Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

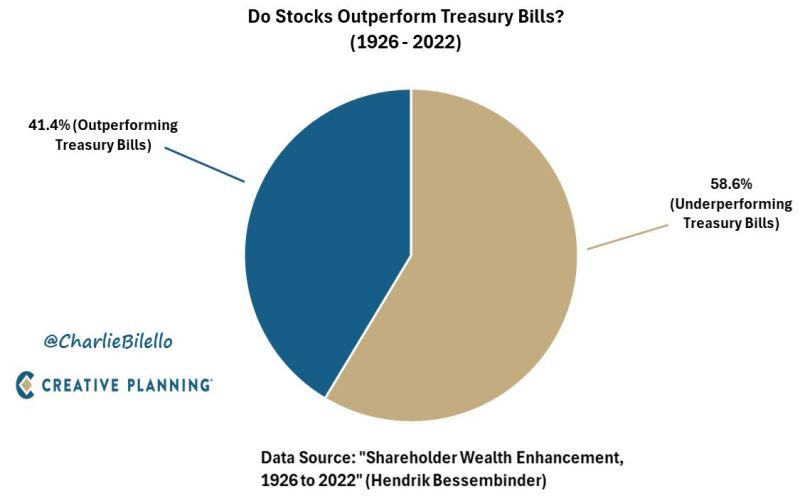

A majority of stocks (59%) underperform Treasury bills over their lifetime and more than half end up having a negative cumulative return.

“Don’t look for the needle in the haystack. Just buy the haystack.” - Jack Bogle Source: Charlie Bilello, Peter Malouk

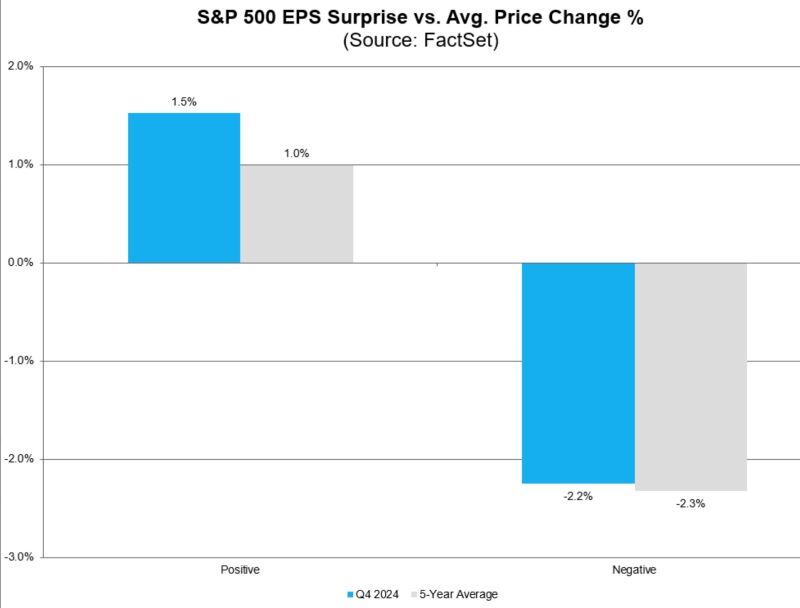

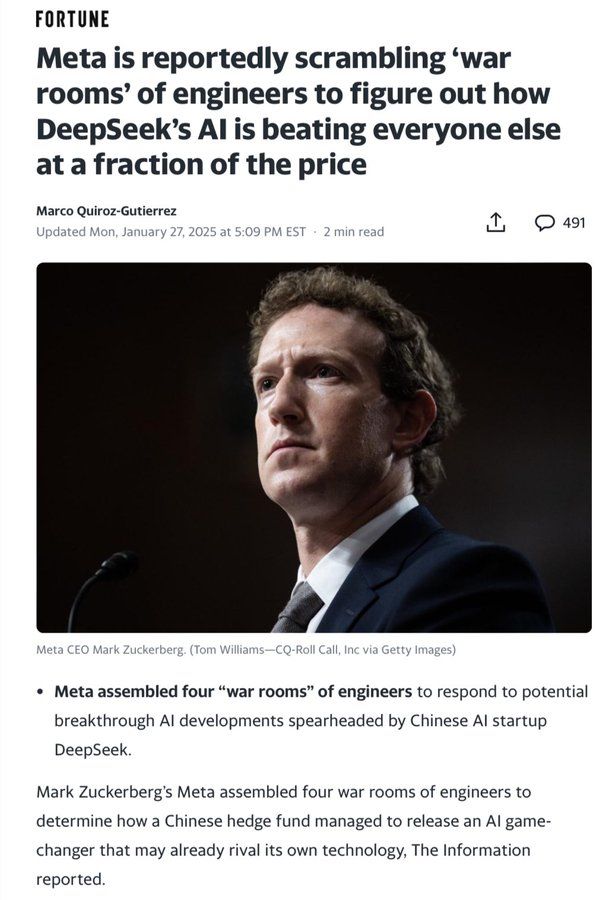

With deepSeek and tariffs, we almost forgot that we are in the middle of the earnings season.

FactSet notes that beats are being rewarded above average and misses are being punished around average.

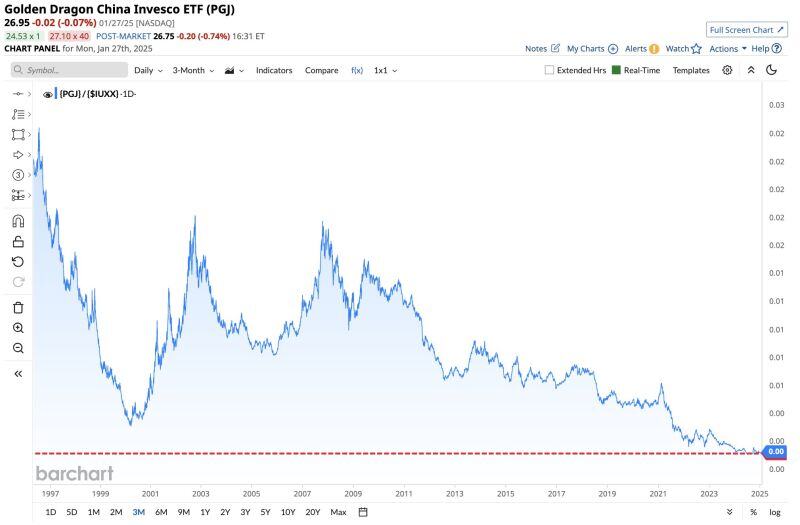

BREAKING 🚨: Chinese tech stocks are underperforming US Tech Stocks by the largest margin in history

Can it last? Source: Barchart

Nvdia closed at $118 yesterday,

below its 200-day Moving average yesterday. The last time it happened the stock was trading at... $16 Source: Trend Spider

Why did $META and $AAPL stocks go up yesterday?

DeepSeek is open source which means everyone can see exactly how it was done. The coding etc. tech companies can thus study AI now and get a much cheaper price.

Investing with intelligence

Our latest research, commentary and market outlooks