Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Quantum computing stocks crash after AI godfather Jensen Huang exploded the quantum computing bubble with 3 lines:

"If you said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30 is probably on the late side. But if you picked 20, I think a whole bunch of us would believe it." Source: HolgerZ, Bloomberg

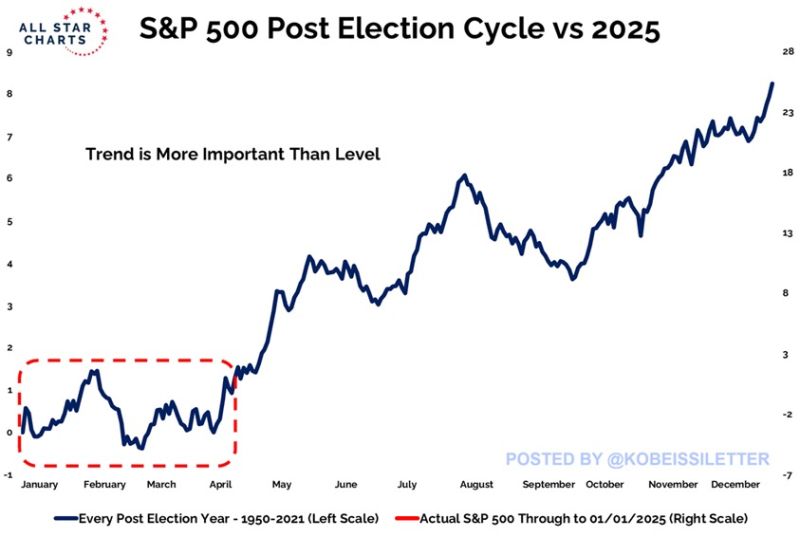

Should we get prepared for a choppy quarter???

The S&P 500 has gained ~1.0% on average in the first quarter after a US presidential election since 1950. It also historically comes with elevated volatility as market swings widen to both directions. On average, the first year of a new presidential cycle has seen an 8.2% average return. Source: The Kobeissi Letter, J-C Parets

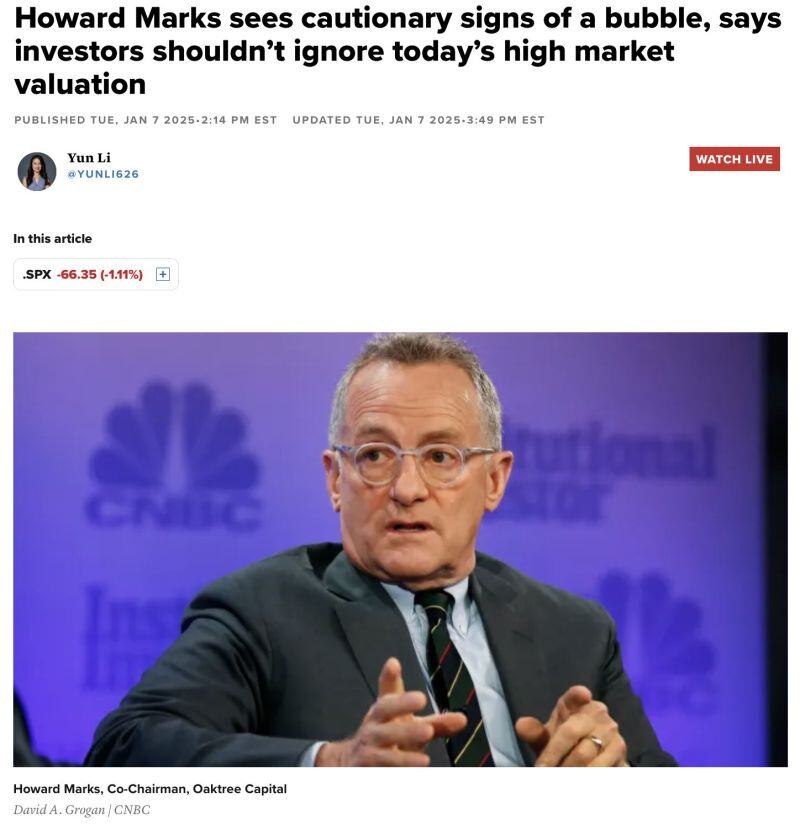

Howard Marks, Co-Chairman of Oaktree Capital and one of the world's most respected value investors, is cautioning about froth in the market and believes we are due for either:

1) a large correction in the market OR 2) 10-year returns of between +2 and -2% Source: Barchart

Markets are heating up Nasdaq just posted its single largest daily volume in HISTORY with 13.4 BILLION shares traded yesterday.

This beats the previous record of 11.9 billion shares on May 16th, 2024. Source: Barchart

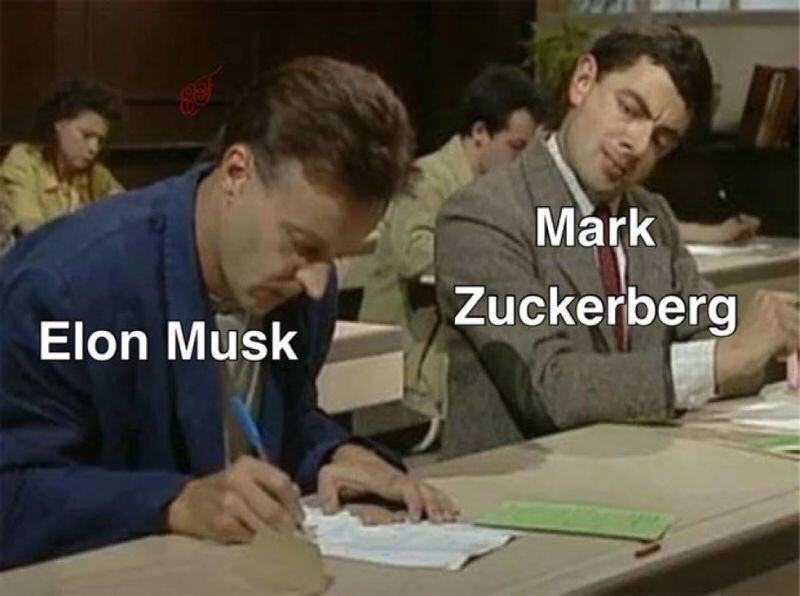

A classic Meta to End Fact-Checking Program in Shift Ahead of Trump Term

Source: TrendSpider

Today's market chaos was brought to you by strong eco data (ISM Services headline and JOLTS), a scary Prices Paid print (two year high), and the return of Trump press conference-driven vol.

Source: www.zerohedge.com, Trend Spider

How much longer can this continue before the crocodile's mouth snaps shut?

(S&P 500 in green vs. US 10-year inverted in RED) Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks