Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

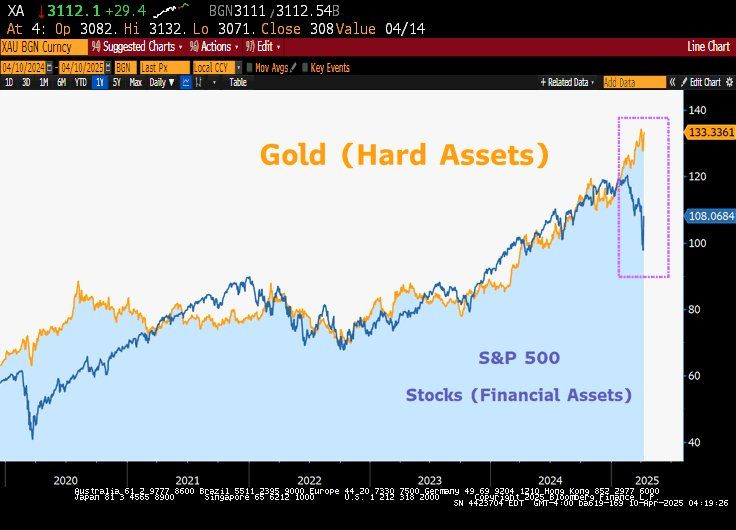

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

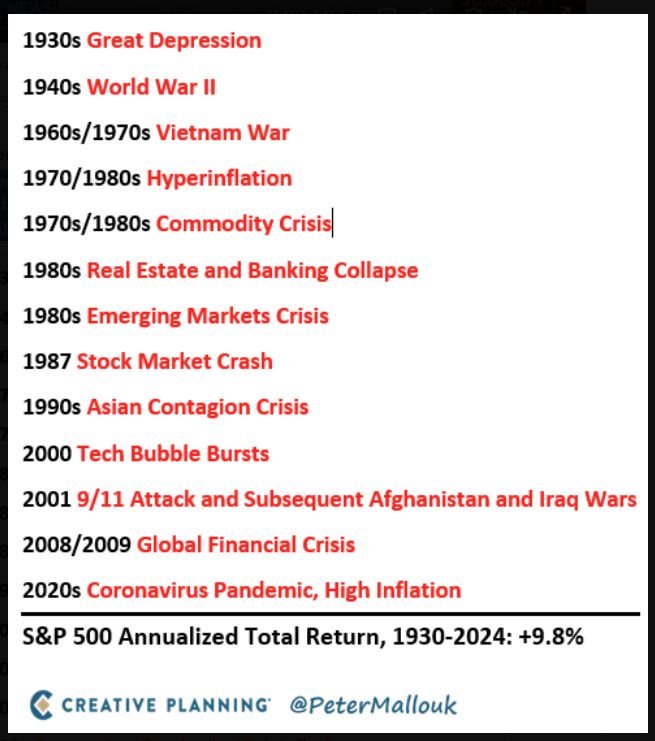

Isn't it the most compelling chart for being a stock market investor?

Over the last 50 years: -US Inflation: up 6x -S&P 500 dividends: up 21x -S&P 500 total return: up 323x Over the long run, stocks trounce inflation and protect your purchasing power. Source: Peter Mallouk

Well said by Peter Mallouk

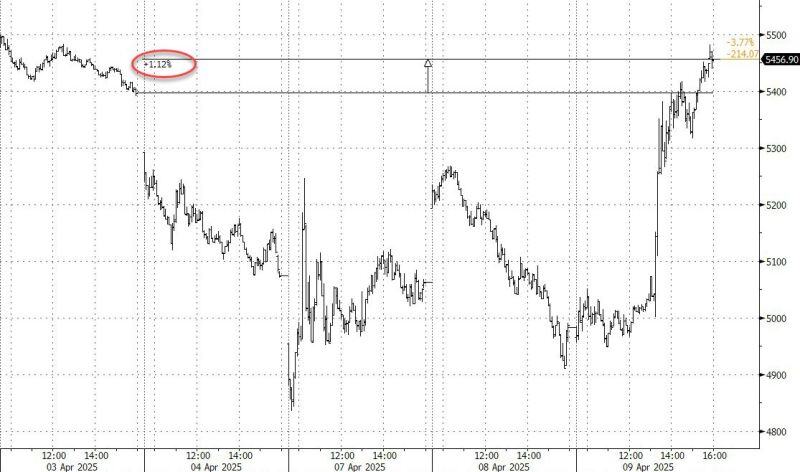

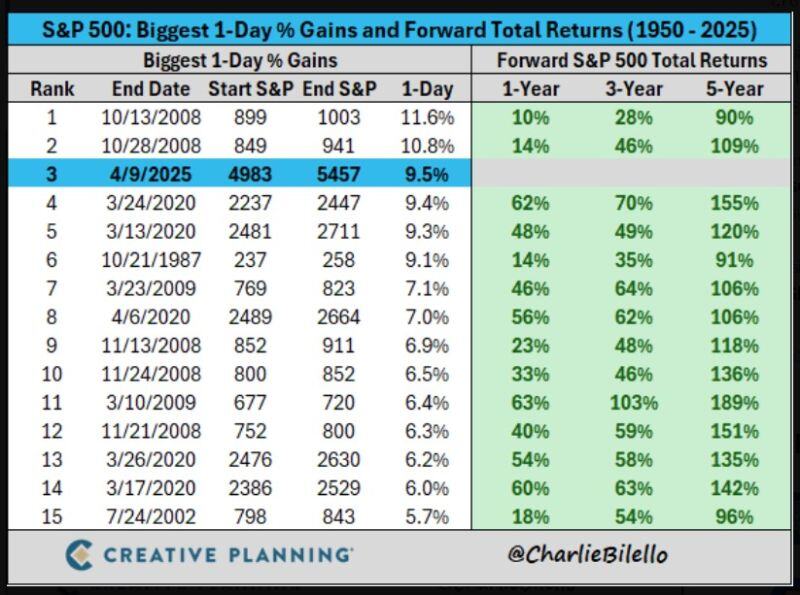

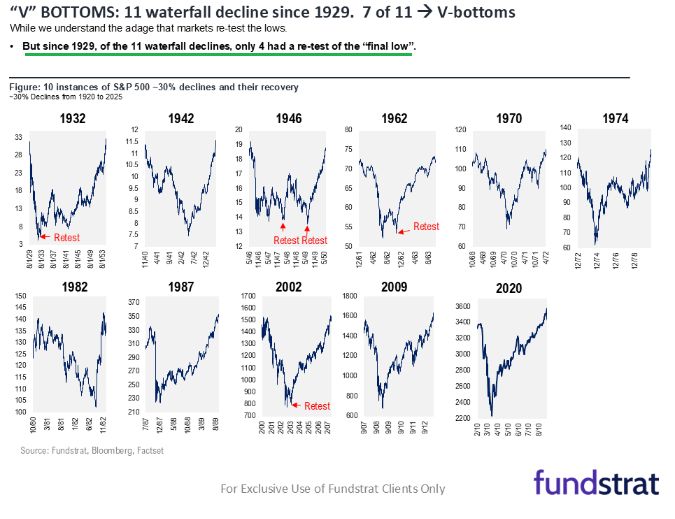

"It’s been a rough year so far for US equity markets, but we’ve been through much worse in the past and gotten through it. We’ll get through this as well. As Abraham Lincoln once said: This, too, shall pass.”

Investing with intelligence

Our latest research, commentary and market outlooks