Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

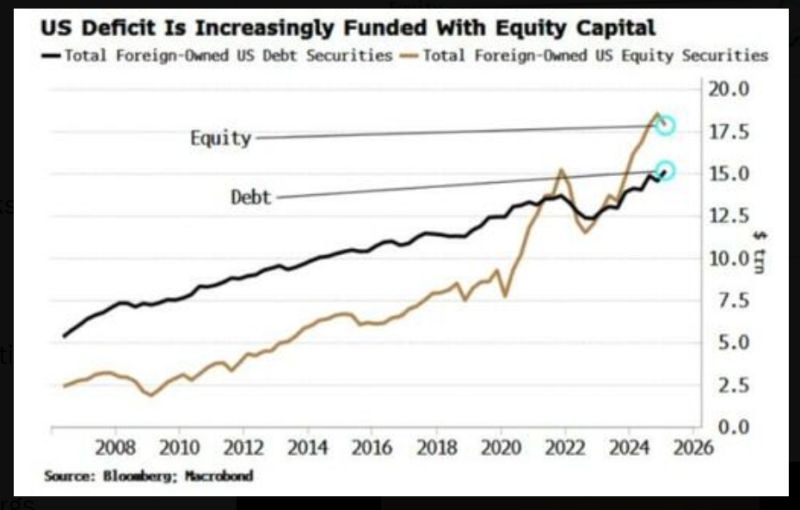

Foreign Investors now own $2.5 Trillion more in U.S. Stocks than U.S. Debt, the widest gap ever

Source. Barchart, BofA

This is how many investors currently feel... but we disagree.

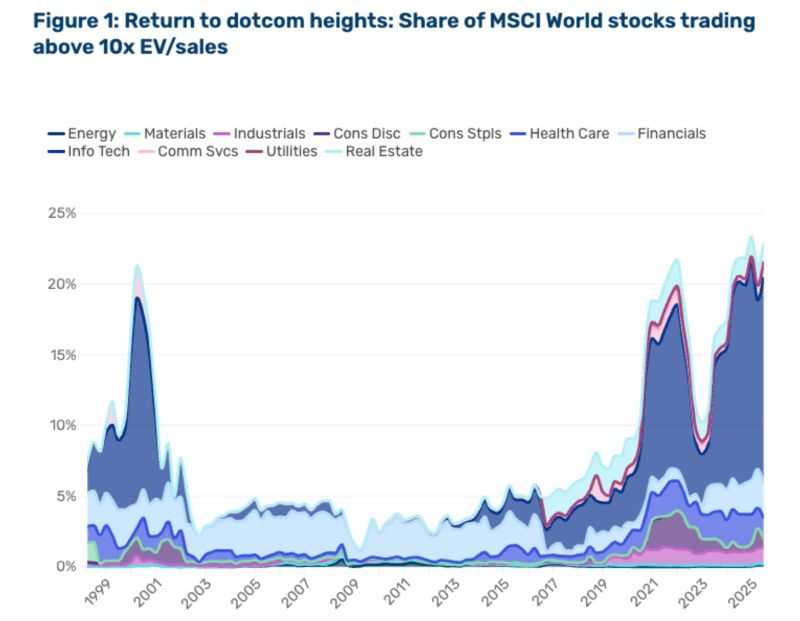

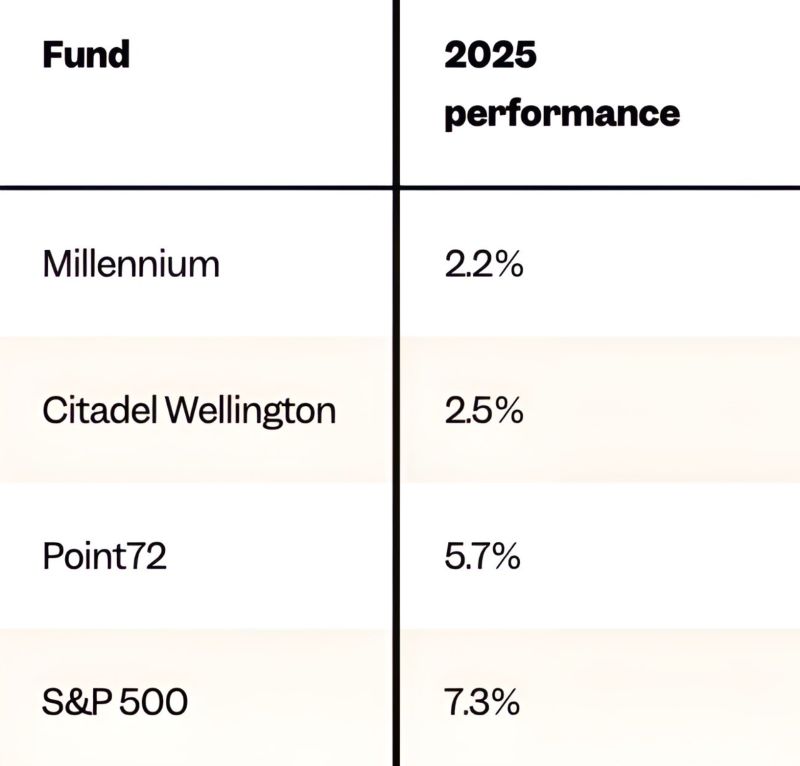

There are "reasons" behind the current bull market. First, liquidity conditions remain favorable with Global M2 (a global liquidity proxy) going up. Second, earnings remain a tailwind with positive earnings revision and 2026 earnings growth reaccelerating. Third, the global macro & geopolitical context is more favorable than in H1 with some clarity on tariffs expected to improve in the coming months and lower taxes ahead. Of course, there are many risks to be taken into consideration but the probability of occurrence is probably exaggerated (e.g. ousting of Fed chairman Powell seems unlikely). But yes indeed, with this level of valuations, any unexpected event could trigger a very decent correction. So stay invested but keep some dry powder to buy the next dip Source picture. Brew markets

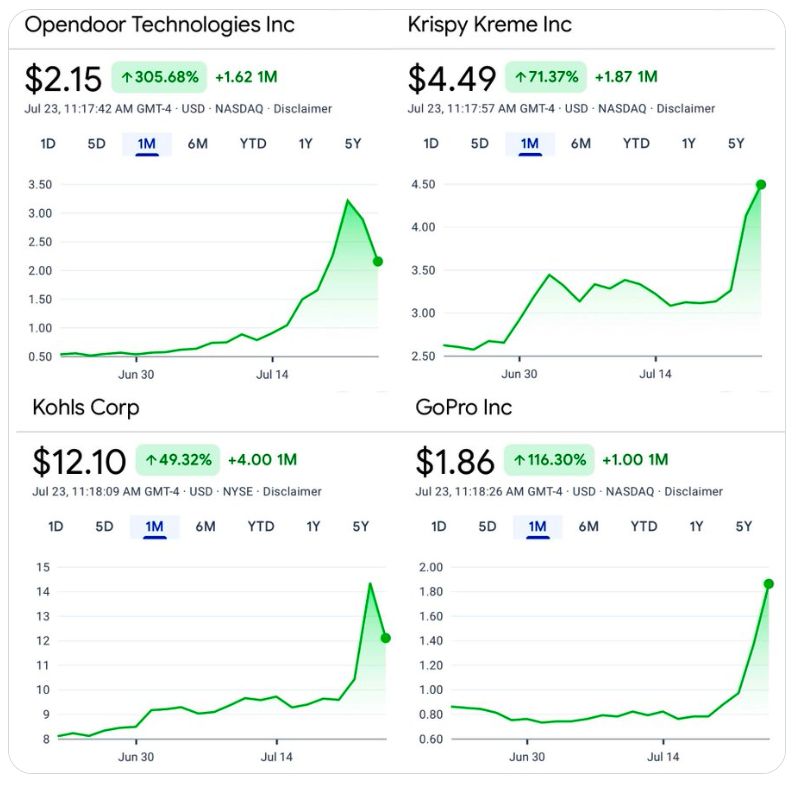

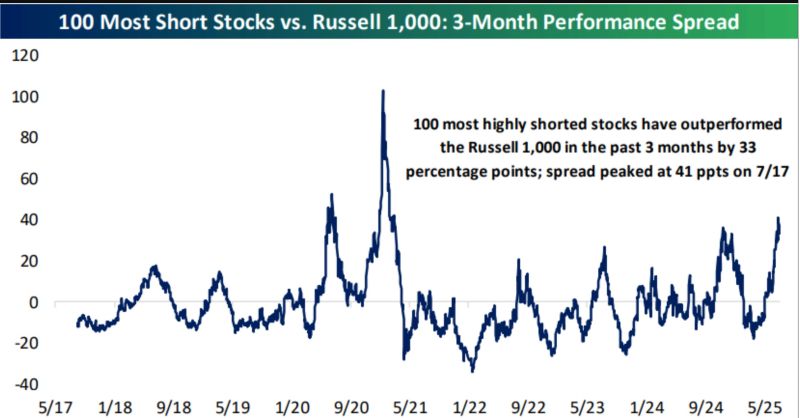

The 100 most shorted stocks in the Russell 1,000 are up 52% over the last three months and have beaten the index by 33 percentage points.

Not quite "meme-stock mania" from 2020/2021 but definitely elevated. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks