Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

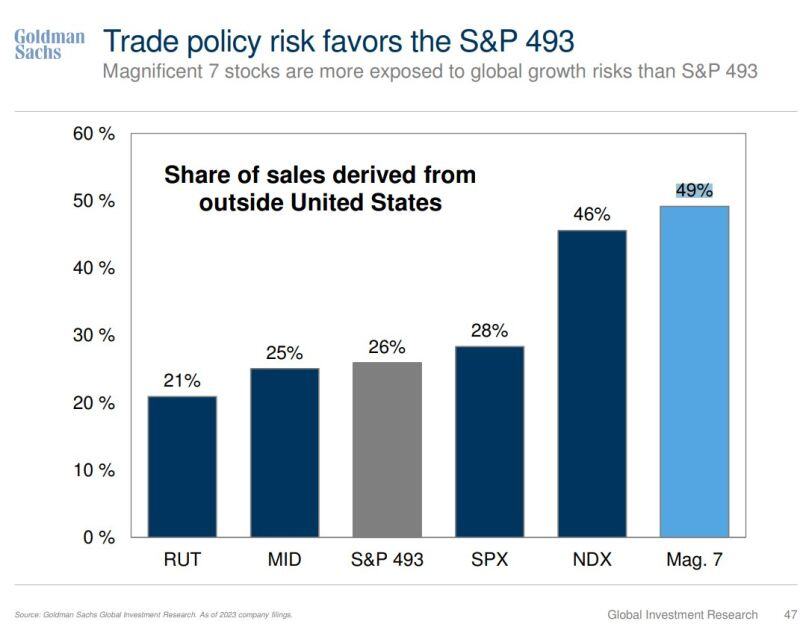

Magnificent 7 stocks are more exposed to global growth risks than S&P 493

(but would take advantage of a weaker dollar) Source: Mike Zaccardi, CFA, CMT, MBA, Goldman Sachs

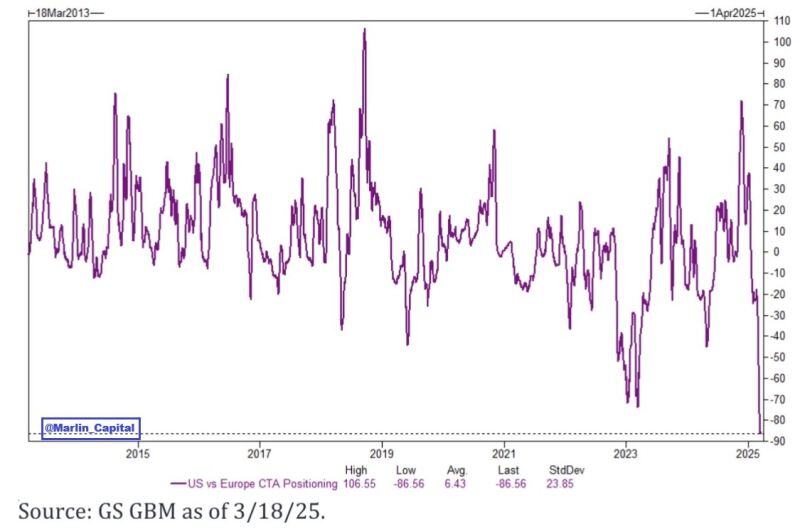

CTAs are short -$34B of US equities and long $52B of European equities.

This is the largest spread we have EVER seen. $SPY $QQQ $IWM $FEZ Source: David Marlin Marlin Capital Solutions

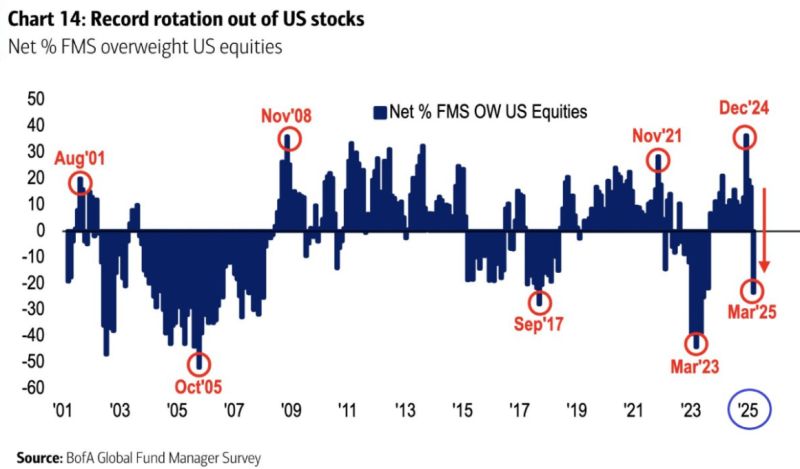

Fund Managers just rotated OUT OF U.S. Stocks at the fastest pace in history

source :BofA

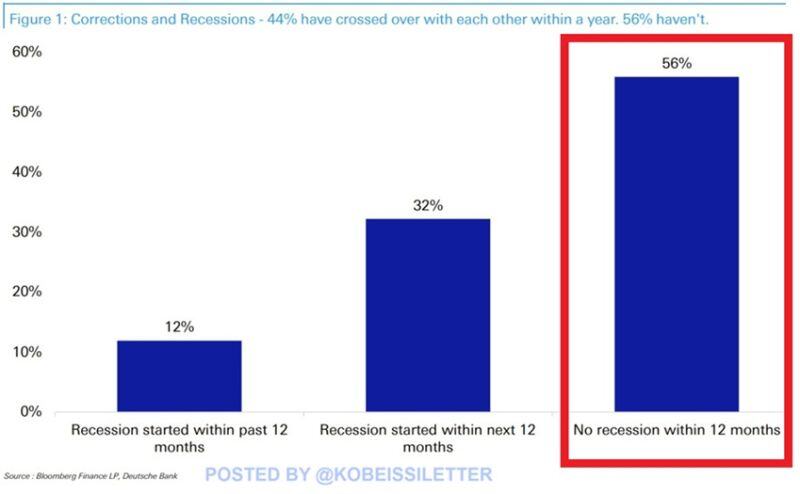

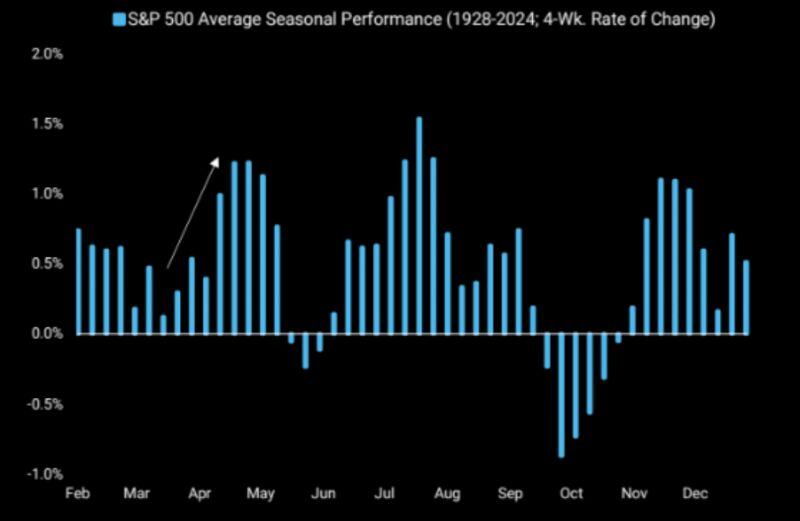

How often do market corrections lead to a recession in the US?

There have been 60 S&P 500 corrections including the most recent one, according to Deutsche Bank analysis. Historically, in 12% of corrections, a recession had already begun in the previous 12 months. 32% of the time a recession took place within the next 12 months. In 56% of corrections, the US avoided an economic downturn within the next 12 months. In other words, market corrections are only accompanied by a recession ~44% of the time. Can we avoid a recession this time? Source: The Kobeissi Letter

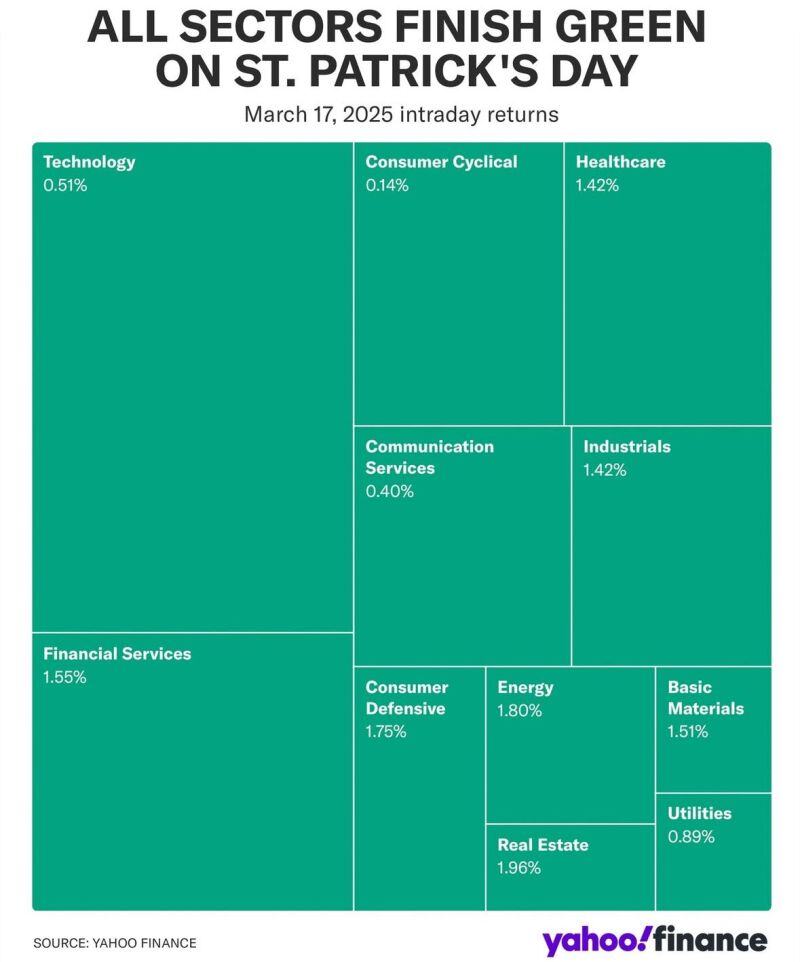

The us stock market was celebrating St. Patrick’s day today. First green close for S&P on a Monday in 4 weeks...

Source: Evan @StockMKTNewz, Yahoo Finance

Investors expect European countries to purchase more military equipment from Asia after Donald Trump threatened to withdraw the US’s security umbrella.

Link >>> on.ft.com/4iC5Fby Source: FT, Bloomberg

Mag 7 now trading at its cheapest valuation since 2023

source : bloomberg, barchart

Investing with intelligence

Our latest research, commentary and market outlooks