Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

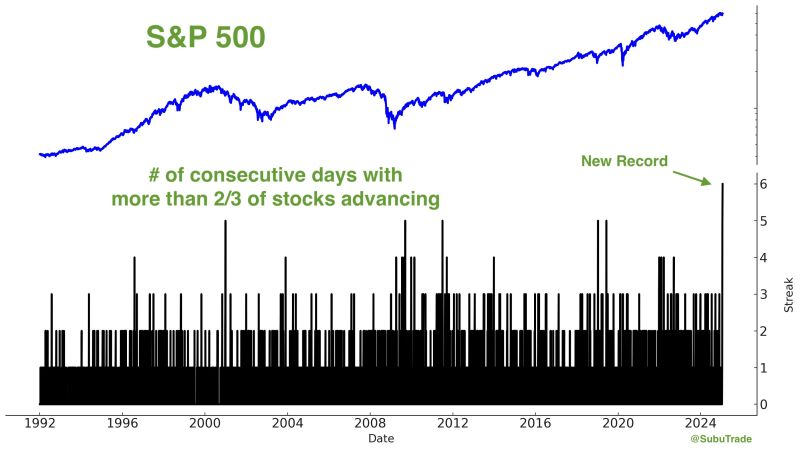

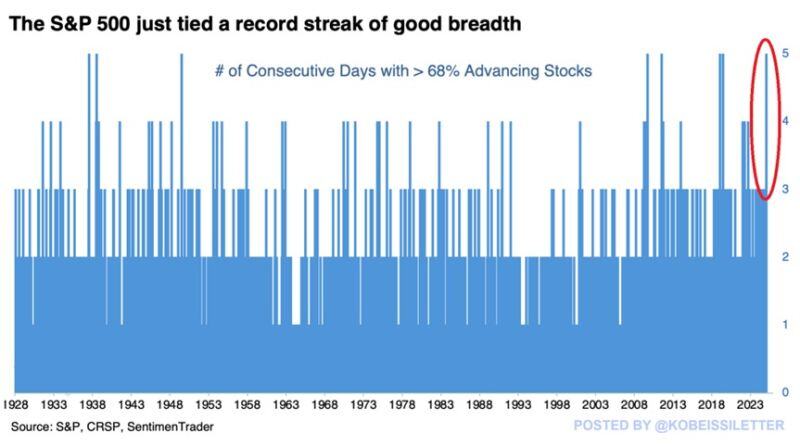

Record strong breadth!

Yesterday was the 6th consecutive day that more than 2/3 of the S&P advanced. First time this has happened in 30+ years. h/t @FrankCappelleri

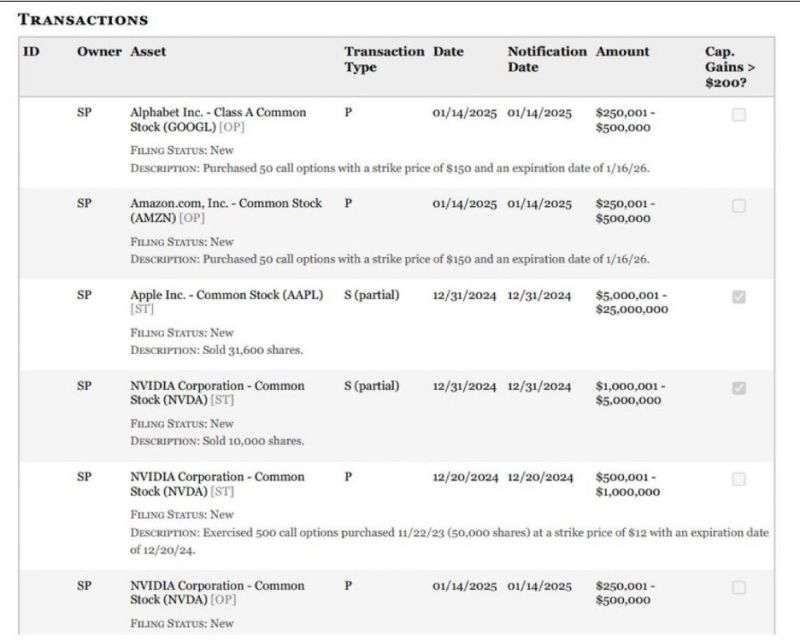

Congress Trade: Representative Nancy Pelosi Just Disclosed New Stock Trades

Representative Nancy Pelosi just filed new stock trades, which we received from a Stock Act disclosure: Nvidia $NVDA: (3 separate transactions) 1) - Exercised 500 call options purchased 11/22/23 (50,000 shares) at a strike price of $12 with an expiration date of 12/20/24 for between $500K-$1M 2) Sold 10K shares for between $1M-$5M 3) - Bought between $250K-$500K worth of Nvidia stock Amazon $AMZN: Purchased 50 call options with a strike price of $150 and an expiration date of 1/16/26 for between $250K-$500K Google $GOOGL: Purchased 50 call options with a strike price of $150 and an expiration date of 1/16/26 for between $250K-$500K Apple $AAPL: Sold 31,600 shares for between $5M to $25M Palo Alto $PANW: Exercised 140 call options purchased 2/12/24 & 2/21/24 (14,000 shares) at a strike price of $100 with an expiration for 12/20/24 for between $1M-$5M Tempus AI $TEM: Purchased 50 call options with a strike price of $20 and an expiration date of 1/16/26 for between $50K-$100K Vistra Corp $VST: Purchased 50 call options with a strike price of $50 and an expiration date of 1/16/26 for between $500K-$1M source :evan, nasdaq

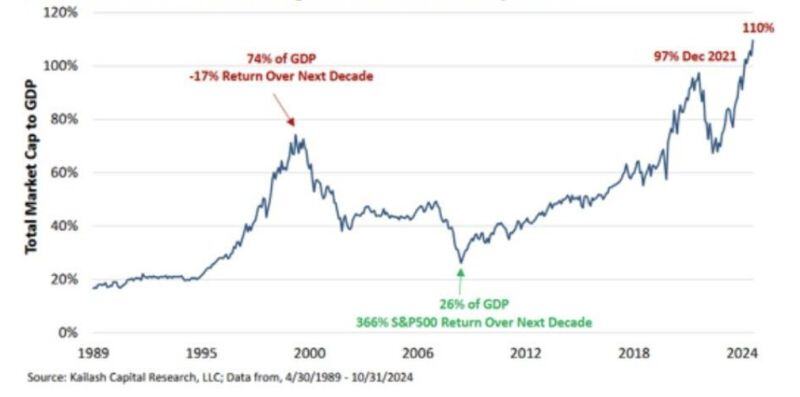

This is from where Trump 2.0 is starting...

US stocks now make up 65% of the global equity market, their highest weighting in history. This is more than 11x bigger than the second largest country by market cap (Japan at 5.6%). With his MAGA, can US weight % of the global equity market hit even higher level??? Source chart: Charlie Bilello

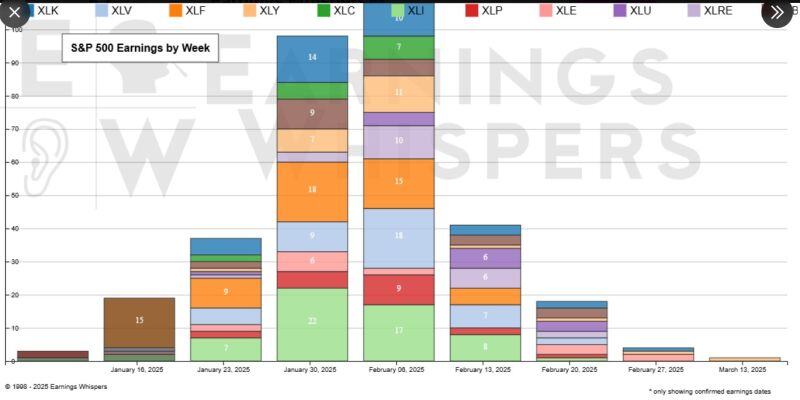

The fourth quarter earnings season is longer than the others because companies need to complete their year-end numbers and get signed off on by the auditors.

Therefore, only half of those S&P 500 $SPY companies expected to report in February have scheduled earnings yet, so look for those right bars to get bigger. That said, we have a pretty good look at the next few weeks. This week will still be mostly about the Financials $XLF, but we’ll begin to get Industrials $XLI reporting too. source : earningswhisper

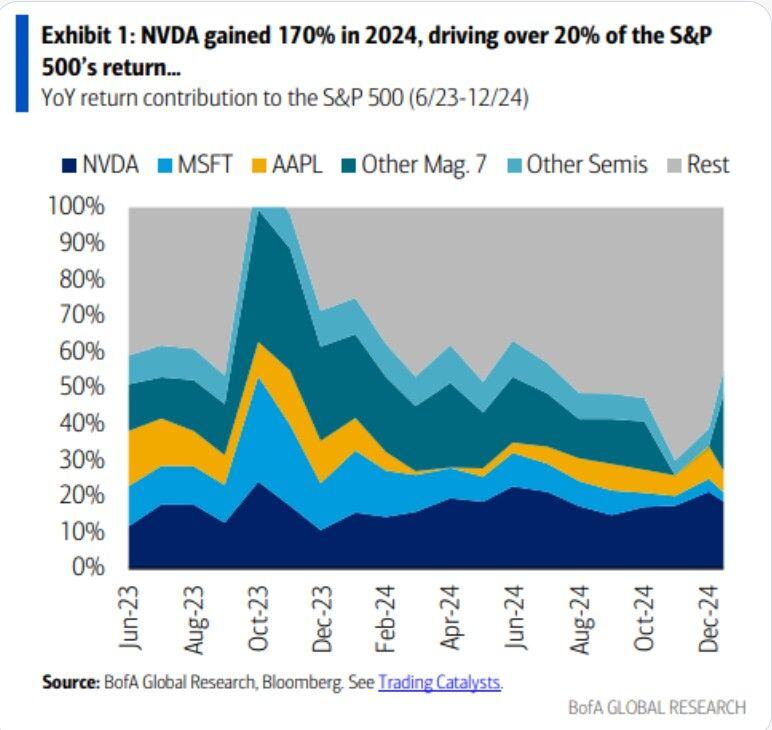

$NVDA: The Driving Force Behind the S&P 500’s 2024 Rally

NVIDIA’s incredible 170% gain in 2024 has played a pivotal role in the market’s performance, contributing to over 20% of the S&P 500’s return. source : BofA, Mike Zaccardi, CFA, CMT, MBA

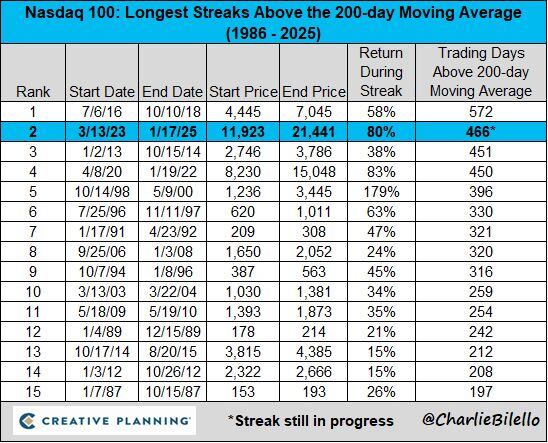

The trend is your friend...

The Nasdaq 100 has closed above its 200-day moving average for 466 consecutive trading days, the 2nd longest uptrend in history. $NDX Source: Charlie Biello

History has been made again in stocks:

Over 68% of the S&P 500 stocks have closed higher for 5 consecutive days, matching all previous records since 1928. If the same occurrence happens on Tuesday, it will mark a new record streak. In other words, the market's breadth has significantly improved. The last 2 times when such a streak occurred were in January and June 2019 which resulted in more upside in stocks. A similar trend was seen in September 2009 which resulted in the S&P 500 rallying 8% in the subsequent 3 months. Can bulls capitalize on this momentum? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks