Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Apple $AAPL stock just closed the day down by 4% its worst day since August 5th

Source: Blossom on X

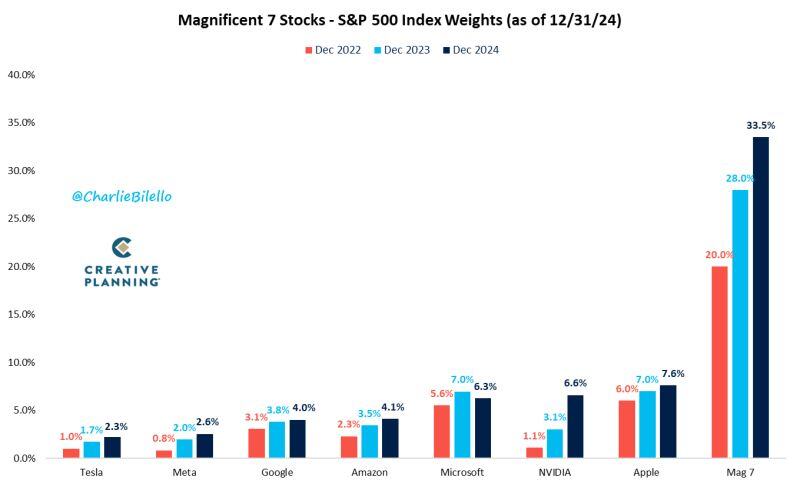

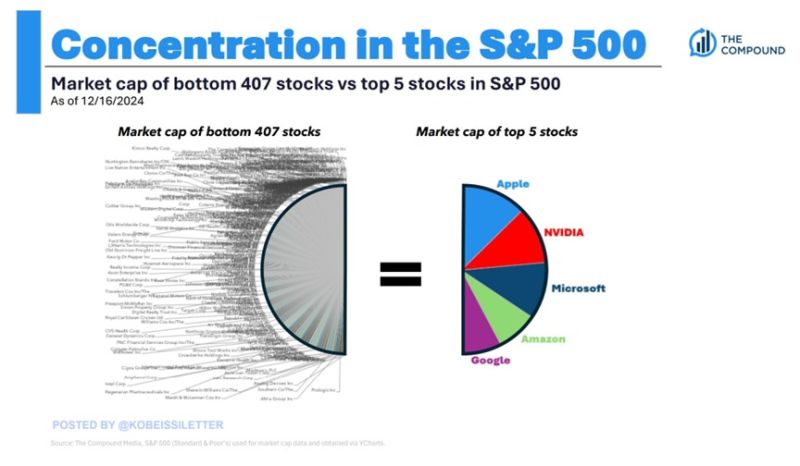

Over a third of the S&P 500 is now concentrated in the "Magnificent Seven" stocks, up from a fifth of the index two years ago.

Source: Charlie Bilello

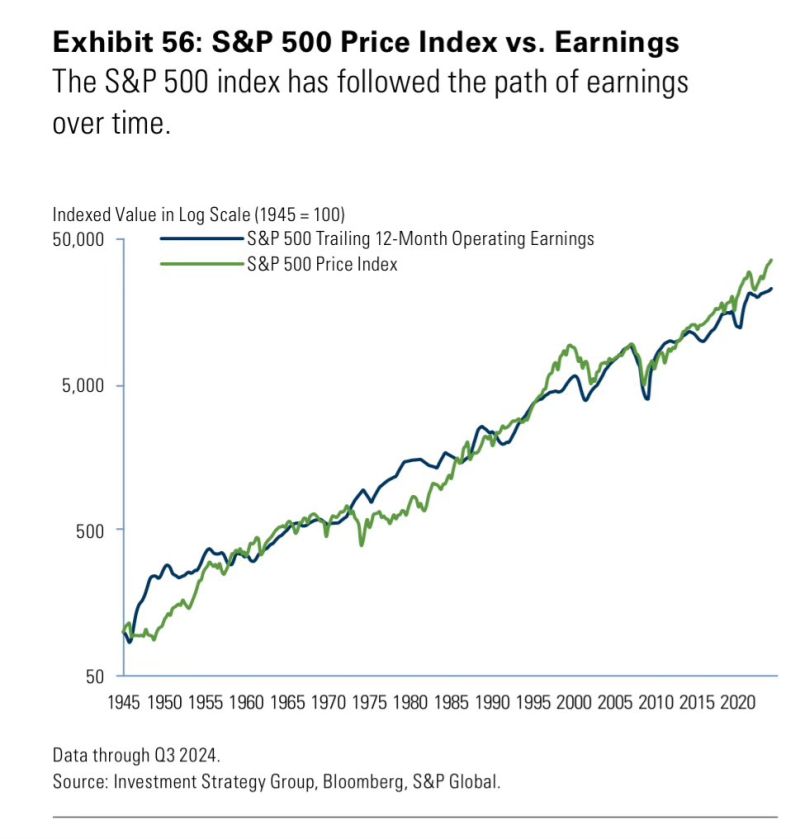

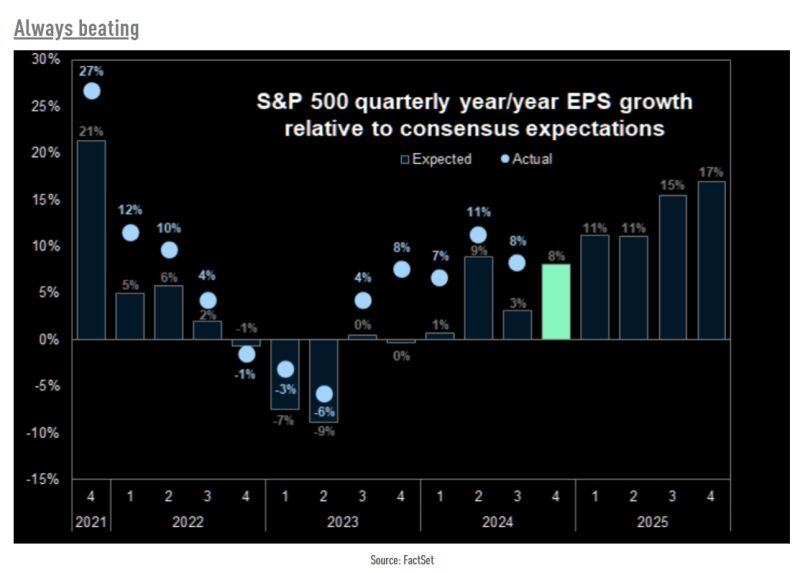

Earnings do matter

Source: Investment Strategy Group, Bloomberg, S&P Global

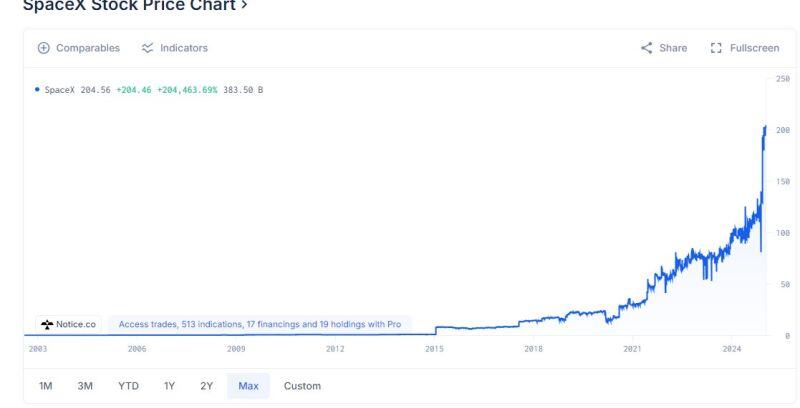

SpaceX is estimated to be up 10x since COVID (private marks)

Source: The Long View @HayekAndKeynes on X

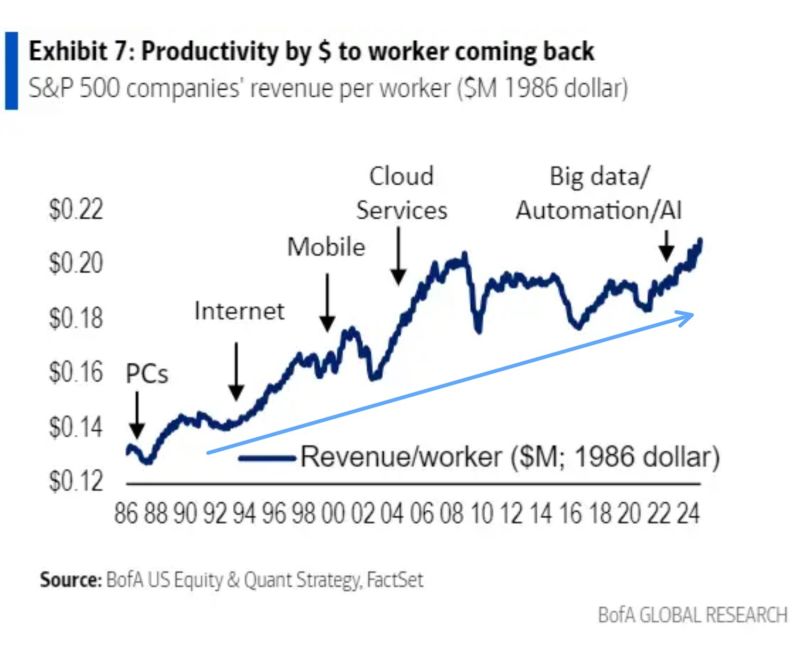

SP500 companies’ revenue per worker.

Source: Eugene Ng on X, BofA

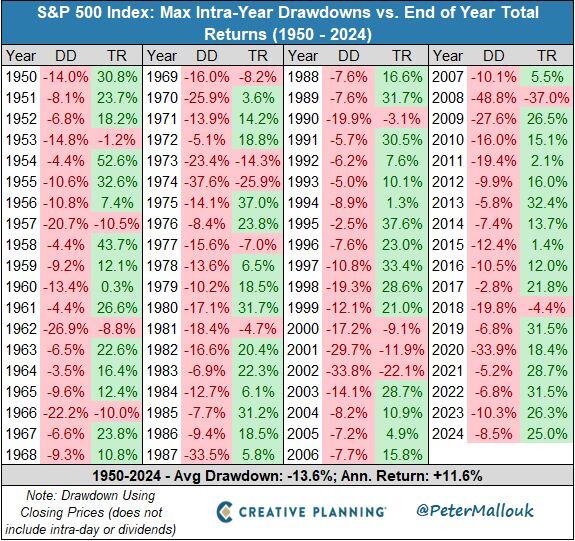

Since 1950, the S&P 500 has had an average intra-year drawdown of -13.6% but is still up 11.6% per year annualized.

No Risk, no Reward. Source: Peter Mallouk @PeterMallouk

Shocking stat of the day: The market cap of the SP500’s top 5 stocks is now equal to the size of the bottom 407 stocks.

Apple, $AAPL, Nvidia, $NVDA, Microsoft, $MSFT, Google, $GOOGL, and Amazon, $AMZN are worth now a combined $15.3 trillion. These companies have added $5 TRILLION in market value since the beginning of last year. To put this into perspective, these 5 stocks are worth now nearly as much as China and Hong Kong's stock markets COMBINED. The top 5 companies reflect a record 24% of the entire US stock market cap. Source: Compound, The Kobeissi Letter

Actual S&P 500 earnings growth has exceeded expectations during the last few years.

Will it be the case again this quarter? Source: The Market Ear, Factset

Investing with intelligence

Our latest research, commentary and market outlooks