Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Did powerlines cause the Los Angeles wildfires?

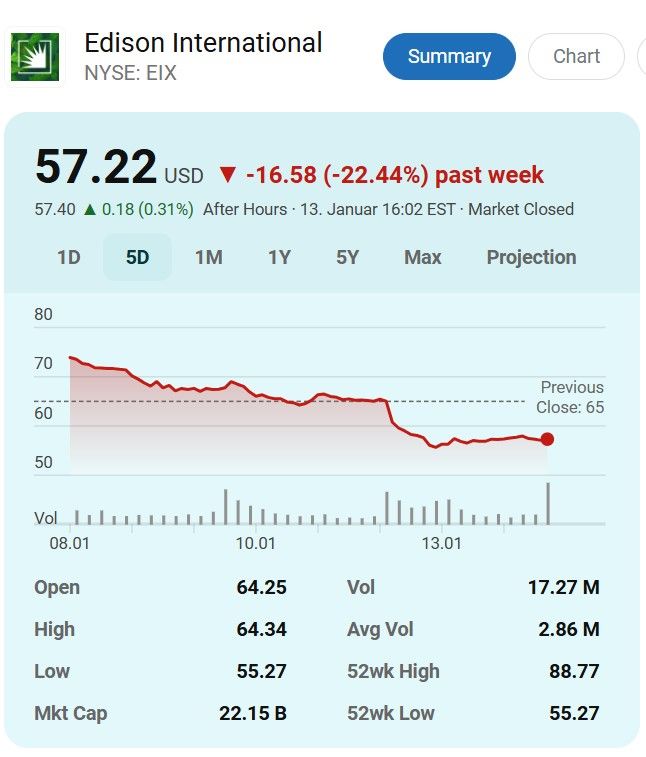

Edison International stock, $EIX, the parent company of Southern CA Edison, is currently crashing. It's now down -30% since the fires began, erasing $10 BILLION of market cap. Could this be the next big bankruptcy? Source: The Kobeissi Letter

Are Insurance stocks set to collapse?

LA wildfires have officially spread over 40,000 acres with INSURANCE LOSSES crossing $20 billion. Since the market closed on Friday, ESTIMATED DAMAGES have TRIPLED to $150 billion. Insurance, power company, and other corporate bankruptcies could emerge from this. As seen with the PG&E bankruptcy in 2019 after the Camp Fire disaster, these events can create economic ripple effects. E.g many bonds will be downgraded to "Junk" rating in the near future. Could LA wildfires cause an economic ripple effect? Source: The Kobeissi Letter

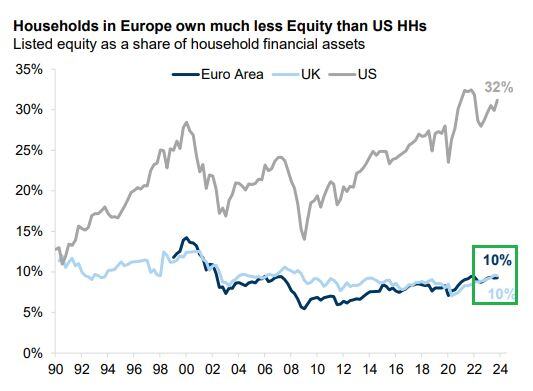

Europeans own much less stocks than those in the US

Source: GD, Mike Zaccardi, CFA, CMT, MBA

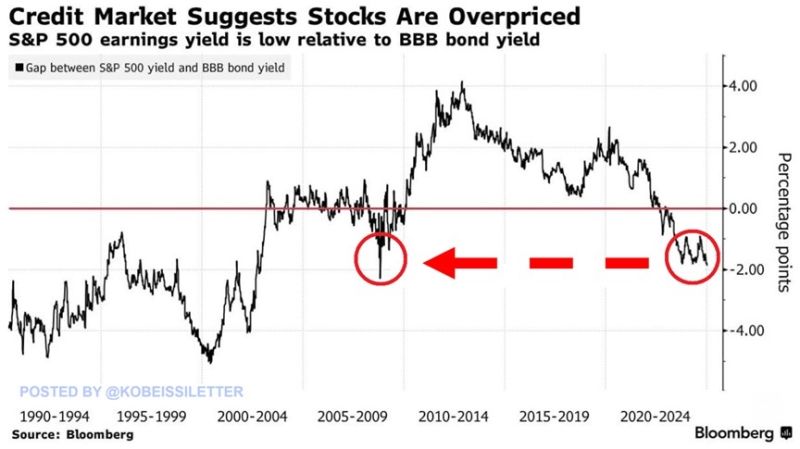

BREAKING: The difference between the S&P 500’s earnings yield and BBB-rated corporate bond yield has dropped to -1.9%, the lowest in 15 years.

Excluding a brief period in 2009, this is the lowest level in 23 years. The gap has fallen by 4 percentage points over the last 5 years as US interest rates have risen sharply. In other words, less risky investment-grade corporate bonds now pay a higher yield than S&P 500 companies' profits relative to their stock prices. This metric suggests the market may be overvalued. Can this gap continue to widen? Source: Bloomberg, The Kobeissi Letter

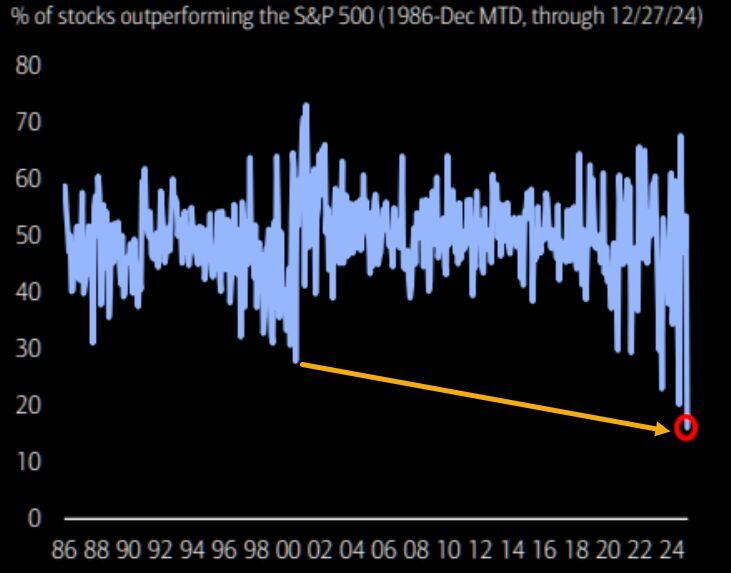

Breadth matters. And what we currently see on us equities does not look healthy.

Here is a visual of the % of stocks outperforming the S&P500: ALL TIME LOWS. In other words, concentration risk measured in this way beats 2000 lows. Source: Samantha LaDuc on X, GS

Year 1 of the presidential election cycle is not that great, but still decent. 1928-2024 $SPX

Source: Mike Zaccardi, CFA, CMT, MBA

Mag 7 EPS vs SPX last 20 years

Source: GS, Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks