Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

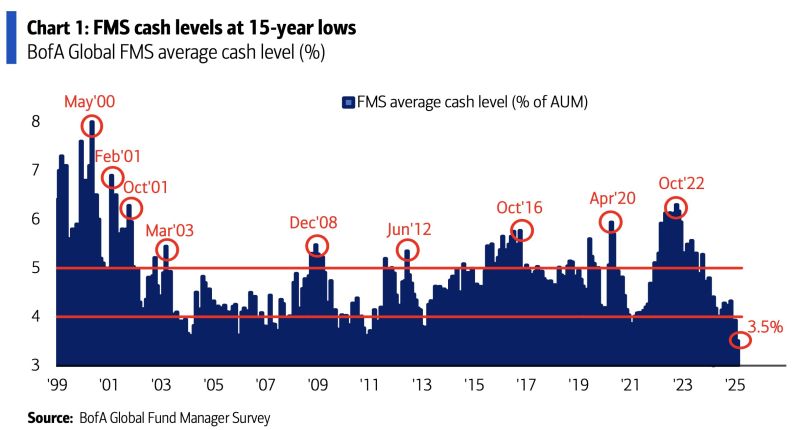

Investors are extremely bullish—heavily invested in stocks while betting against everything else.

Cash levels have dropped to just 3.5%, the lowest since 2010, according to the BofA Fund Manager Survey. Source: BofA

European Stocks see largest weekly inflow in more than 2 years 🚨

Source: Barchart

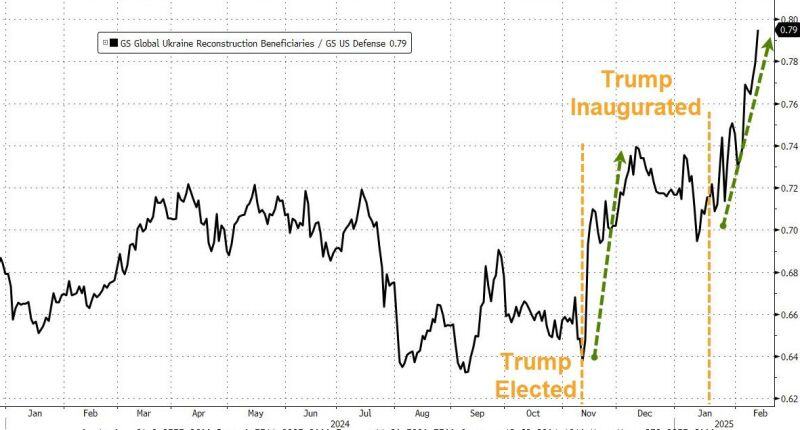

Goldman's basket of Ukraine reconstruction beneficiaries has dramatically outperformed defence stocks since Trump's election.

It's composed of industrials/infrastructure stocks. Source: www.zerohedge.com, Goldman

GameStop surged +20% on news it is considering buying Bitcoin with its $4.6 BILLION cash balance.

Source: Radar 𝘸 Archie

"AI" +"Adoption" mentions of the US companies with over $1 billion in market capitalization spiked to ~100, an all-time high.

During Q4 2024 earnings, a record 50% of S&P 500 firms mentioned “AI”. Source: Global Markets Investor

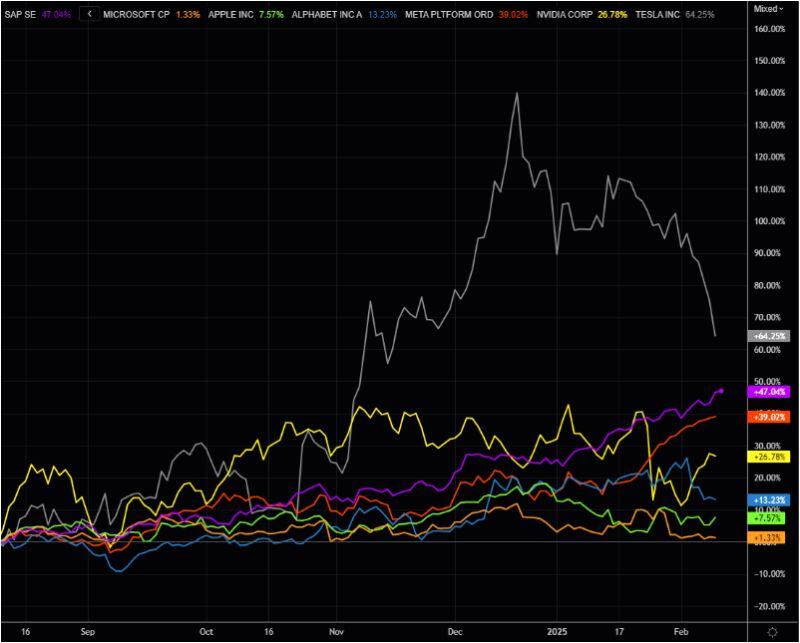

SAP beating all MAG stocks except Tesla over the past 6 months (in %).

source : refinitv, tme

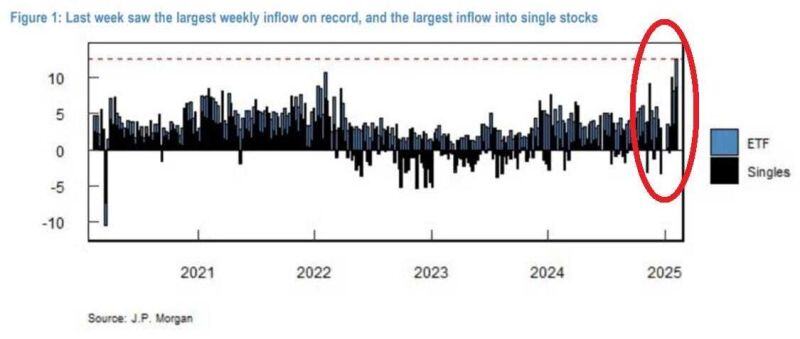

⚠️Retail investors have never been more EUPHORIC on US stocks:

Mom-and-pop investors bought a record $12 BILLION equities in the 1st week of February 👇 Roughly 70% went to Magnificent 7 ‼️ 🚨 Meanwhile, institutional investors have been selling over the last few weeks! Source: Global Markets Investors, JP Morgan

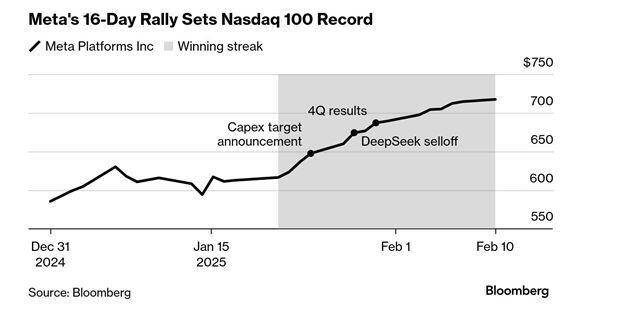

Meta's Record Run

The shares are coming off a rally of 16 straight sessions, the longest streak of any current Nasdaq 100 Index company going back to 1990. The stock added more than 17% over the surge, bringing its market capitalization above $1.8 trillion. source : bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks