Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. stock returns after declining 10% or more

Source: George Maroudas, CFP® @ChicagoAdvisor

Monday was the worst day of the year for the S&P 500 at -2.7%.

It turns out even the best years usually have a bad day. @Ryan Detrick found 22 times >20% for the year and the average worst day in those years was -3.5%. 1997 had a 6.9% worst day and still gained 31% for the year in fact. Source: Carson

HolgerZ:

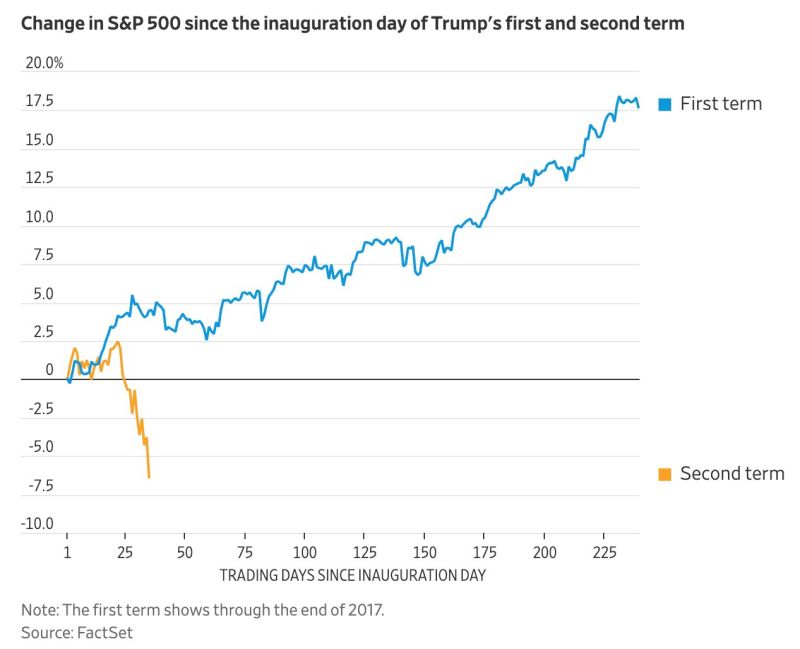

"US President Donald Trump is dealing a lasting blow to confidence in the US, its products, and its stock markets. US exceptionalism is under threat from uncertainties about Trump’s political and economic policies" Source: Bloomberg

‼️ BREAKING: EU EQUITIES UNDER PRESSURE ‼️

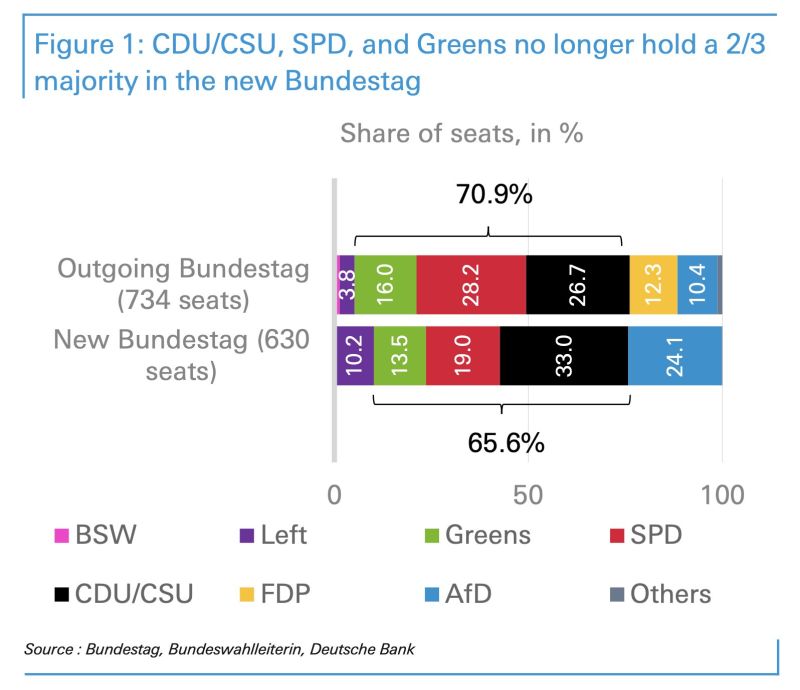

Germany's Greens won't support draft debt package in parliament. The CDU/CSU and SPD need the support of the Greens to achieve the two-thirds majority in the Bundestag in its old composition. The FDP, which was represented in the old Bundestag, will hardly vote in favor of such a debt package. Source: HolgerZ, DB

Market VOLATILITY is back:

The S&P 500 has seen a move of more than 1% in either direction for 6 straight trading sessions, the longest streak since November 2020. Source: Bloomberg

Equity markets are fearful of far more than some marginal tariff tensions.

Macro data this week broadly speaking reinforced the growth scare (red line below) while inflation anxiety is back way up... Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks