Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

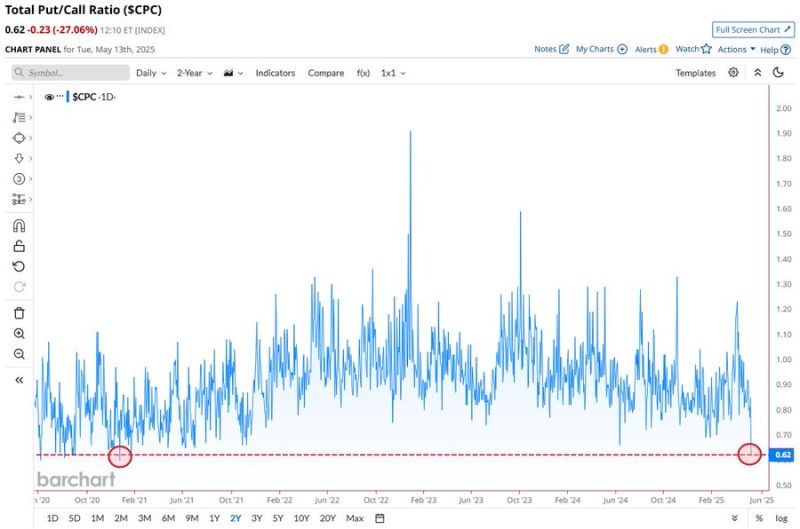

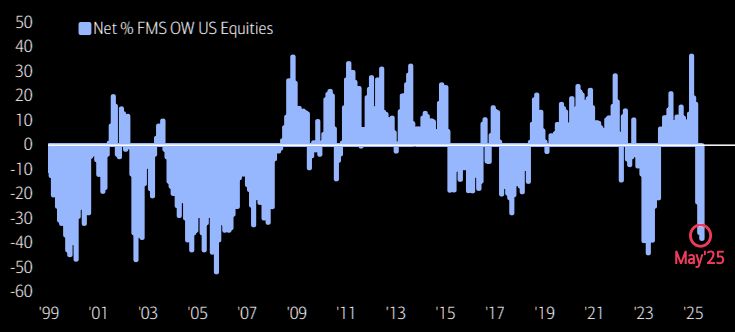

BREAKING 🚨: Fund Managers

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years 👀 Source: Barchart, BofA

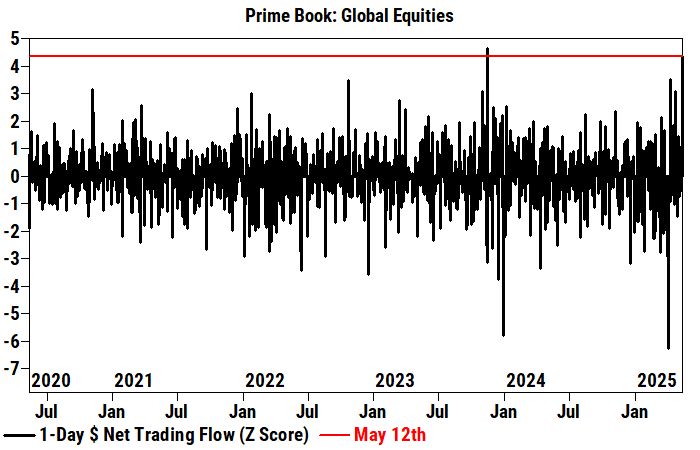

Hedge fund capitulated with second biggest short covering panic on record during Monday melt-up 🚀

On Monday, the Goldman Prime Brokerage Global equities book saw the second largest notional net buying in 5 years (+4.3 sigma), driven by short covers and to a lesser extent long buys (1.6 to 1). All regions were net bought, led by North America and to a lesser extent Europe (both led by short covers). Goldman HF Prime report shows that hedge funds net bought US equities at the fastest pace since Apr 9th (+4.0 sigma one-year), driven by short covers and long buys (1.5 to 1). Single Stocks / Macro Products were both net bought and made up 53% / 47% of the total notional net buying, led by short covers / long buys, respectively. Source: Goldman, zerohedge

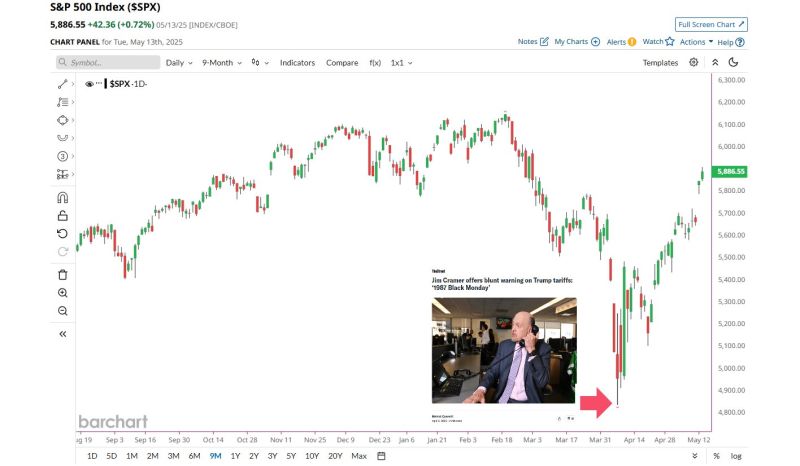

Jim Cramer Remains Undefeated His "Black Monday" warning occurred at the EXACT time that the Stock Market bottomed.

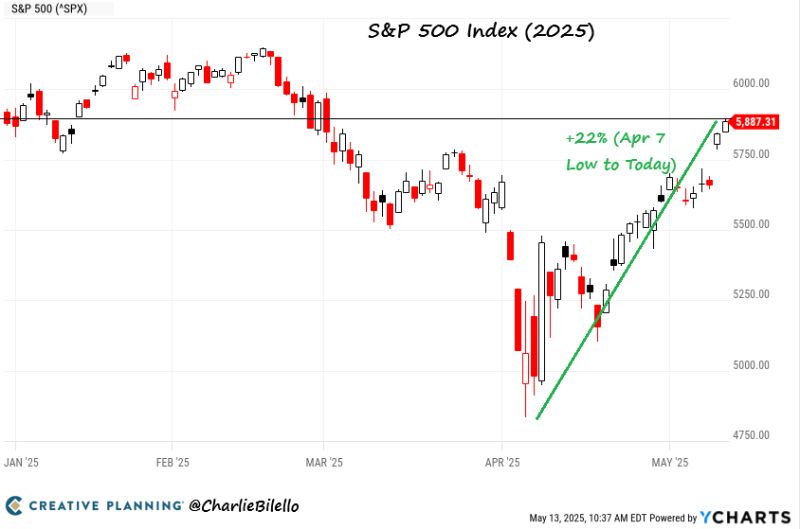

S&P 500 is now in a bull market Source: Barchart

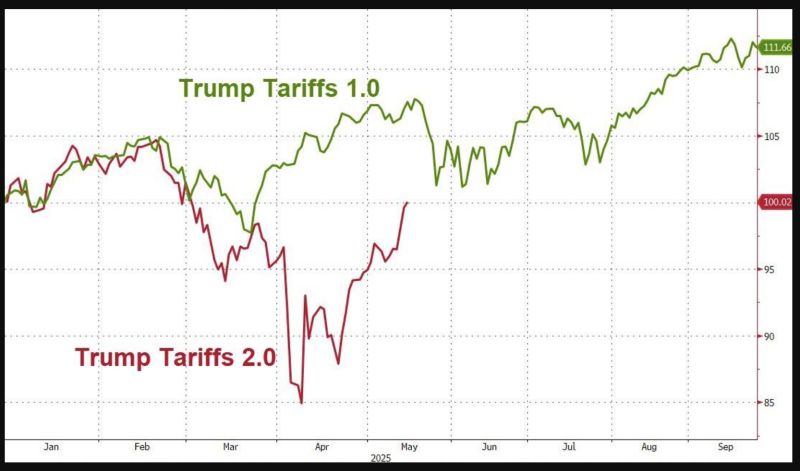

"History does not repeat itself but often rhymes" - Mark Twain

On the back of lower than expected inflation CPI report yesterday, the S&P 500 joined the Nasdaq 100 in the green year-to-date, erasing all of the April pullback. The S&P 500 Trump Tariffs 2.0 line is catching up with the Trump Tariffs 1.0 one... Source: zerohedge

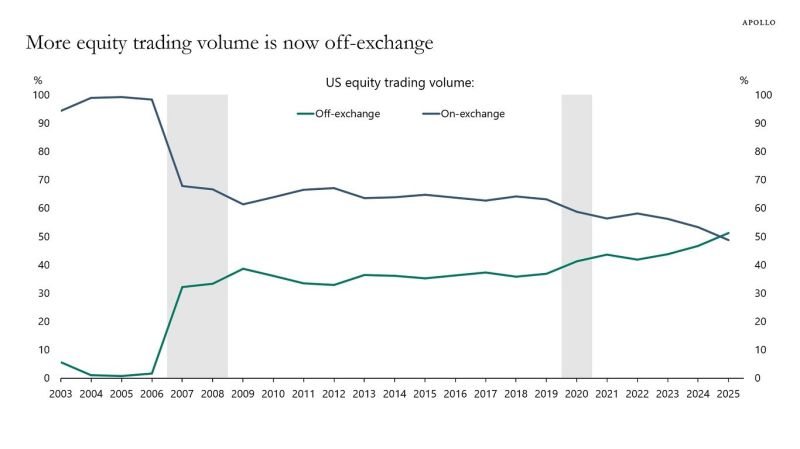

Dark pools are a bigger and bigger part of the stock market, now eclipsing volume at exchanges

Source: Markets & Mayhem, Apollo

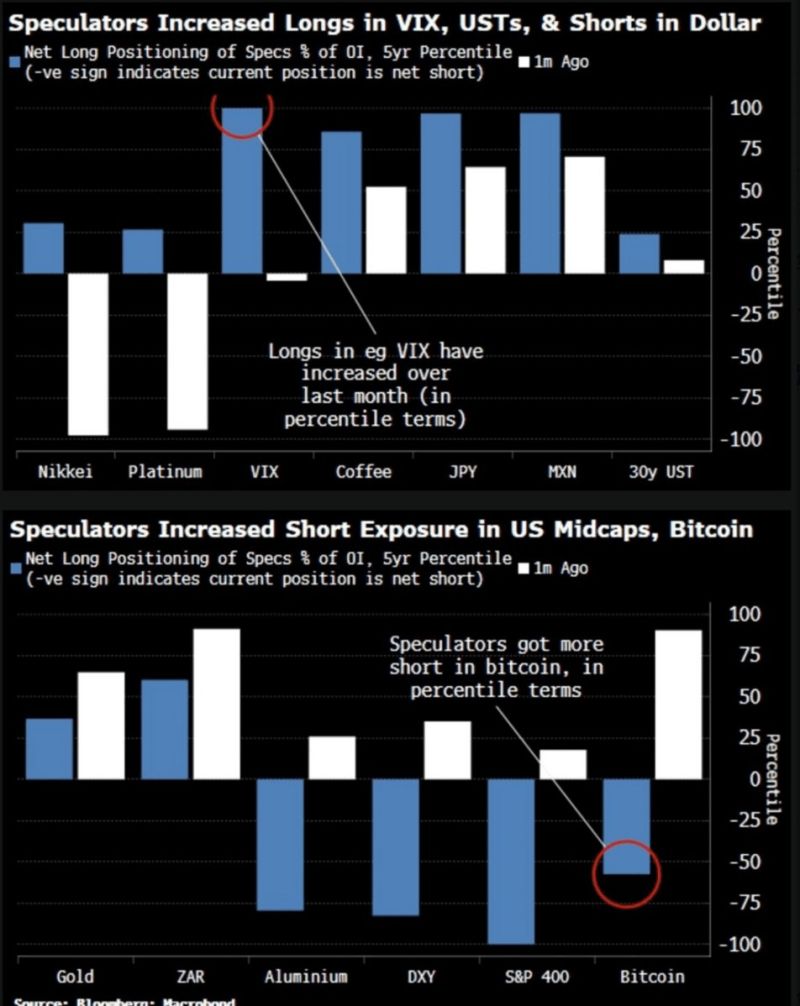

BREAKING: Hedge Funds

Hedge Funds were long volatility, short U.S. Dollar, short equities, and short Bitcoin $BTC before the U.S.-China trade agreement was announced... Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks