Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

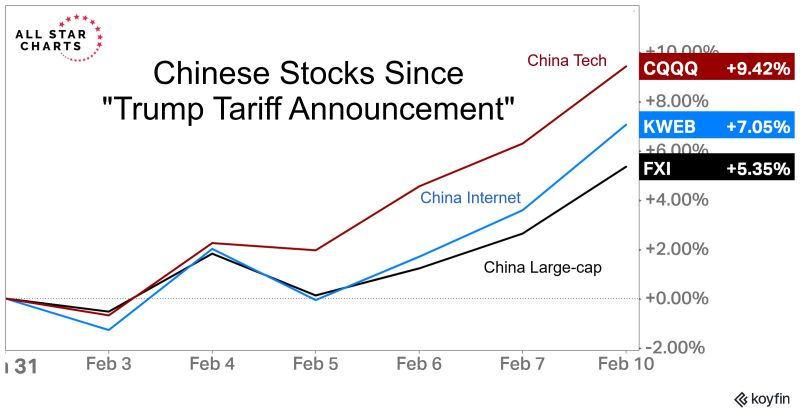

Here's how Chinese stocks have done since they all told you that Chinese stocks were going to crash because of something they're calling "Tariffs"

Source: J-C Parets

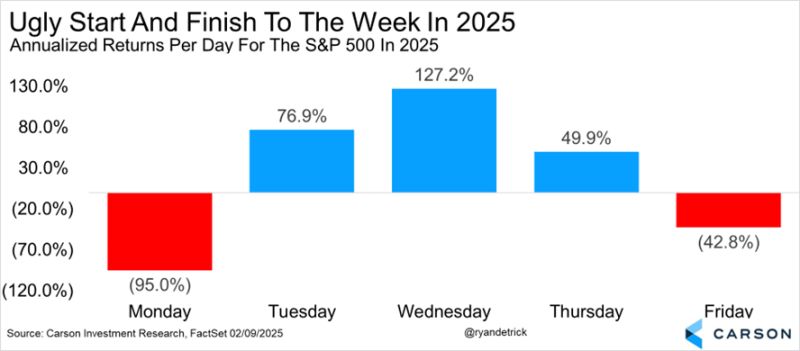

Monday and Friday have been quite bad for stocks so far in 2025.

The other three days have been solid. Source: Ryan Detrick, Carson

Gold has been truly one of the GREATEST assets over the last few years, widely outperforming the S&P 500:

🔴 1-year performance: Gold +41% S&P 500 +21% 🔴 3-year: Gold +59% S&P 500 +34% 🔴 5-year: Gold +84% S&P 500 +80% Source. Global Markets Investor

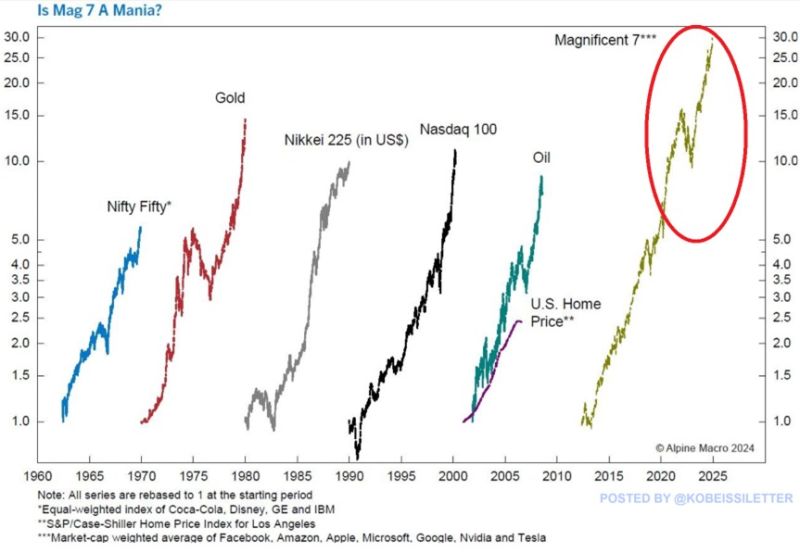

Is AI hype a bubble or the next big thing?

Magnificent 7 stocks are 30 TIMES higher than where they were 10 years ago, exceeding gains of other historical manias. The Nasdaq 100 rose 12x in 10 years before the 2000 Dot-Com Bubble popped. The Nikkei 225 rose 10x in a decade during the Japanese bubble of the 1980s. Furthermore, Gold saw a 15x increase in price in the 1970s before its peak. Lastly, Nifty Fifty stock prices rose 5x in the 1960s before the bull market ended in 1969. Will AI live up to the historically high expectations? Source: The Kobeissi Letter

2025 could be a great year for IPOS

9 potential IPOs for 2025 by WOLF Wolf Financial

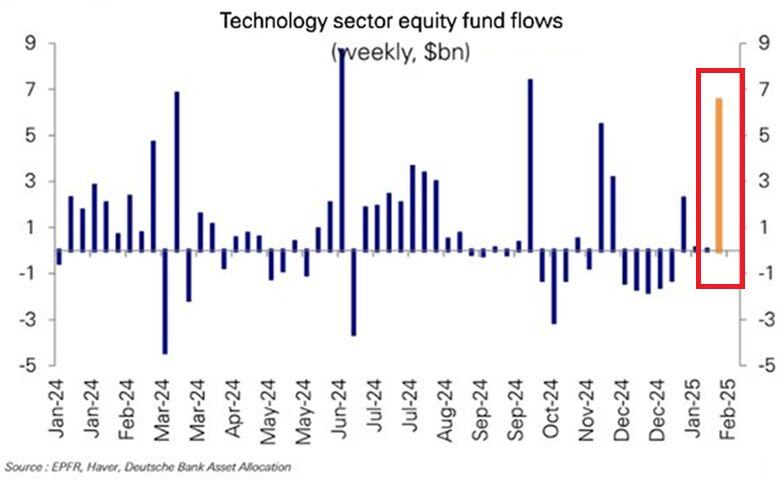

🔴 The Fear of Missing Out (FOMO) is still alive: US technology equity funds saw nearly $7 BILLION in net inflows last week, one of the biggest flows in 14 months.

Net positioning in US mega-cap and technology stocks at one of the most extreme levels in history. Source: Global Markets Investor, EPFR, Haver, DB

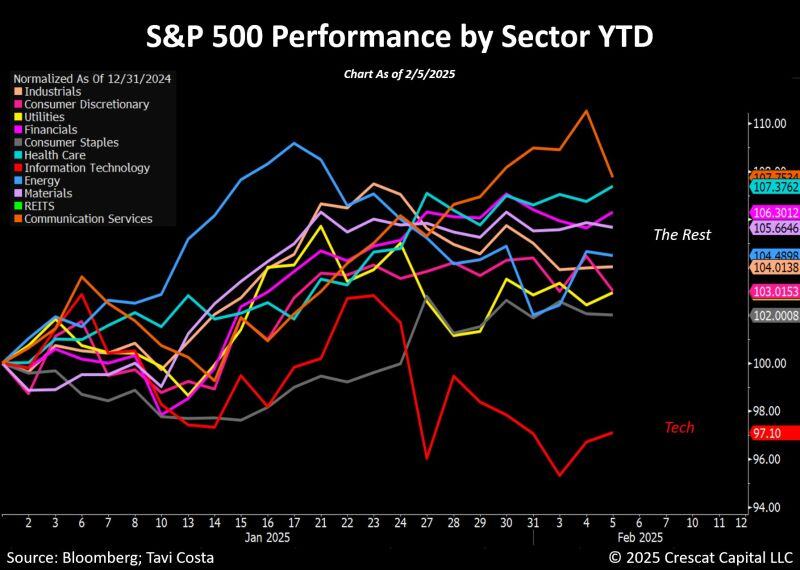

There has been significant rotation happening beneath the surface of the markets.

Tech is the only sector down year-to-date, while every other sector has climbed—some quite substantially already. Source: Otavio (Tavi) Costa

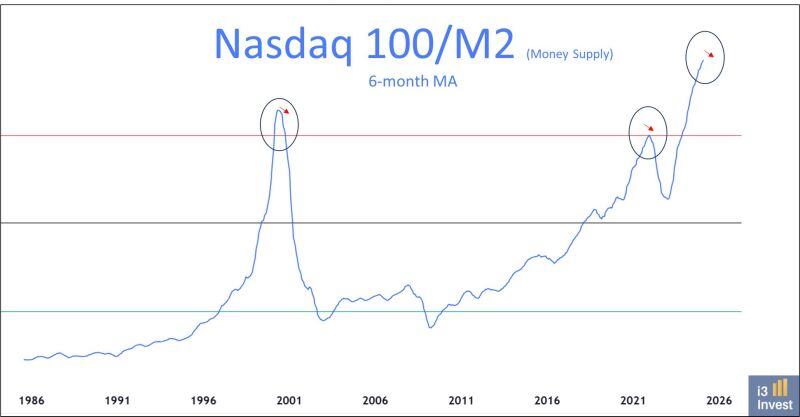

As shared by Guilherme Tavares i3 invest :

Nasdaq 100 / M2 Levels never seen before...

Investing with intelligence

Our latest research, commentary and market outlooks