Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Happy 68th Birthday to the S&P 500! 🎉📈

Yesterday marked a significant milestone in financial history On March 4, 1957, Standard & Poor’s officially launched the S&P 500 Index, replacing its previous 90-stock index. For nearly seven decades, the S&P 500 has been a benchmark for the U.S. equity market, evolving alongside the economy and shaping investment strategies worldwide. From its inception to becoming a cornerstone of global finance, the index has stood the test of time, reflecting innovation, resilience, and market dynamics. Here’s to 68 years of market history—and many more to come! 🥂📊

Price has respected this trendline since the bear market lows of 2022...

Seems like an important spot to watch. $QQQ Source. Trend Spider

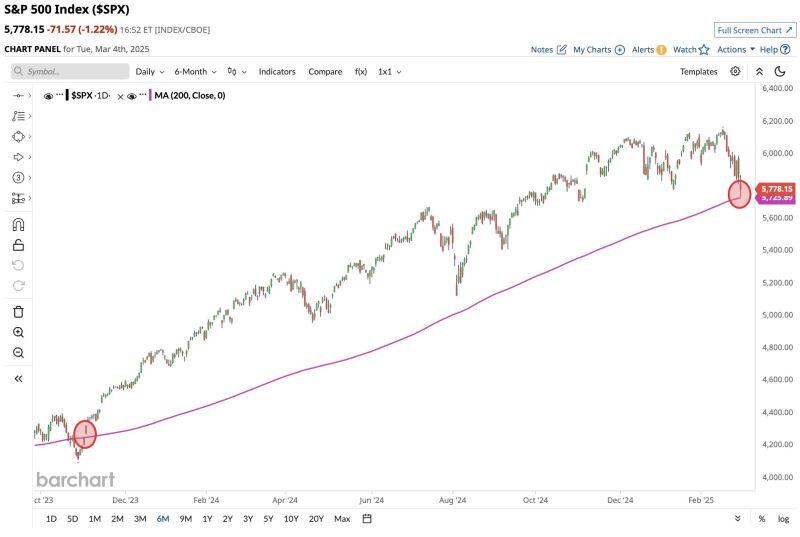

S&P 500 facing a date with destiny!

$SPX is testing its 200 Day moving average for the first time since November 2023 🚨 Source: Barchart

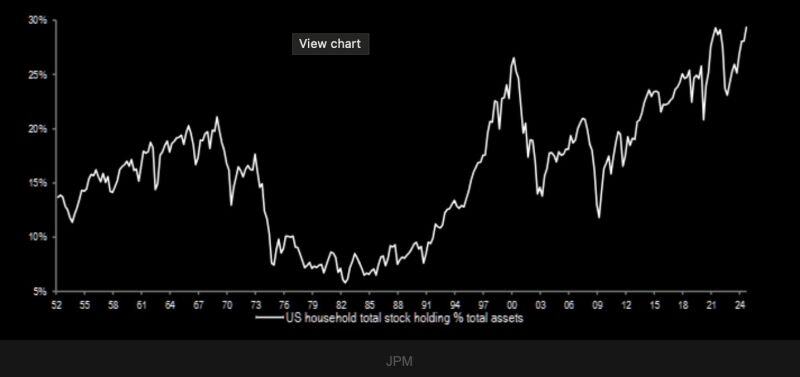

U.S. households now have the biggest allocation to stocks in history

Source: Win Smart, CFA @WinfieldSmart

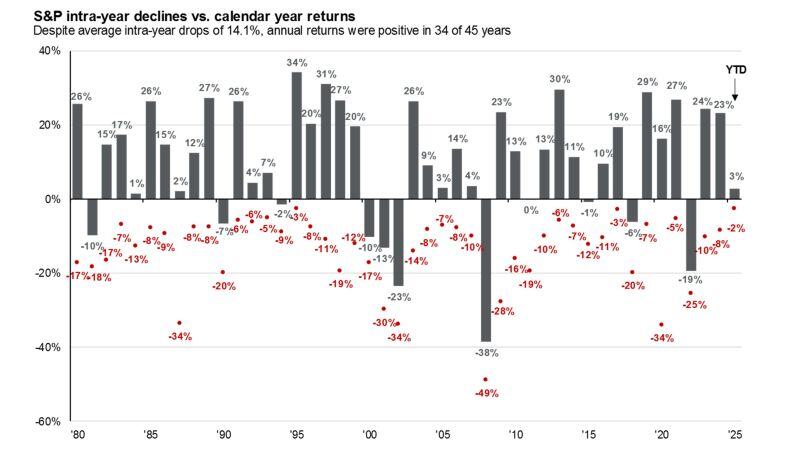

Remember: The average $SPX intra-year drawdown is 14.1%

Source: Bloomberg, Mike Zaccardi, CFA, CMT, MBA

"Be Greedy When Others Are Fearful"

One of Warren Buffett’s most famous quotes is to “be greedy when others are fearful.” Unfortunately, many anxious investors can’t stomach losses in the stock market, causing them to go to “all cash” at exactly the wrong times. Take large declines, for example. Since WW2, the S&P 500 has fallen more than 15% in nine different quarters. Following every single instance, the index was higher a year later with an average one-year gain of 25.1%. Similarly, the S&P 500 has had two-quarter drops of 20%+ just eight times, and over the next year, the index was up by at least 17% with gains every single time. source : bespoke

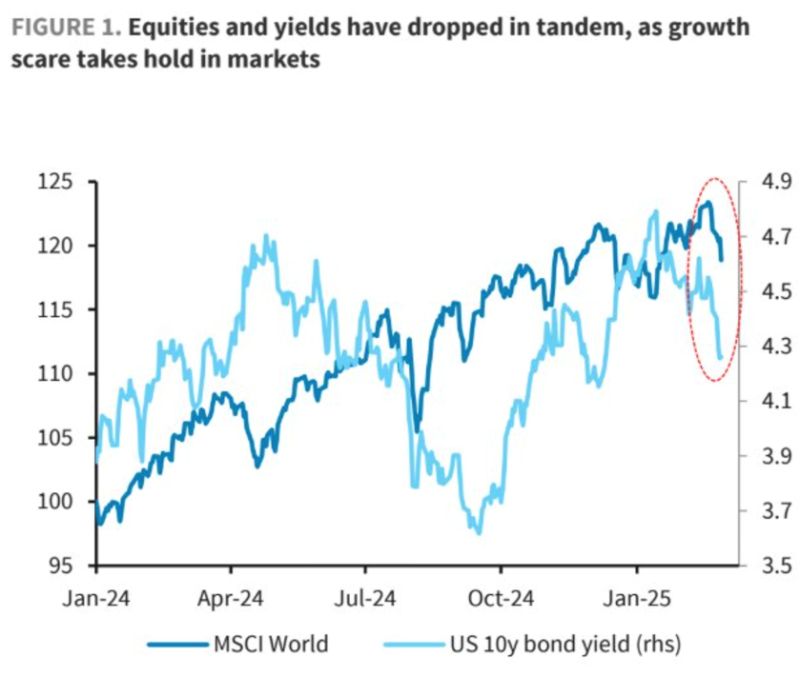

We have seen some positive correlation between bond yields and stocks recently.

Adding long-dated US Treasuries as a portfolio hedge now makes more sense. Source: Bloomberg, Barclays

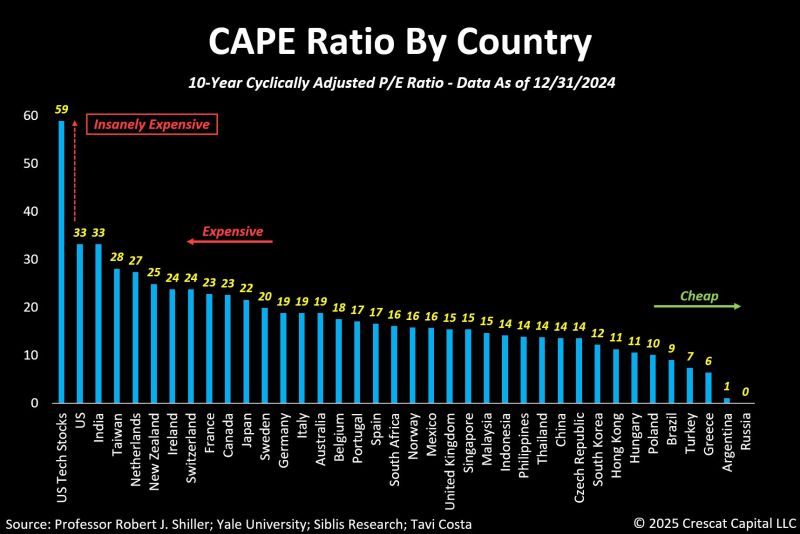

US equities now have the highest CAPE ratio globally.

More importantly: The tech sector alone is at a staggering ~60x CAPE. Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks