Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

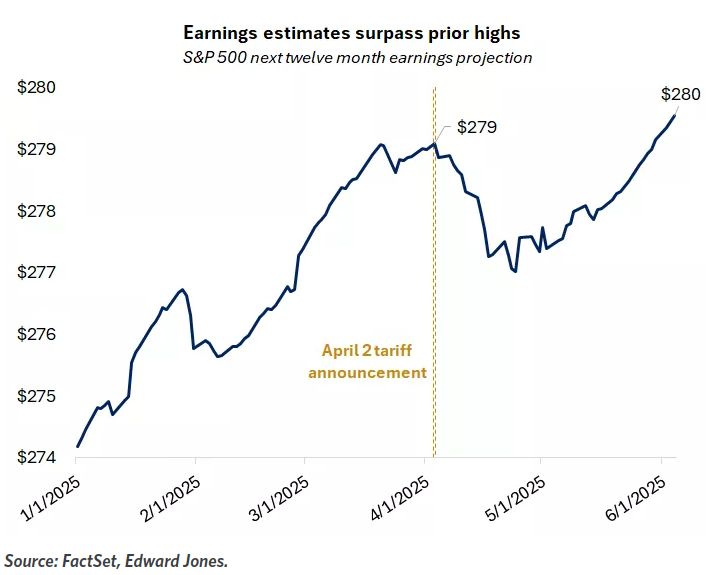

S&P 500 earnings estimates are now surpassing the prior high, which happened just before 'Liberation Day'.

First-quarter earnings season wraps up, underscoring corporate strength. S&P 500 companies grew profits 12.5% y-o-y, the third quarter of double-digit growth in the past four. While earnings growth estimates for 2025 have been revised down from 14% to 8.5%, the 2026 outlook remains steady, pointing to the potential for reacceleration. Notably, the forward 12-month earnings estimate has recently reached a new high, providing a fundamental anchor for rising equity markets. While valuations have undoubtedly contributed to the recent gains, earnings appear to have also played an important role as well. Source: Edward Jones

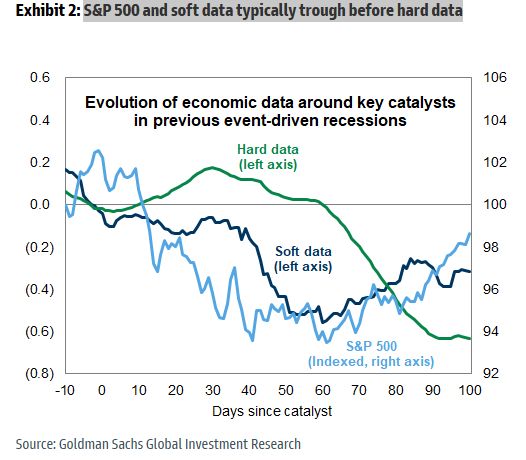

GS: S&P 500 and soft data typically trough before hard data

Source: Goldman Sachs, Mike Zaccardi, CFA, CMT, MBA

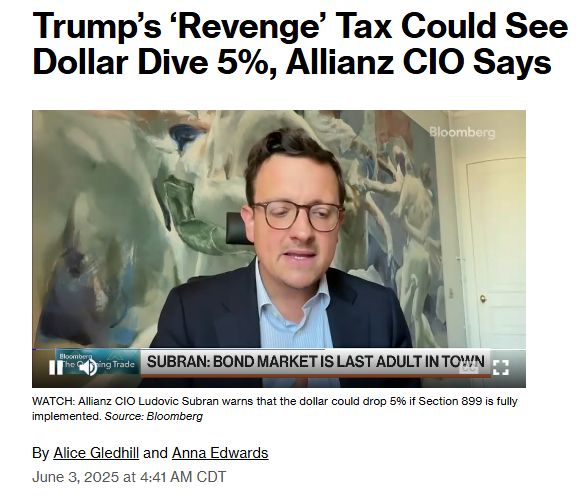

Stocks would plunge 10% and the U.S. Dollar would fall 5% if the foreign tax provision, known as Section 899, passes Congress, warns Allianz SE 🚨🚨

Source: Barchart

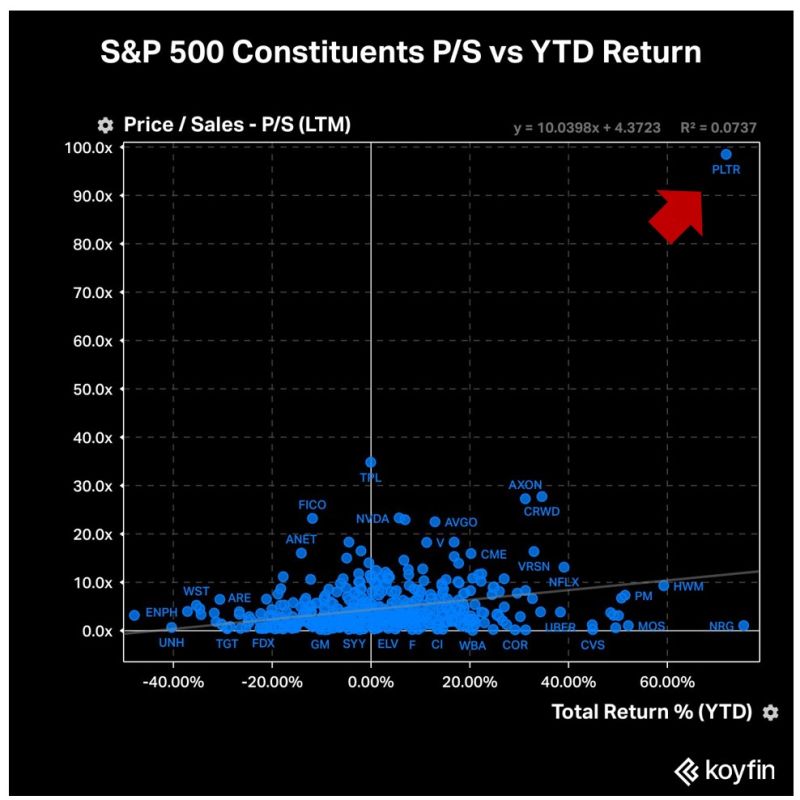

If you squint hard enough, you'll notice an outlier in the S&P 500 when it comes to Price/Sales vs YTD Return.

Source: Koyfin

Circle stock ($CRCL) surges 168% in blockbuster NYSE Debut as stablecoin giant goes public.

The stablecoin issuer's shares closed at $83.23, marking the crypto industry's second-largest public listing. The stablecoin giant's first day as a public company saw explosive trading activity, with 47.1 million shares changing hands as the stock swung between a daily high of $103.75 and low of $66.60. The dramatic price action pushed Circle's market capitalization to $16.7 billion by the closing bell, a remarkable turnaround for a company that had priced its IPO below its previous private market valuation. Circle's successful flotation represents the largest crypto-related public listing since Coinbase's 2021 debut and marks a watershed moment for the stablecoin sector. The Boston-based company raised $1.05 billion in an upsized offering that comes three years after a failed attempt to go public through a $9 billion SPAC transaction that collapsed in 2022. Source: www.blocklead.co

Current state of affairs 🍿Markets situation yesterday summarized in one image courtesy of Trend Spider.

Tesla was a big laggard in the session, down more than 14%, after President Donald Trump said he was “very disappointed” in CEO Elon Musk. Musk shot back at President Donald Trump, saying in a post on X that “without me, Trump would have lost the election.” The feud further intensified after Trump called Musk ”‘CRAZY” and signaled that he might cut his companies’ government contracts.

The Trump-Elon meltdown: the breakup between the world’s most powerful politician and the world’s richest man is playing out in a manner befitting an era of hyperreality:

With stunning speed, wild recriminations, and in public via television and their own social media platforms. Tesla shares plunged 14%, comp lost $153bn in mkt cap, now worth less than $1tn. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks