Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

If Goldman is wrong and the market has priced in all the downside of April 2 (and then some)

it is possible that stocks will continue to rally, which means that the analogue chart between Trump 2 and Trump1 will remain valid. Source: www.zerohedge.com, Bloomberg

The S&P has closed above the 200-day moving average... WE DID IT! $SPY

The Great Market Crash of 2025 • Born: March 2025 • Died: March 2025 ??? Source: StockTwits

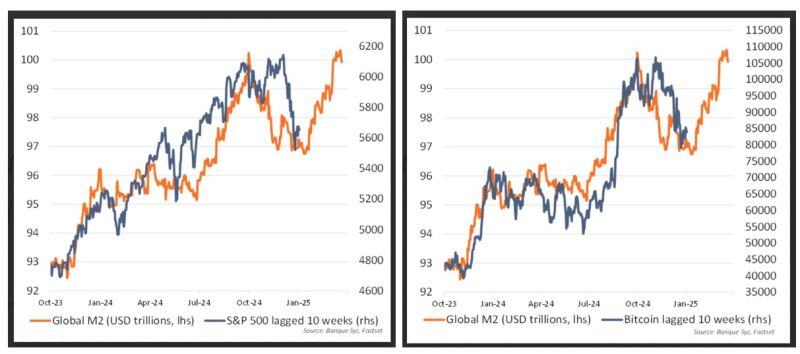

As our proprietary charts of M2 proxy (10 weeks advance) vs BTC and S&P500 suggested on Friday

The bottom could be near for risk assets as the lagged effects of a weaker dollar on global liquidity will provide a support to stocks and BTC Yesterday's advance seem to corroborate these findings. Source: Bank Syz

National Capitalism and the Trump Effect on Investment Pledges in the US 👇

Hyundai — $20 Billion UAE — $1.4 Trillion Saudi Arabia — $600 Billion Apple — $500 Billion Softbank, Open AI, Oracle — $100 Billion Nvidia — $100 Billion + Johnson & Johnson — $55 Billion Taiwan Semiconductor — $100 Billlion CMA CGM Group — $20 Billion Eli Lilly — $27 Billion Merck — $1 Billion GE Aerospace — $1 Billion Roughly $ 3 Trillion in new direct investment into America in the first few weeks of the Trump Administration. Source: Charlie Kirk @charliekirk11, FoxNews

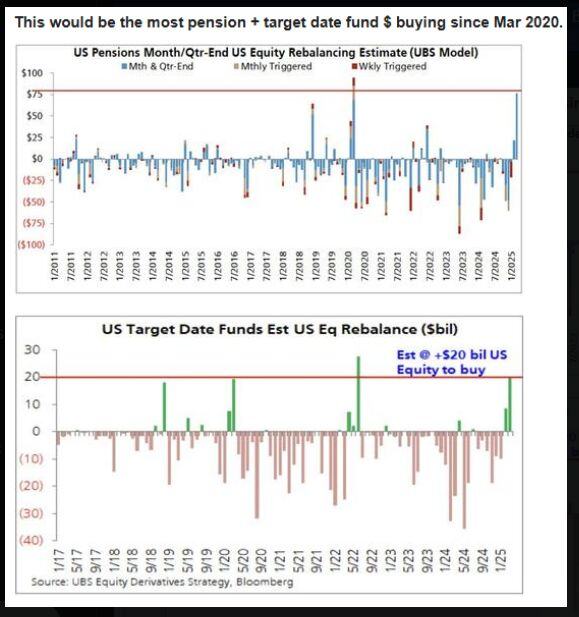

📢 Pension Funds and Target Funds could buy a combined $105 Billion of U.S. Stocks for monthly/quarterly rebalancing, according to UBS 🚀 🚀🚀

Source: Barchart

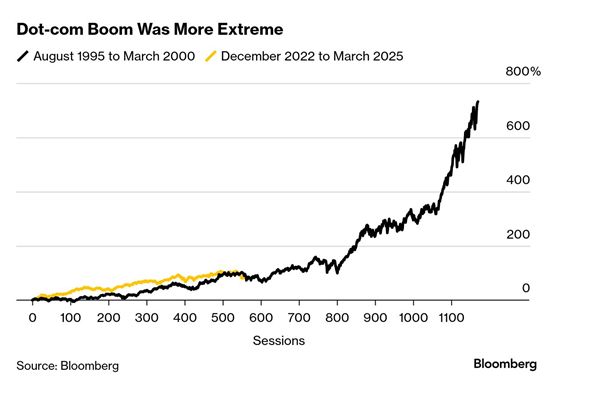

🎈 Happy Anniversary, Dot-Com Bubble.

On this day 25 years ago — March 24, 2000 — the S&P 500 hit a peak it wouldn’t revisit until 2007. Three days later, the Nasdaq 100 reached its final all-time high… for the next 15 years.

The army of retail investors is fighting the US stock market:

Mom-and-pop investors have bought US equities for 7 days STRAIGHT ending Wednesday. Individuals have sold stocks on net only in 7 trading sessions out of 52 in 2025. Is the army of retail investors going to win? Source: Global Markets Investor @GlobalMktObserv

Investing with intelligence

Our latest research, commentary and market outlooks