Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

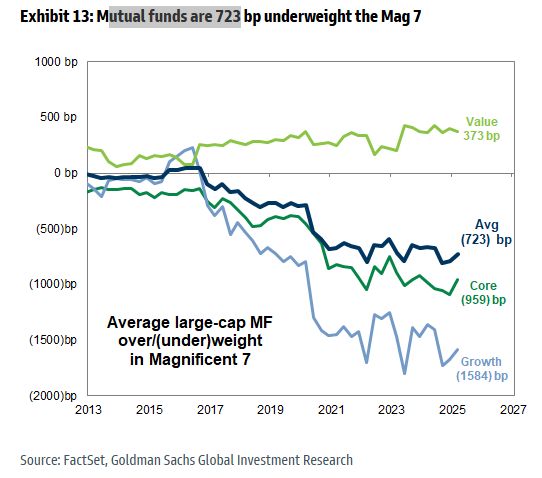

Mutual funds are 723bps underweight the Mag7

Source: Mike Zaccardi, CFA, CMT, MBA

In case you wonder why stocks when down yesterday

BOND AUCTION FOR THE US 20-YEAR TREASURIES WAS UGLY Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%. Stock markets didn't like it Source: amit @amitisinvesting

Are rising bond yields the elephant in the room for equities?

Source: Trend Spider

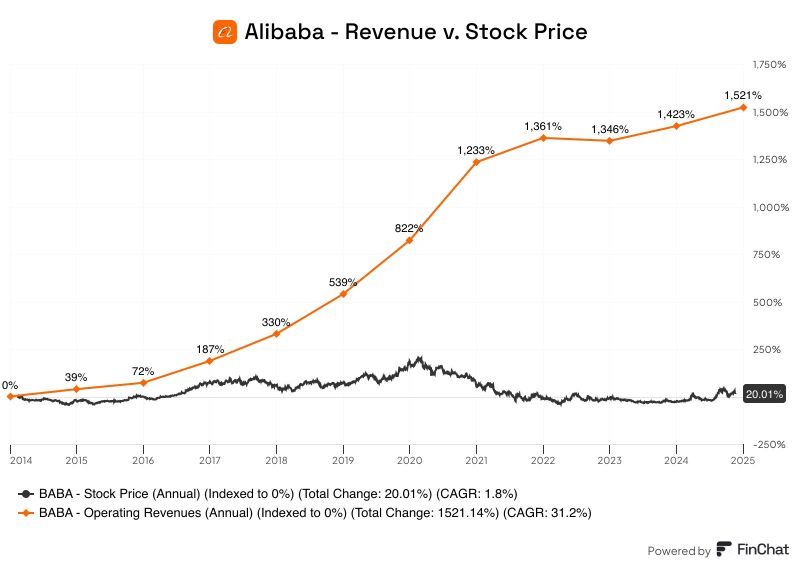

What a wild chart...

Alibaba Revenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_ioRevenue v. Stock Price Revenue: +1,521% Stock Price: +20% $BABA Source: FinChat @finchat_io

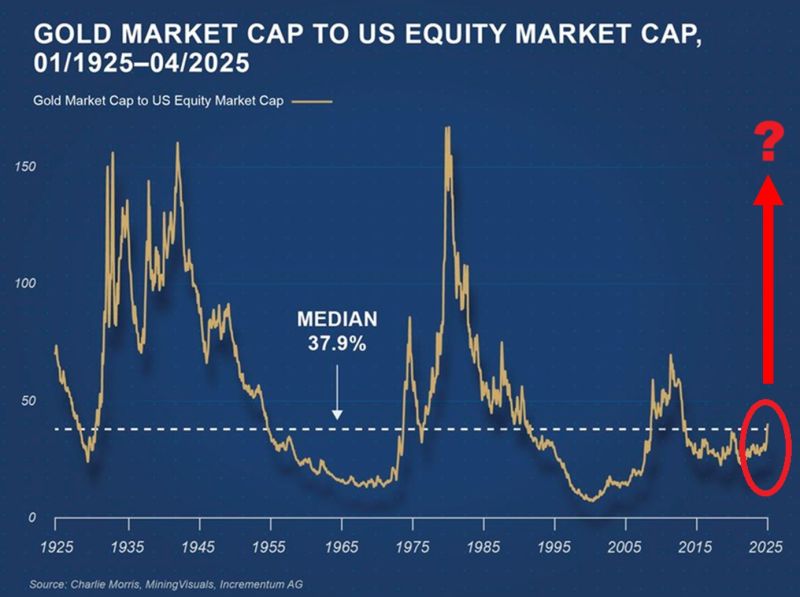

Gold market cap relative to the US equity market cap hit its highest level in 12 YEARS and is exactly at its long-term median.

Given the geopolitical and likely financial markets changes underway, will we see a repeat of the 1970s??? Source: Global Markets Investors, Incrementum AG

S&P 500 ekes out sixth winning day as investors look past U.S. credit downgrade.

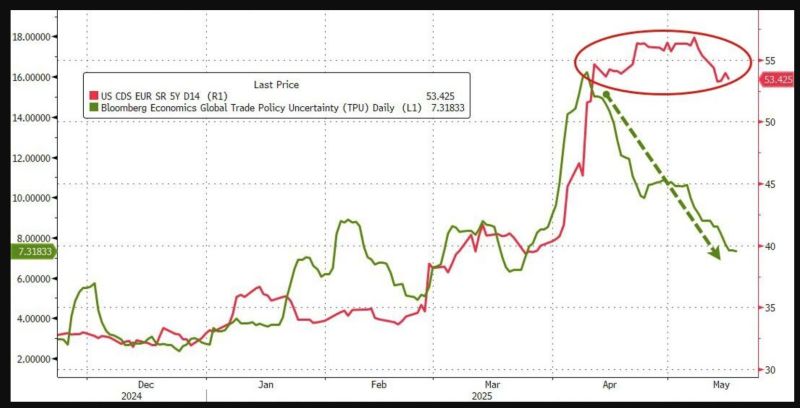

As shown below, US CDS (red line) barely moved on the news. And any way, investors are more focus on the green line (global trade policy uncertainty) than anything else. Source: zerohedge

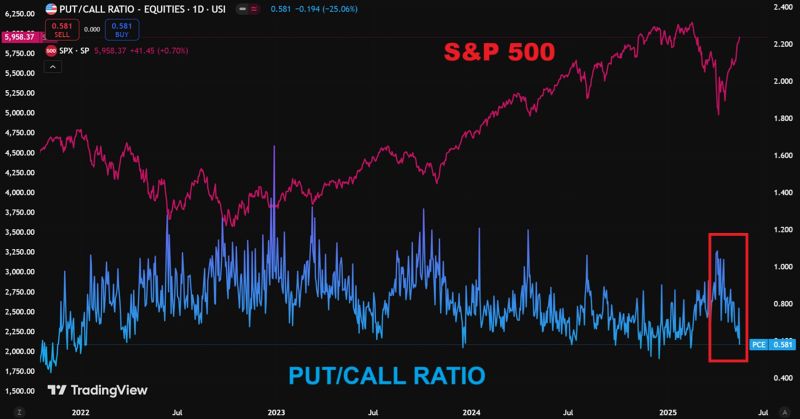

🚨Are investors too complacent?

The US equities put/call ratio fell from the highest level in 12 months to the 2nd-lowest level this year. Since the 2022 bear market, the put/call ratio has rarely been this low. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks