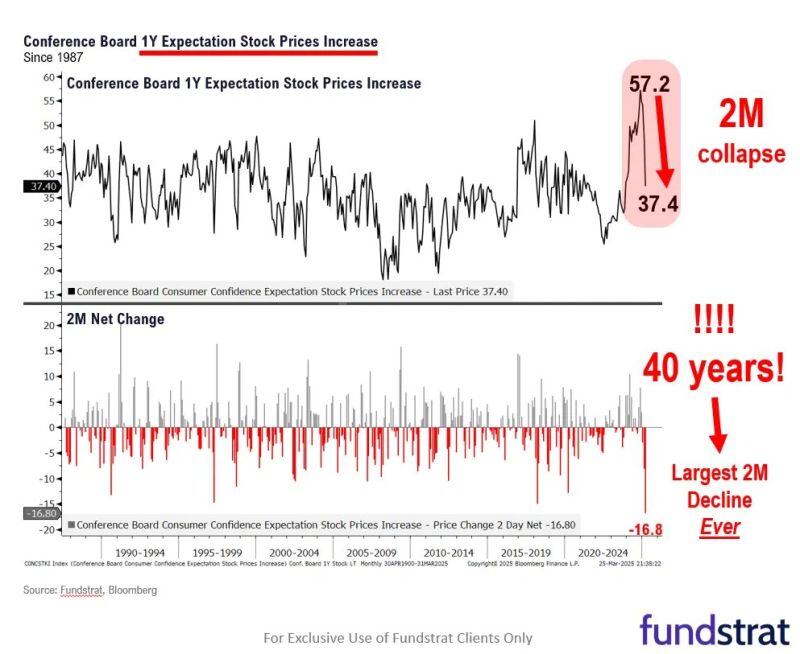

Tom Lee: Conference Board shows largest ever plunge in stock expectations, which is a contrarian buy signal

Source: Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi, FundStrat

There’s another S&P 500 target cut — to a new Wall Street low

Another bank has cut its price target, and this time it’s to a new low on Wall Street. Barclays strategists say they’ve lowered their year-end S&P 500 price target to 5,900 from 6,600. That’s the lowest of any firm that’s a U.S. Treasury dealer, though Montreal-based BCA has a 4,450 year-end call. source : marketwatch

‼️'Retail investors' money is FURIOUSLY buying US equities:

Retail flows into technology stocks have more than TRIPLED in just a few weeks. Mom-and-pop investors have bought the largest US tech stocks despite the Nasdaq 100 index falling into a correction.👇 Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks