Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

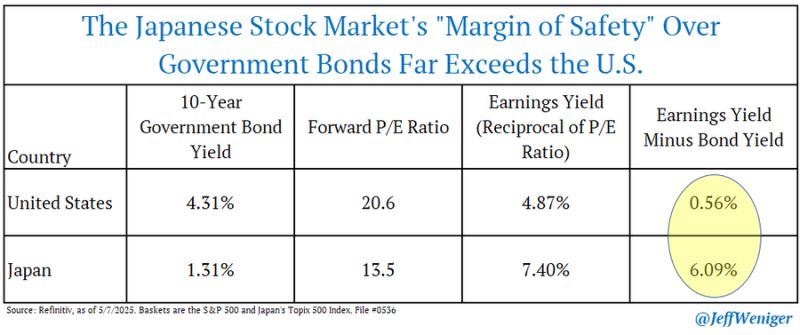

Japan is cheap...

Japan's forward P/E ratio is 13.5, or a 7.4% earnings yield. That is a 609bps premium to the 1.31% yield in 10-year Japanese government bonds. For context, the S&P 500 trades for 20.6 times forward earnings, for an earnings yield of 4.87%. That is just 0.56% over 10-yr T-Notes. Source: Jeff Weniger

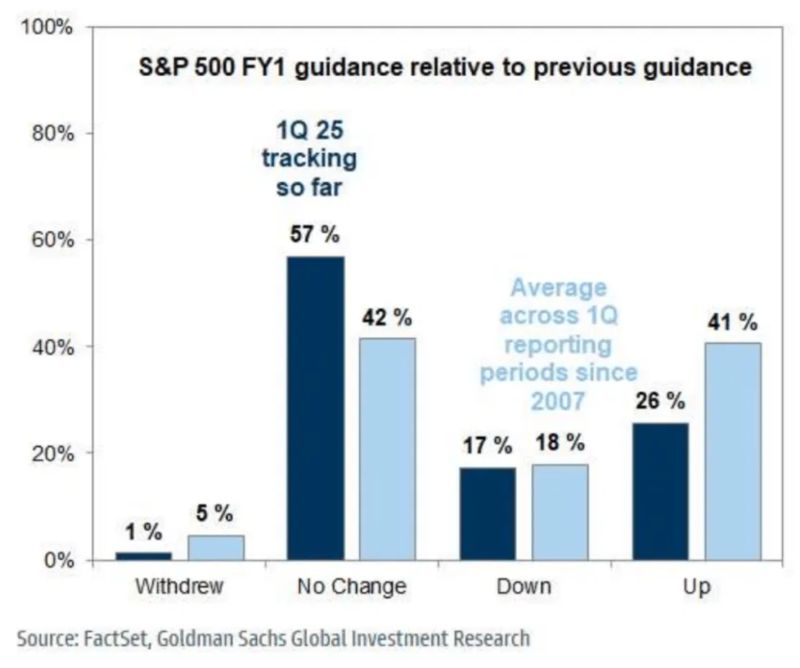

So far very few US earnings downgrades...

Source: GS, Ronnie Stoeferle @RonStoeferle

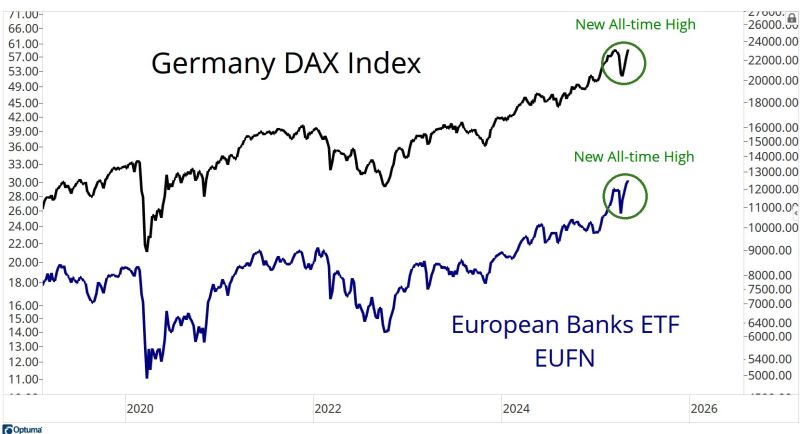

The recent outperformance of european vs. US equities in context

Source: Michel A.Arouet, @Augur Infinity

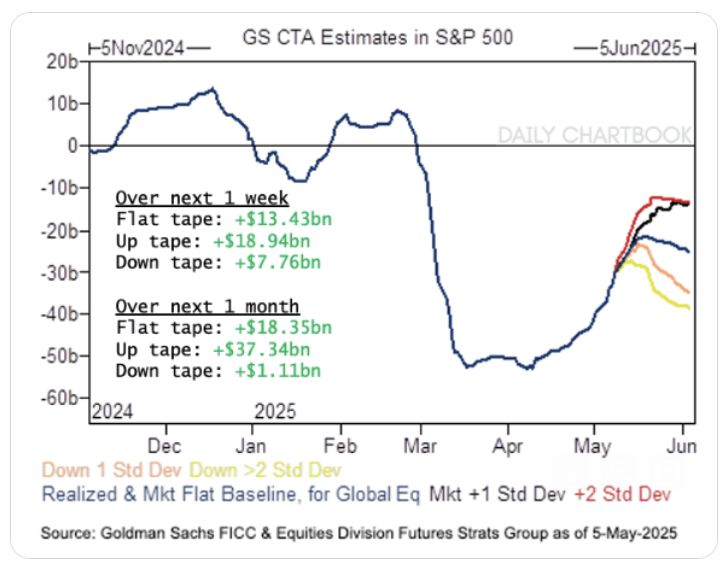

According to Goldman Sachs, CTAs are projected to buy US stocks in EVERY SINGLE SCENARIO over the next week and month.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks