Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

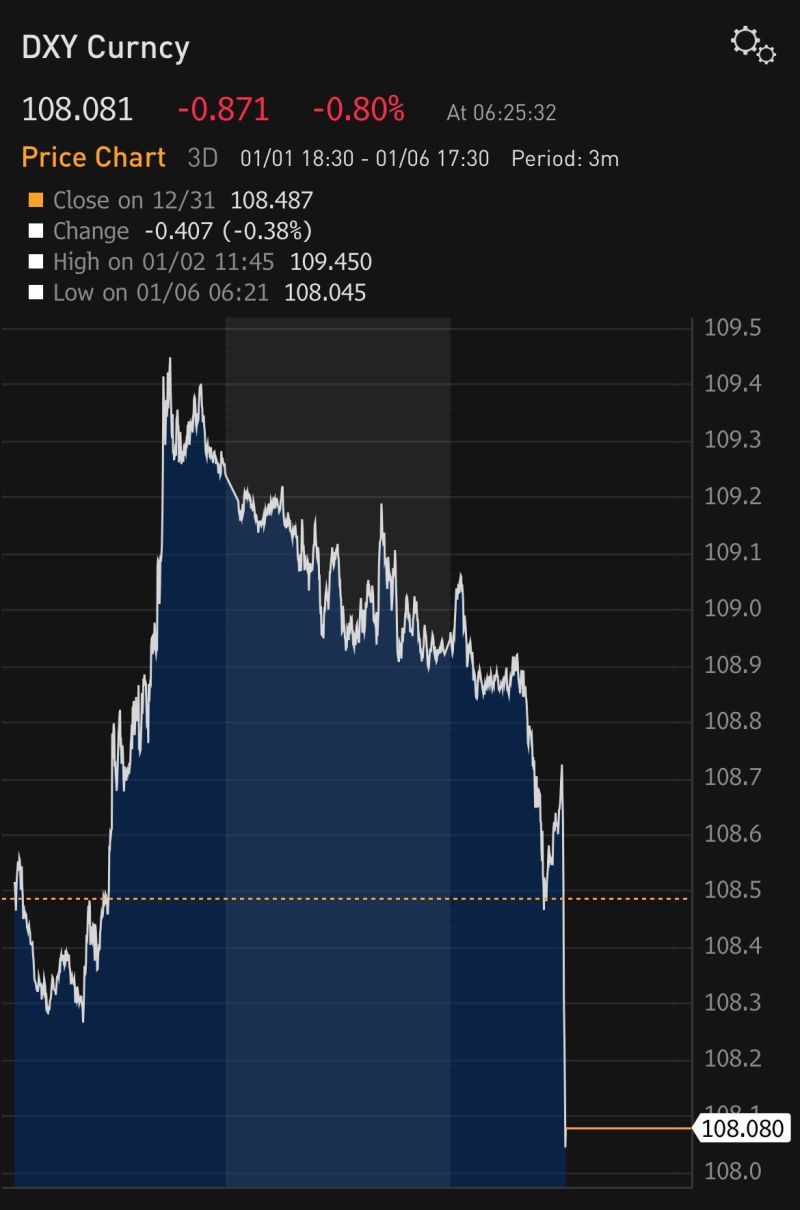

BREAKING: The dollar dropped and stocks surge after the Washington Post reported that Donald Trump’s aides are exploring tariffs that would apply to every country, but only cover critical imports

See the kink to our 10 surprises 2025 (surprise #1: Trump 2.1 "(...) What if concerns over the inflationary effects of tariffs prompt him to pivot, adopting a more conciliatory approach with trading partners—a shift from Trump 2.0 to Trump 2.1): https://lnkd.in/eKXRsc58 Source: MenthorQ, Bloomberg

European stocks trade at over 40% discount versus the US stock market, the biggest in at least 35 YEARS!

This comes as Europe's forward P/E ratio is ~13x, way below the S&P 500 P/E of 22x. Europe has rarely been so cheap on a relative basis. This is also valid on a sector-adjusted basis. Source: Goldman Sachs, Global Markets Investor, Datastream

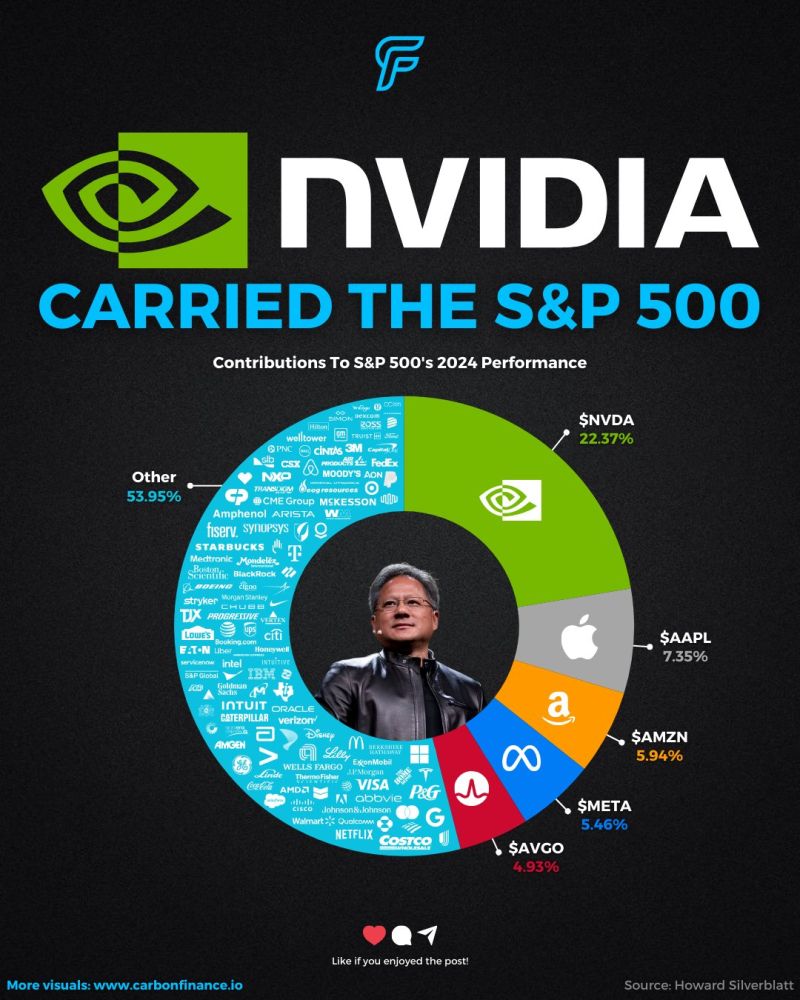

Nvidia $NVDA carried the S&P 500 $SPX in 2024

The AI leader drove 22% of the index’s total gains. Apple $AAPL, Amazon $AMZN, and Meta $META added another 19% combined. Broadcom $AVGO chipped in nearly 5%. These 5 companies powered almost half of the index's 2024 returns. Source: Carbon Finance

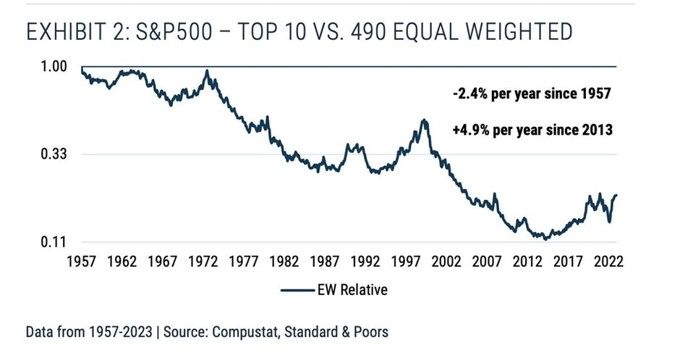

Interesting observation from GMO thru Callum Thomas:

"Since 1957, the 10 largest stocks in the S&P 500 have underperformed an equal-weighted index of the remaining 490 stocks by 2.4% per year. But the last decade has been a very notable departure from that trend, with the largest 10 outperforming by a massive 4.9% per year on average.“ It’s rare and bubbly for the top stocks to outperform like this! Source: Thomas Callum, GMO

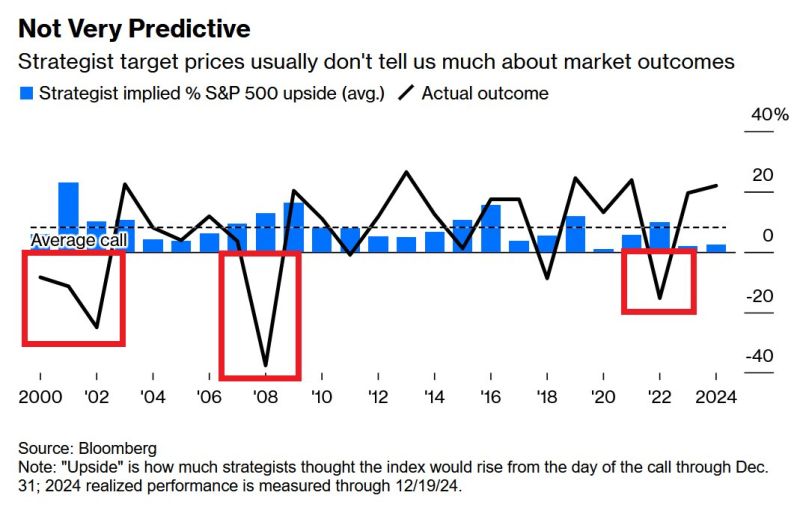

WALL STREET ANALYSTS' S&P 500 MEDIAN TARGET FOR 2025 IS 6,600

Wall Street expects a 12% increase in the S&P 500 in 2025. As shown by blue bars, Wall Street always projects positive years. This is despite declines in 2000-2002, the 2008 Financial Crisis or 2022. Source: Global Markets Investor, Bloomberg

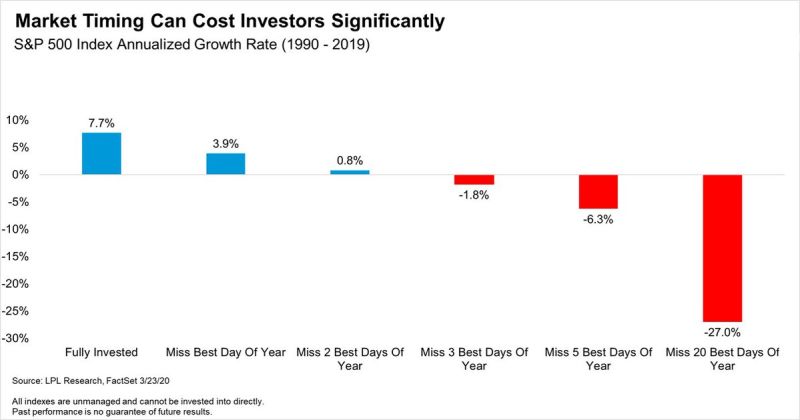

Don't try to time the market:

Source: LPL research through Brian Feroldi

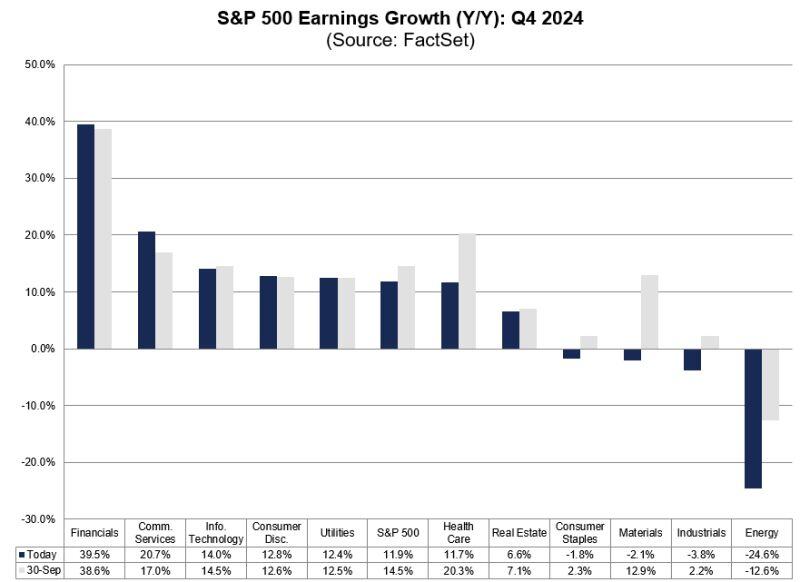

$SPX is expected to report Y/Y earnings growth of 11.9% for Q4 2024, which is below the estimate of 14.5% on September 30

Source: Factset

Investing with intelligence

Our latest research, commentary and market outlooks