Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

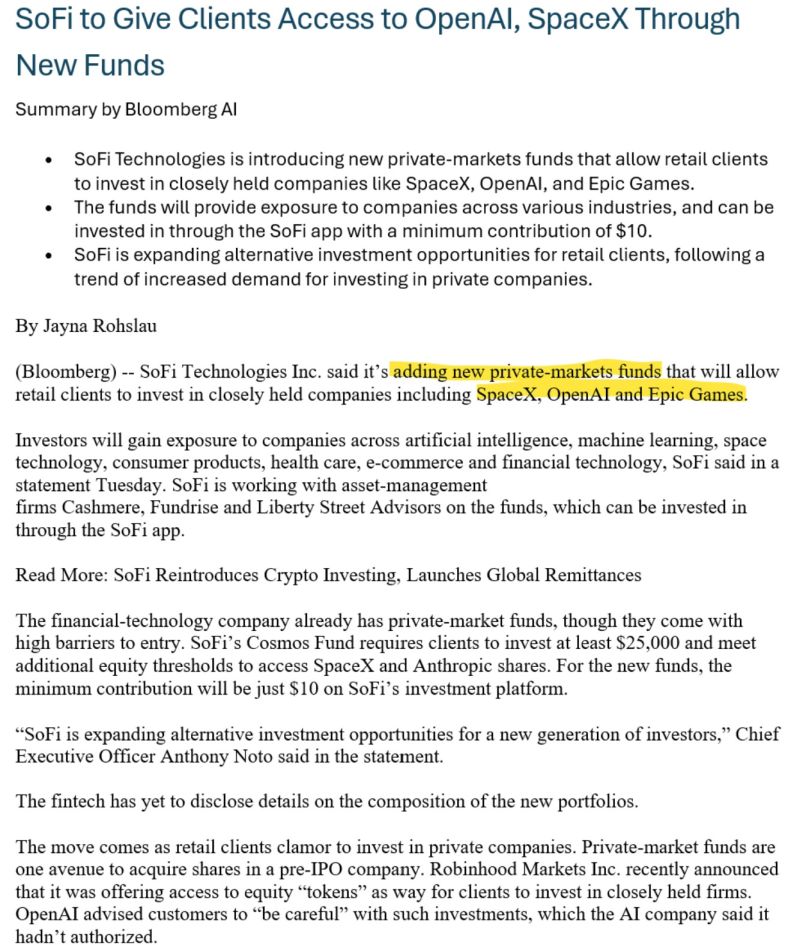

Fintech stock $SOFI sofi technlogies JUST HIT $20 AFTER ANNOUNCING RETAIL ACCESS TO PRIVATE MARKETS

New funds now offer exposure to OpenAI, SpaceX & Epic Games -- starting at just $10. SoFi Technologies SOFI +is expanding access to private markets, an asset class once reserved for institutional investors and high-net-worth individuals. Following this news, SOFI stock surged about 5% shortly after the market opened on Tuesday and hit a new 52-week high of $20.89. Through new partnerships with asset management firms such as Cashmere, Fundrise, and Liberty Street Advisors, SoFi is allowing its members to invest in high-growth private companies like OpenAI, SpaceX, and Epic Games with a minimum of $10. SOFI is Breaking Down Barriers Private markets have often delivered strong returns but were inaccessible to retail investors. By lowering the entry point and simplifying the process, SoFi is making it easier and more affordable for retail investors to enter this market. This move is part of SoFi’s efforts to expand its alternative investment offerings. It recently added new funds from big names such as ARK, KKR, Carlyle CG and Franklin Templeton BEN , giving users access to private credit, real estate, and pre-IPO companies. Source: Tipranks.com, Bloomberg AI

Carvana has pulled off one of the greatest comebacks in stock market history.

Carvana Co., together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. The company offers vehicle acquisition, inspection and reconditioning, online search and shopping experience, financing, complementary products, logistics network and distinctive fulfillment experience, and post-sale customer support. Comment by Next100 baggers on X: "The stock had to rally 9,900 % just to crawl out of a 99 % draw-down, so even at $345 it’s still below the 2021 peak. The turnaround is real, SG&A per unit has fallen from roughly $4.7 k to $2.2 k, gross profit per unit has doubled to about $6.4 k, and the $5.7 B debt deal pushed maturities out to 2030 but fundamentals now carry a premium price tag. At $345 the market cap is roughly $75 B and enterprise value about $50 B, versus Street FY25 EBITDA estimates near $2.1 B, which puts you in the mid 20s EV/EBITDA range while retail unit volume is still shrinking. Fantastic comeback trade, much tougher fresh entry". Source: Brew markets

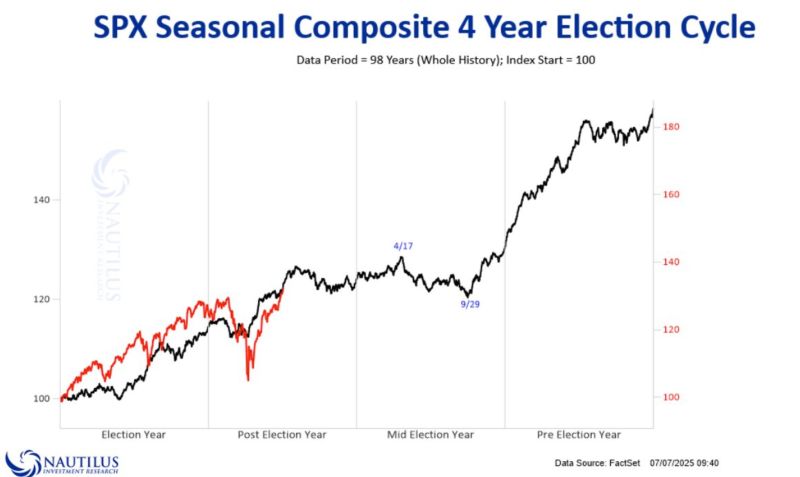

Nautilus Research ➡️ 2025 vs. 4-year Election Cycle Composite.

A last "hurrah" before some troubles ahead?

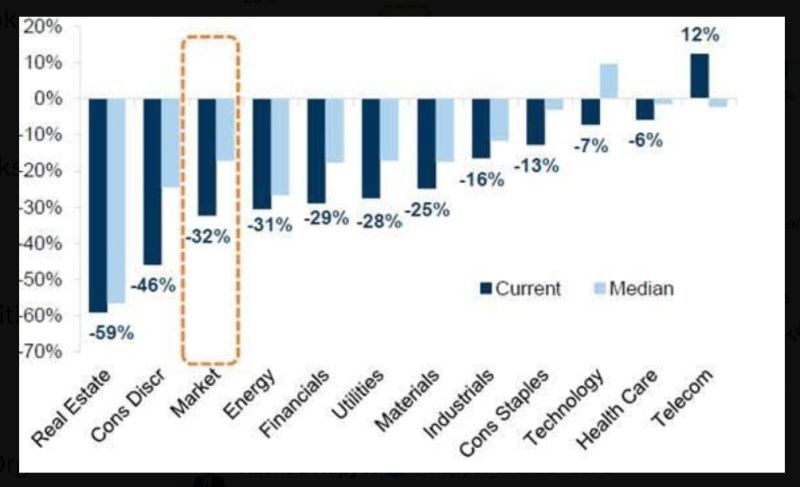

European stocks are trading at a wider-than-usual discount vs their US counterparts, per Goldman

Source: Markets & Mayhem on X

The SP500 has traded above its upper Bollinger Band for the past 8 days.

The last time it did that was in July 2024 and then $SPY promptly corrected by 10%. Source: Barchart

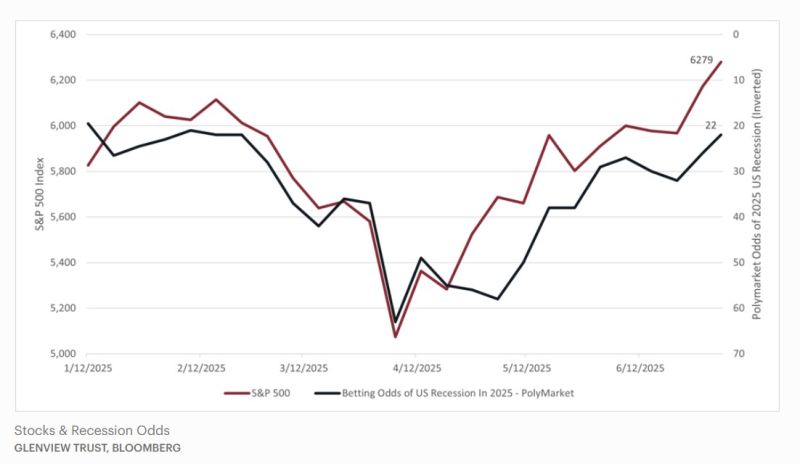

As the threat of recession has waned, as illustrated by the lower betting odds of recession, stocks have rallied to new highs.

At the early April stock lows, the massive US tariffs announced on Liberation Day sent the betting odds of recession soaring to 65%. As the tariff threat eased and some progress was made on trade agreements, stocks have recovered sharply. The resiliency of the labor market and an expected economic boost from the tax cuts in the "Big Beautiful Bill" helped push the probability of an economic downturn closer to the lows of the year. Source: Barron's

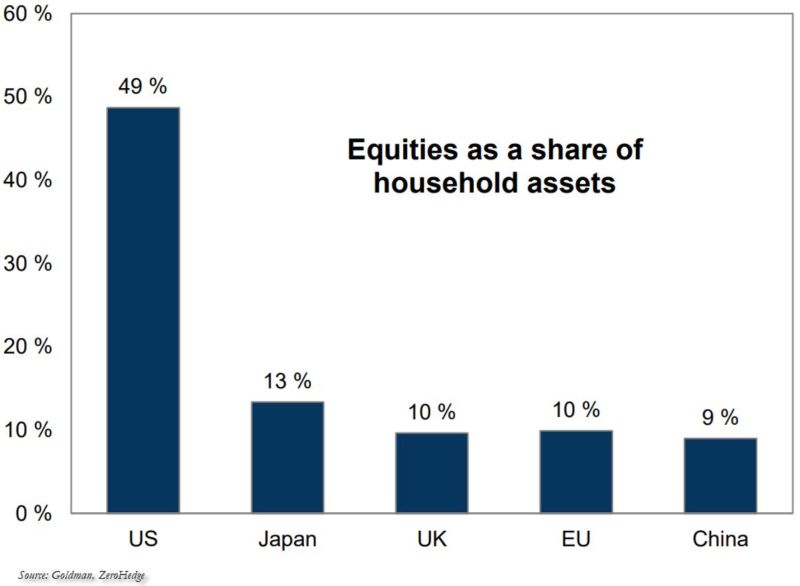

Stocks as a share of household assets

Source: zerohedge @zerohedge

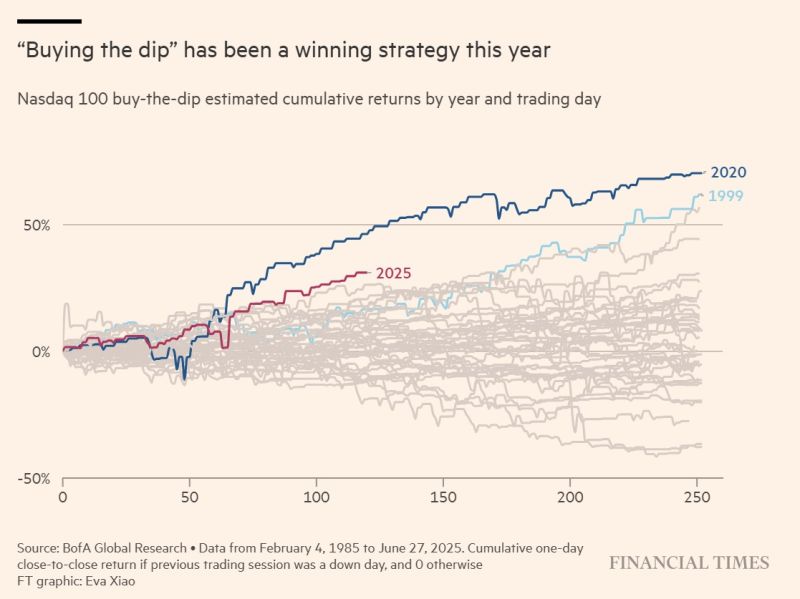

Very interesting article by FT

Retail investors reap big gains from ‘buying the dip’ in US stocks: "Retail traders “buying the dip” in US stocks this year have racked up the biggest profits since the early stages of the Covid-19 crisis, helping to fuel a rally that has pushed Wall Street equities to record highs. Individual investors have poured a record $155bn into US stocks and exchange traded funds during 2025, according to data provider VandaTrack, surpassing the meme-stock boom of 2021 (...) The rebound in US stocks — which hit fresh all-time highs last week even as the dollar and US Treasuries remain under pressure — has been “powered by a buy-the-dip dynamic that by some metrics has been even stronger than that seen in the latter stages of the 90s tech bubble,” said BofA equity analyst Vittoria Volta. Professional investors have eyed the rally with caution due to lingering concerns over the impact of Trump’s landmark tax and spending bill on America’s national debt and the potential hit to US economic growth from his tariffs. Deutsche Bank strategists said this week that there had been “few signs of strong bullish sentiment and risk appetite” among institutional investors since their demand peaked in the first few months of this year. But dip-buyers are playing a risky game by opting not to cash out when prices surge, according to Rob Arnott, chair of asset management group Research Affiliates.

Investing with intelligence

Our latest research, commentary and market outlooks