Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tesla $TSLA is currently the 5th worst-performing stock in the S&P 500 YTD, down 23%. Brutal.

Source: Trend Spider

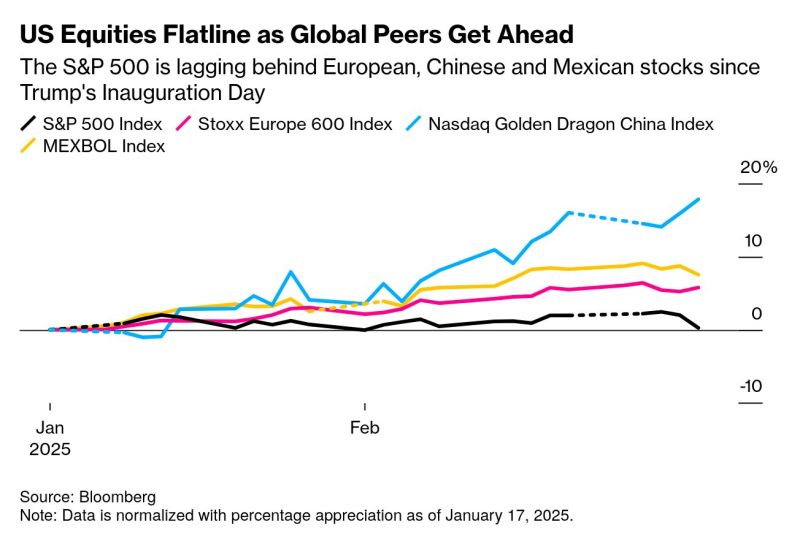

Yesterday, S&P 500 and 10y Treasury yield rolled over intraday ...

markets showing more concern for growth as opposed to inflation when it comes to tariffs. Source: Kevin Gordon @KevRGordon on X, Bloomberg

Bitcoin and TQQQ (3x QQQ) have moved in tandem for a long time.

Looks like BTC wants "this" even lower. Source: The Market Ear

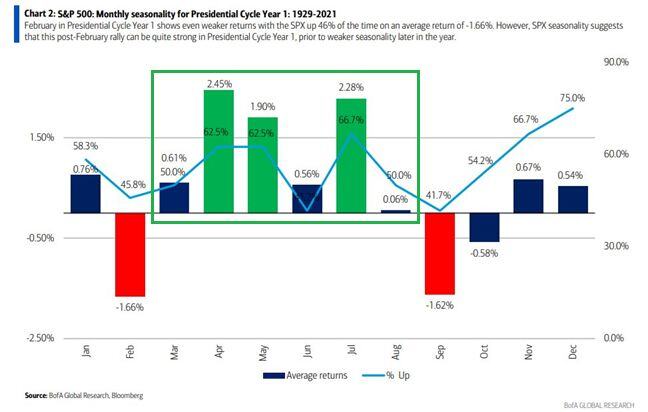

More Year 1 seasonality...

March-August pretty solid, on average. SPX 1929-2021 Suttmeier BofA. Source: Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi

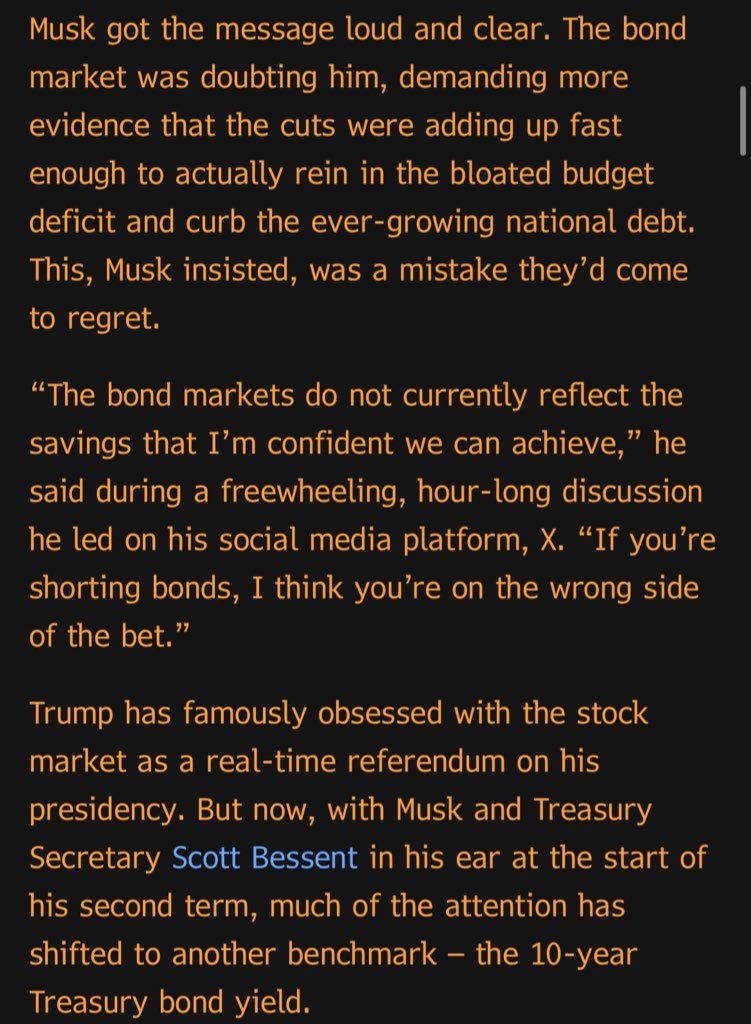

The Trump 1.0 put was on equities $SPY

Will the Trump 2.0 put be on us treasuries $TLT ??? Source: Geiger Capital @Geiger_Capital on X, Bloomberg

While equities took a beating Friday, bonds quietly broke out—closing above 5 months of trendzone resistance.

Right into PCE week… Interesting. $TLT Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks