Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Semiconductor fund managers after seeing 4 memes about DeepSeek on X.

Chip stocks are plunging overnight on the back of the DeepSeek story: 1. Arm, $ARM: -5.5% 2. Nvidia, $NVDA: -5.3% 3. Broadcom, $AVGO: -4.9% 4. Super Micro, $SMCI: -4.6% 5. Taiwan Semi, $TSM: -4.5% 6. Micron, $MU: -4.3% 7. Qualcomm, $QCOM: -2.8% 8. AMD, $AMD: -2.5% 9. Intel, $INTC: -2.0% DeepSeek is only story in town and it’s showing up in global markets this Monday

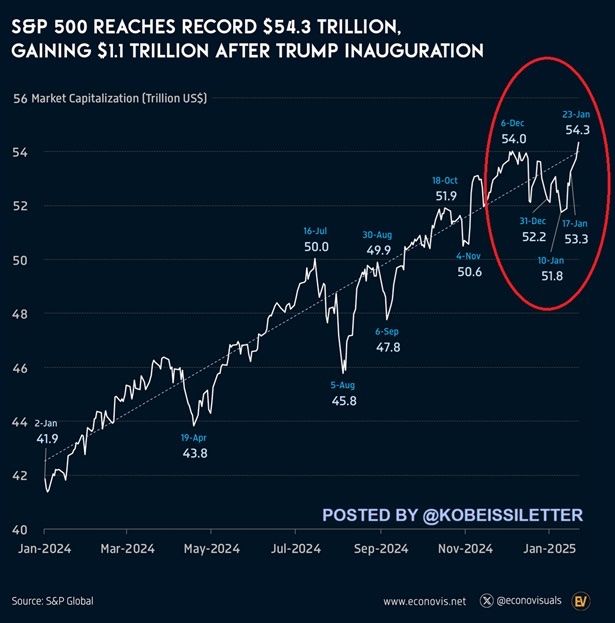

The S&P 500 reached a record $54.3 trillion in market cap last week, adding $1.1 trillion in 1 week.

Since the August low, the index's market cap is up a massive $8.5 trillion. Furthermore, the index has added $12.4 trillion in value since the beginning of 2024. The S&P 500 has added 78% of Europe's market cap and DOUBLE the size of the Japanese market in 1 year. As a result, the US market cap to GDP ratio has reached an all-time high of 209%. Source: The Kobeissi Letter

All eyes on the Nasdaq 100.

Over 25% of stocks in the index report earnings this week... Source: Trend Spider

“Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.” - Peter Lynch

Source: J-C Parets

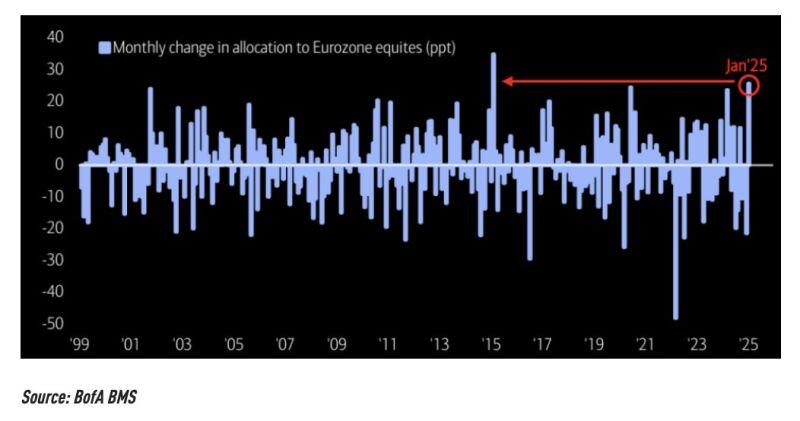

According to BofA, we've just seen one of the largest month-over-month allocations to European equities on record.

Is this signaling a European comeback, or simply a rotation ? source : BofA

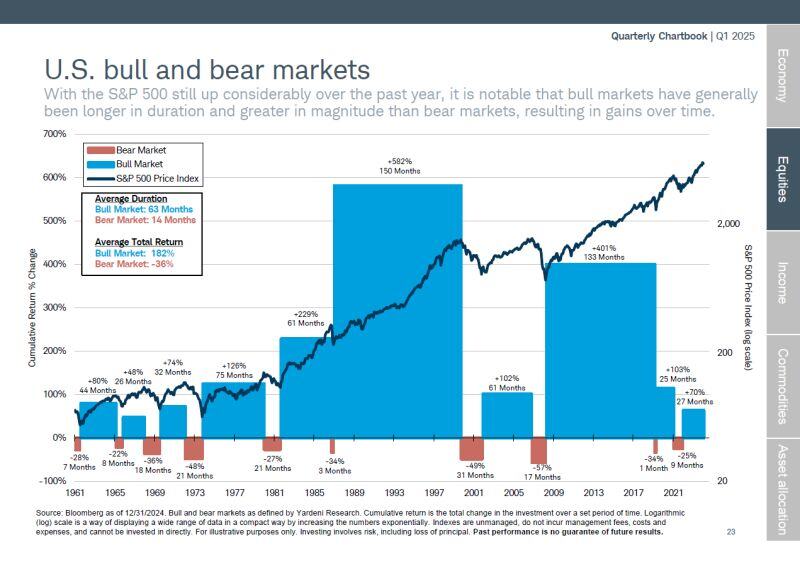

Bear markets pale in comparison to bull markets, both in market movement and duration.

Remember this chart during the next - and inevitable - correction or bear market. Source: Peter Mallouk

The 2nd largest rotation into european equities in the last 25 years is currently taking place.

Source: Bloomberg, Barchart

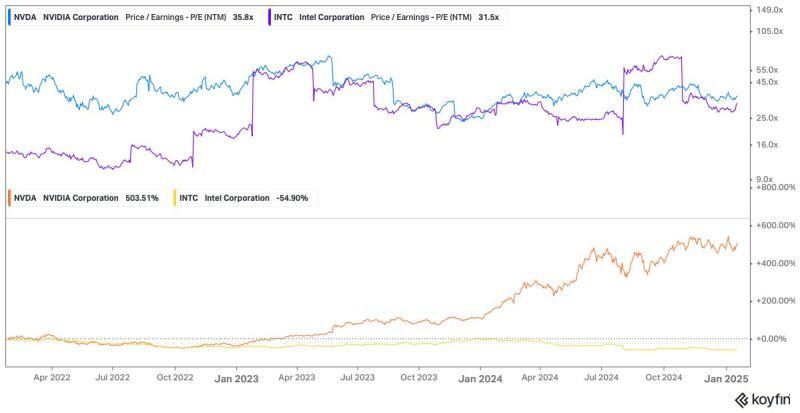

Three years ago, you could have invested in $INTC at just 14x forward earnings or $NVDA at 45x forward earnings.

The returns: $NVDA: +503% $INTC: -55% As Terry Smith said, "Owning good companies is more important than owning undervalued companies." Source: Wolf of Harcourt Street @wolfofharcourt

Investing with intelligence

Our latest research, commentary and market outlooks