Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Should we fear bearish engulfing patterns on the S&P 500?

Fundstrat: " $SPX and equities are overbought. So a bit of consolidation is expected. But we believe the risk/reward for stocks remains favorable. And we think stocks will likely be higher 2 weeks from now." Source: Seth Golden @SethCL

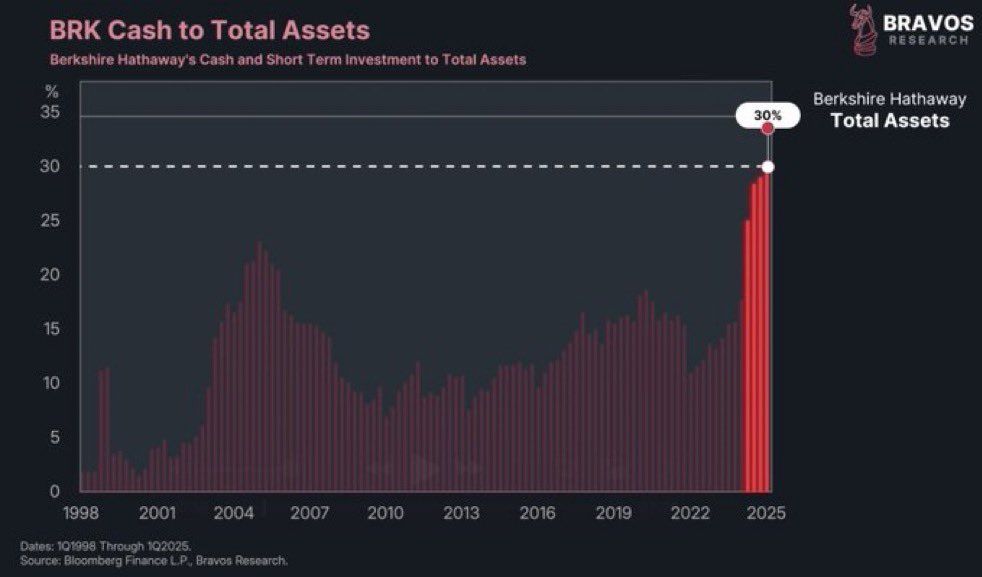

Berkshire Hathaway’s cash position is now 30% of their total assets, the most in history.

Source: Barchart

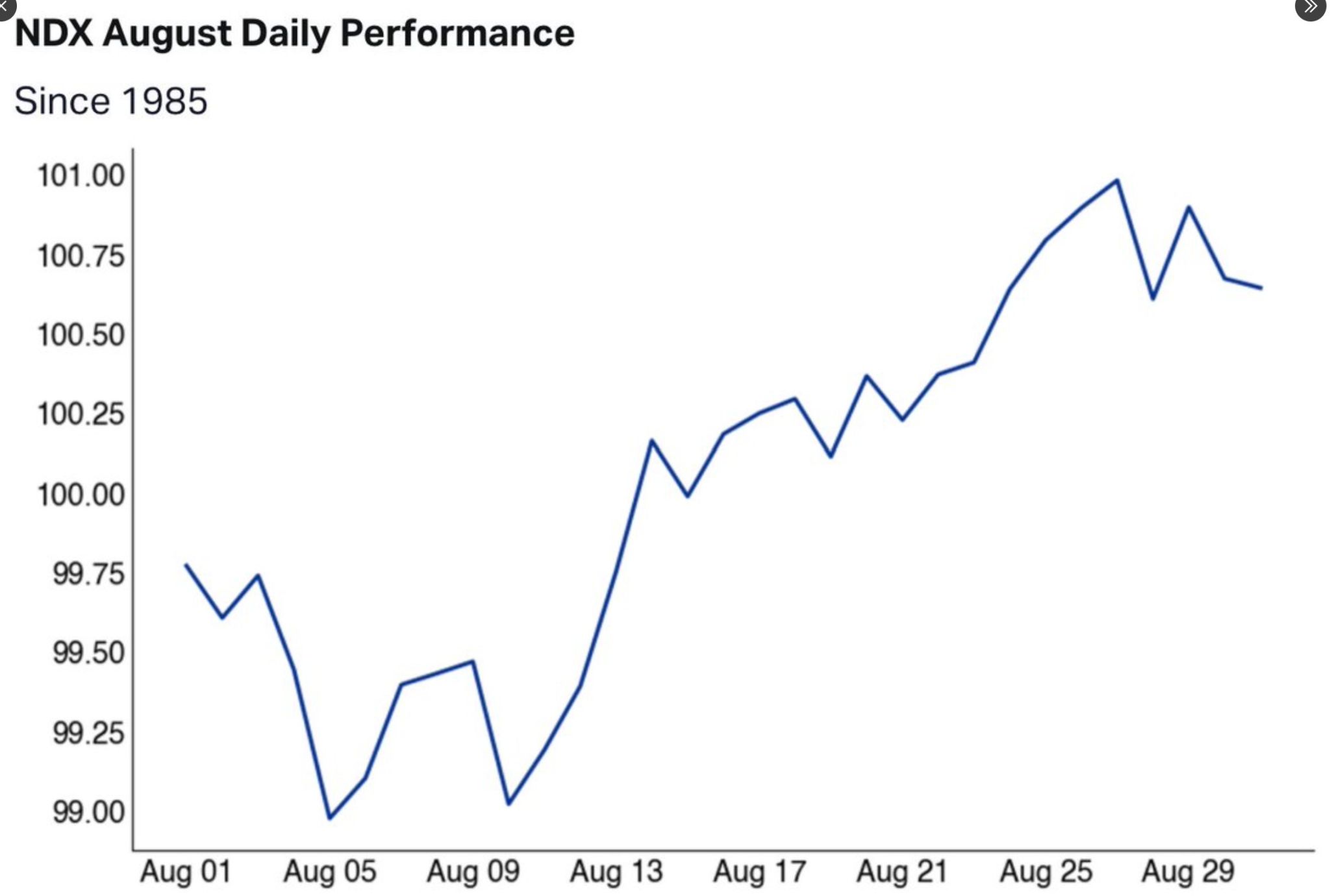

Since 1985, Nasdaq 100 has a rough start to August, with double-dips ultimately resulting in a W-shaped recovery into end-of-month.

Might take a little longer (release of CPI mid-month) if downside persists and before recovery ensues in 2025. Source: Seth Golden

Ever wonder why S&P 500 concentration is hitting record highs?

Investors are piling into mega tech for one big reason: huge free cash flow generation and strong net income growth! ➡️ The net income gap between the top 10 giants and the rest keeps widening. Without the top 6, S&P 500 earnings growth is flatlining. ⚠️ Meanwhile, around 40% of Russell 2000 small caps aren't even profitable. Source: FT thru Andrea Lisi

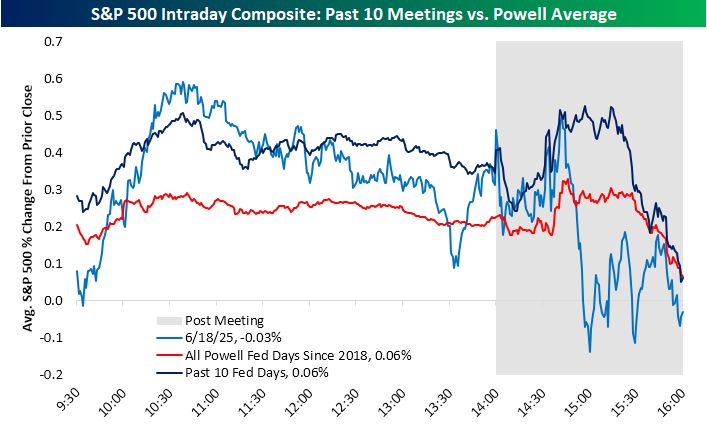

Will we see the typical post-Powell sell-off again today? It's a tradition.

Source: Bespoke @bespokeinvest

Foreign Investors now own 18% of U.S. Equities, the most in history.

Source: barchart

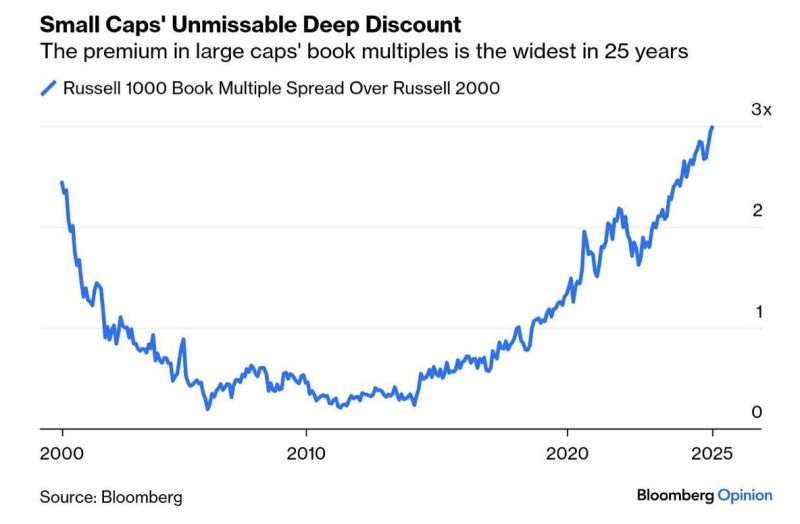

Small Cap Stocks are trading at the largest discount relative to Large Caps in AT LEAST 25 years

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks