Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Berkshire Hathaway increased its holdings in 5 Japanese trading houses, filings to Japan’s Finance Ministry show.

Mitsui & Co. stake rises to 9.82% from 8.09% Mitsubishi Corp. rises to 9.67% from 8.31% Sumitomo Corp. rises to 9.29% from 8.23% Itochu rises to 8.53% from 7.47% Marubeni rises to 9.30% from 8.30% source : bloomberg

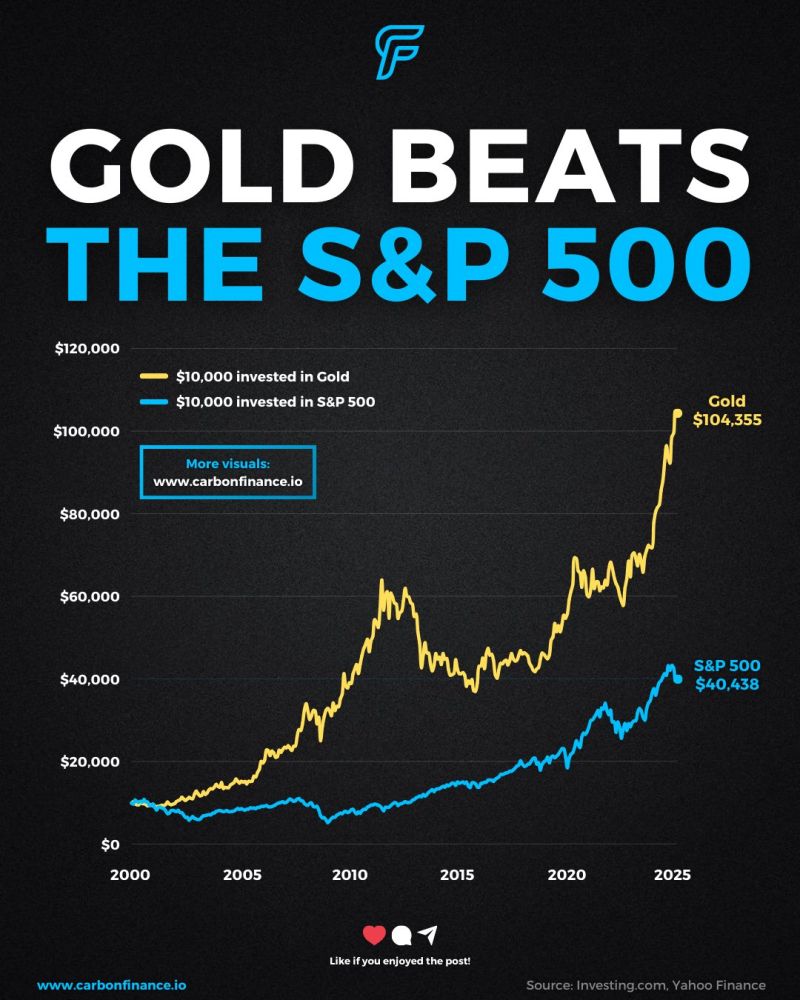

Gold $GLD has outpaced the S&P 500 $SPX by 2.5x since 2000.

A $10K investment in Gold is now $104K, while the S&P 500 sits at $40K. Source: Carbon Finance

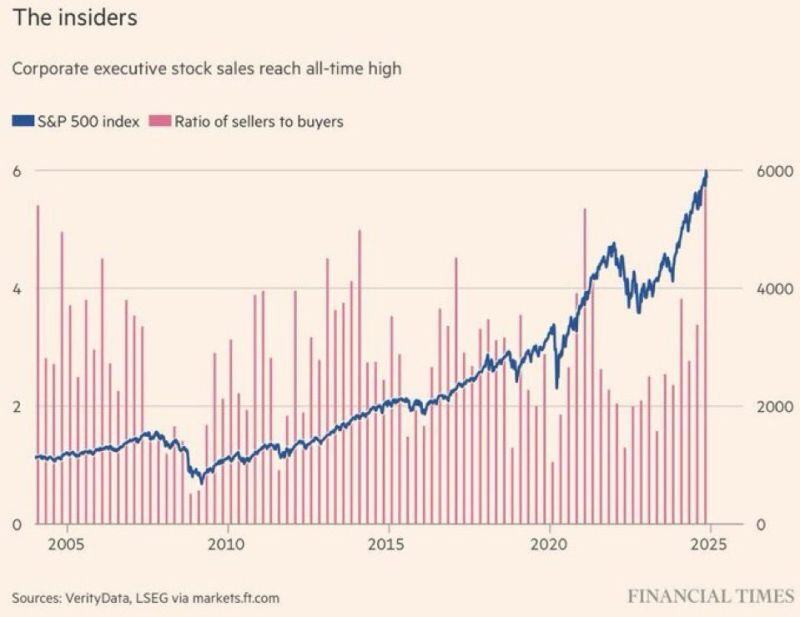

Corporate Insiders are dumping shares at the fastest pace in AT LEAST the last 2 decades.

Source: Barchart, FT

The gold-to-S&P 500 ratio is now near 4-year highs.

Source: Bloomberg, Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks