Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

S&P 500 PULLBACK

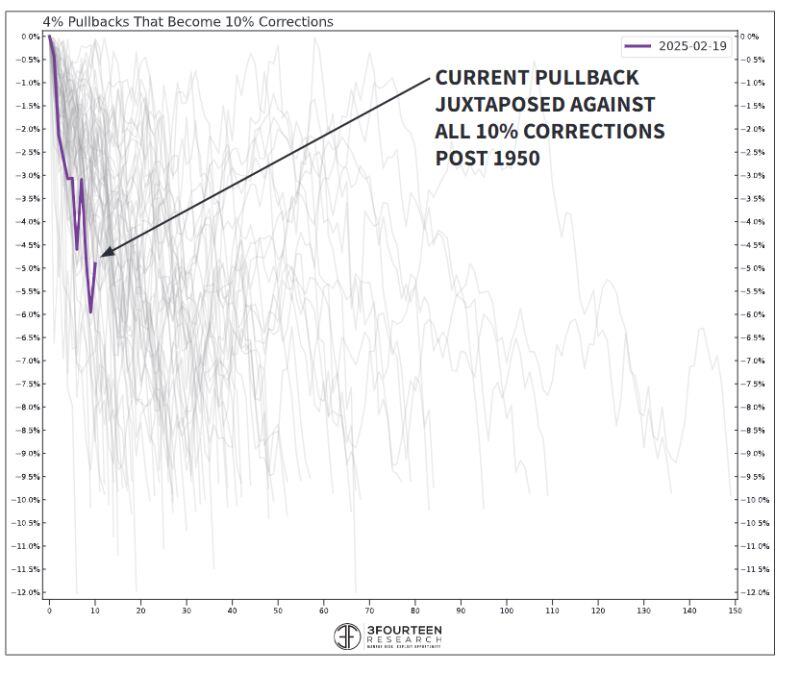

If the current pullback is going to devolve into a correction, it should happen relatively quickly. Historically, 76% of S&P 500 corrections play out w/i a 60-day window (mid-April). About half are done in <40 days (late-March). Source: 3F Research Group, Warren Pies @WarrenPies on X

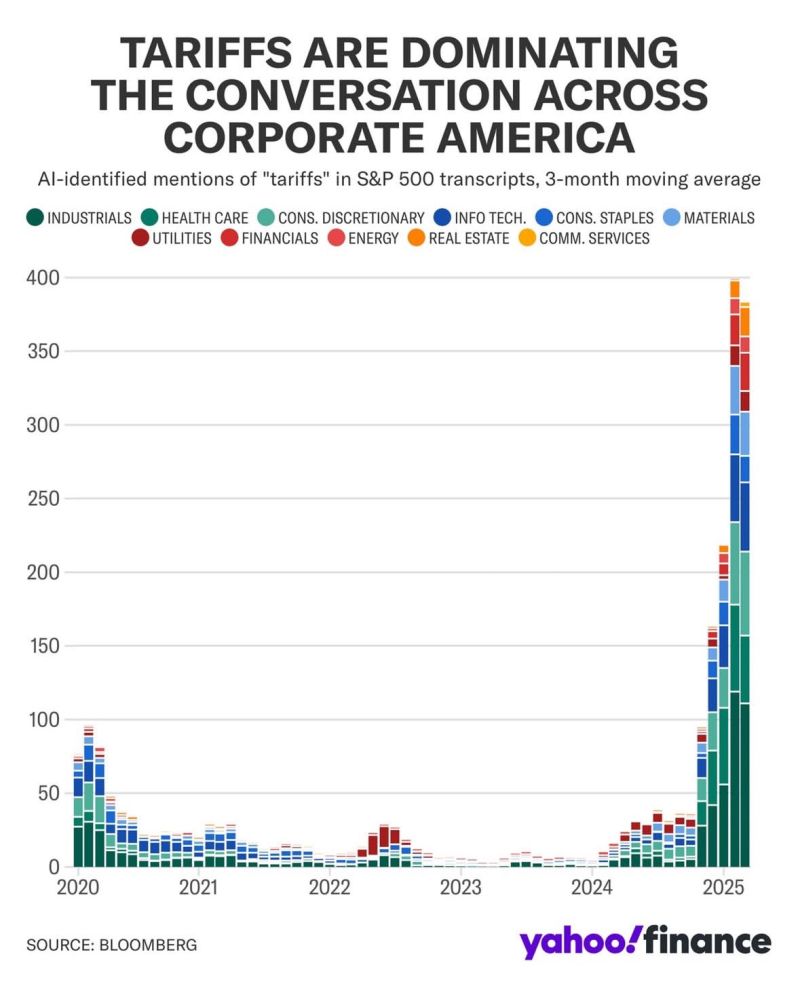

Roughly 80% of the stocks in the SP500 said the word tariffs on their last earnings call

Source: Evan on X

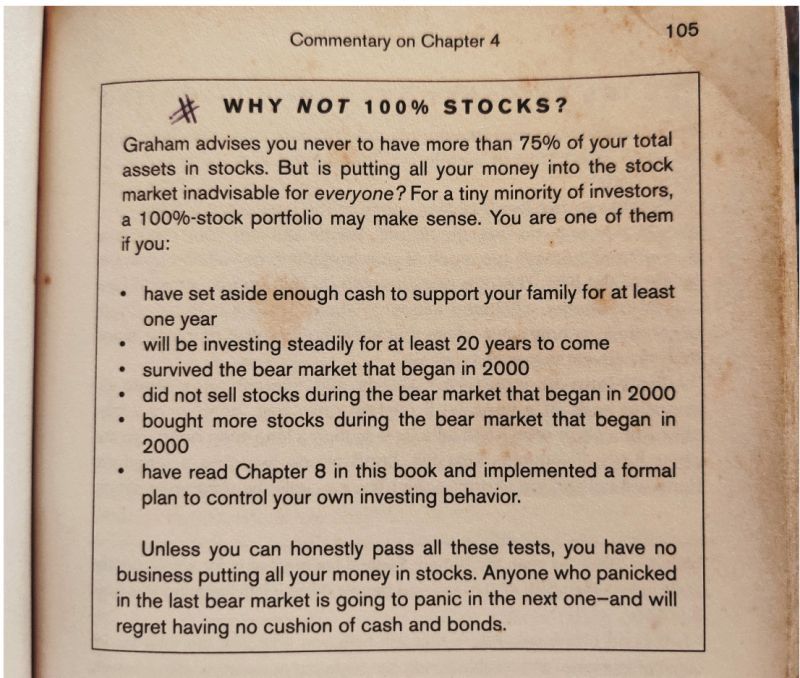

Jason Zweig on reasons to not allocate 100% to stocks:

Source: Brian Feroldi

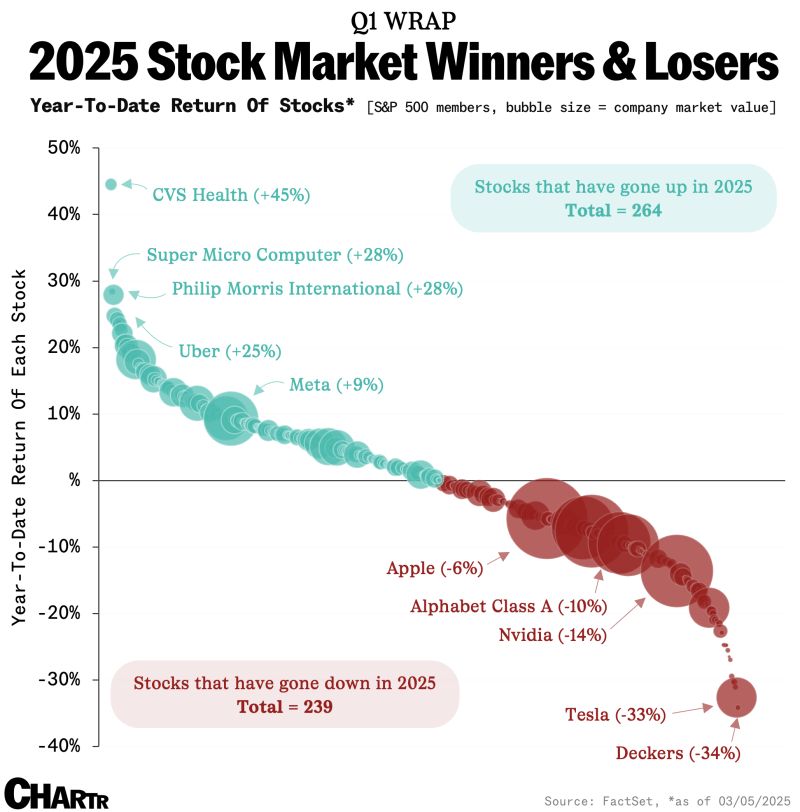

264 of the S&P 500’s constituents, or a little over 52% of the index, are actually still up in 2025.

The star of the S&P 500 Class of Q1 so far is CVS HealthCVS $65.81 (2.74%), which has jumped 45% since the start of the year, closely followed by Philip Morris InternationalPM $153.14 (-0.58%) and Super Micro, which is doing the absolute bare minimum to remain on the market. Uber also joins the all-star lineup, ahead of Meta, which is the best of the Big Tech stocks, evading the pain of peers Amazon (-7%), Nvidia (-14%), and Tesla (-33%), which are all down. But the one company that’s down deepest in the trenches is UGG and Hoka shoe company DeckersDECK $136.40 (1.67%), which never recovered from getting stomped after its underwhelming Q3 update. Source: Chartr

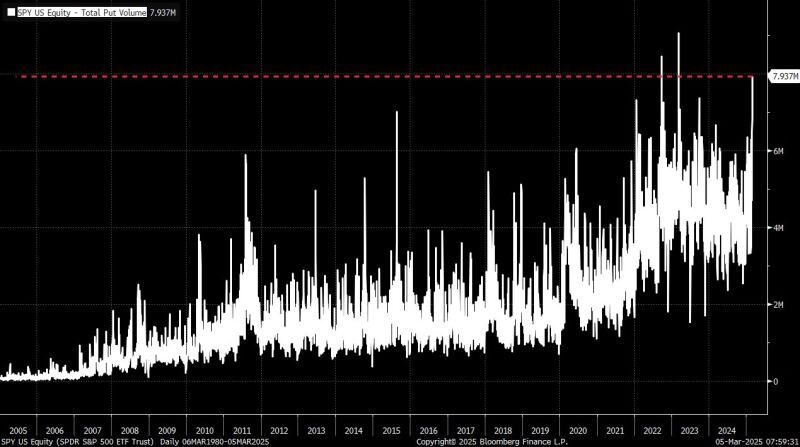

"SPY put volume spiked yesterday to the 3rd highest in history.

Previous 2 spikes were bottoms for the S&P 500. QQQ Put volume made a new all-time high yesterday" Source: GS thru www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks