Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

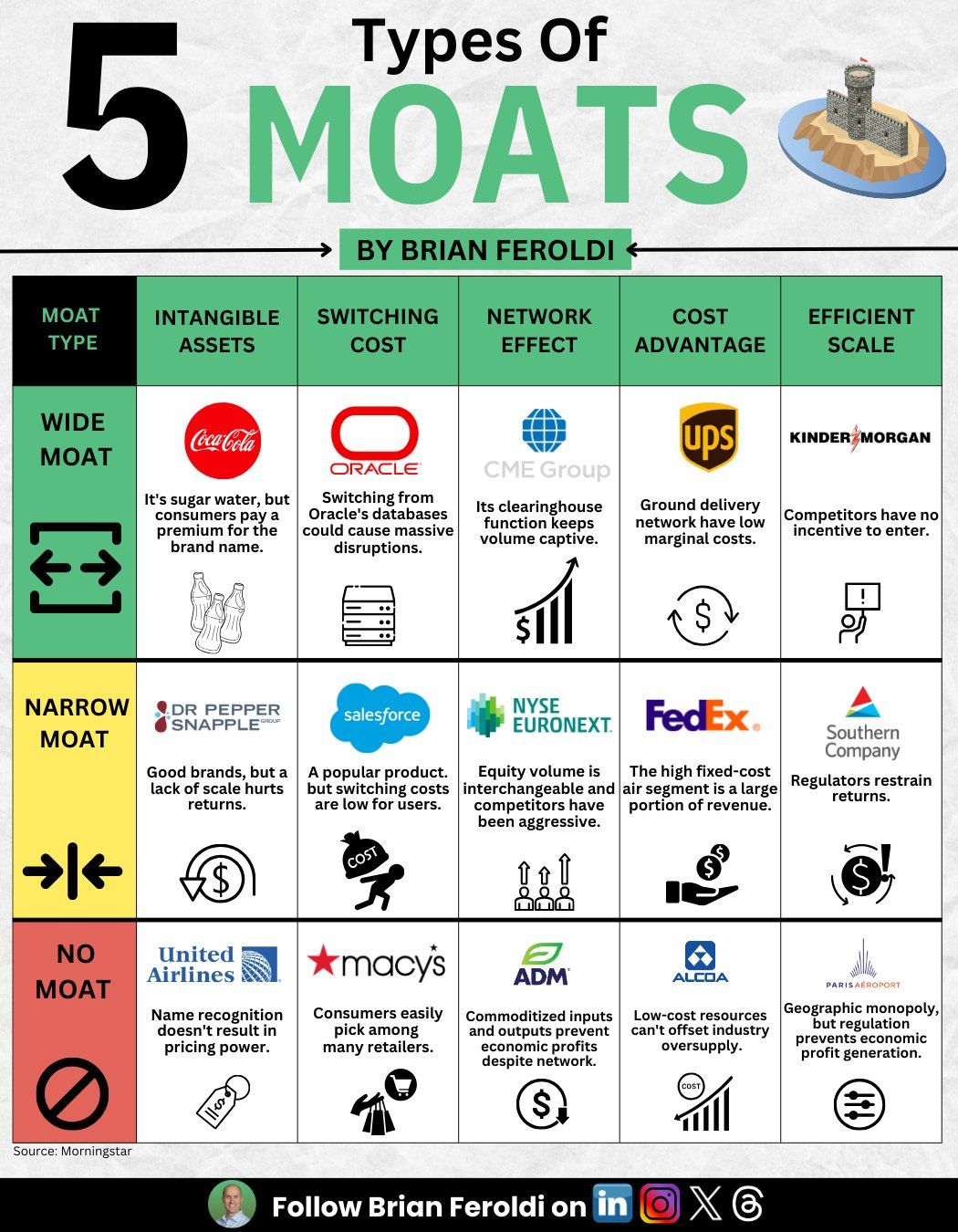

If you buy individual stocks, you must know how to identify a moat

Source: Brian Feroldi

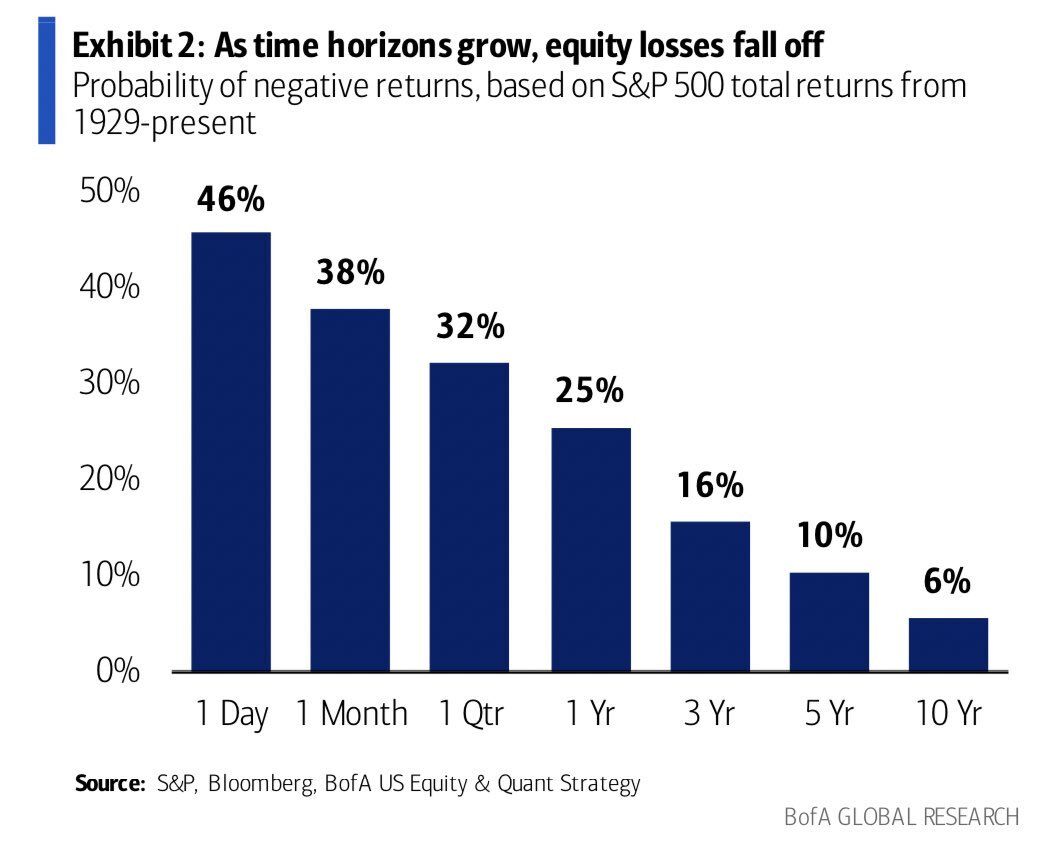

How to not lose money in the stock market

1: Wait longer Source: Brian Feroldi, BofA

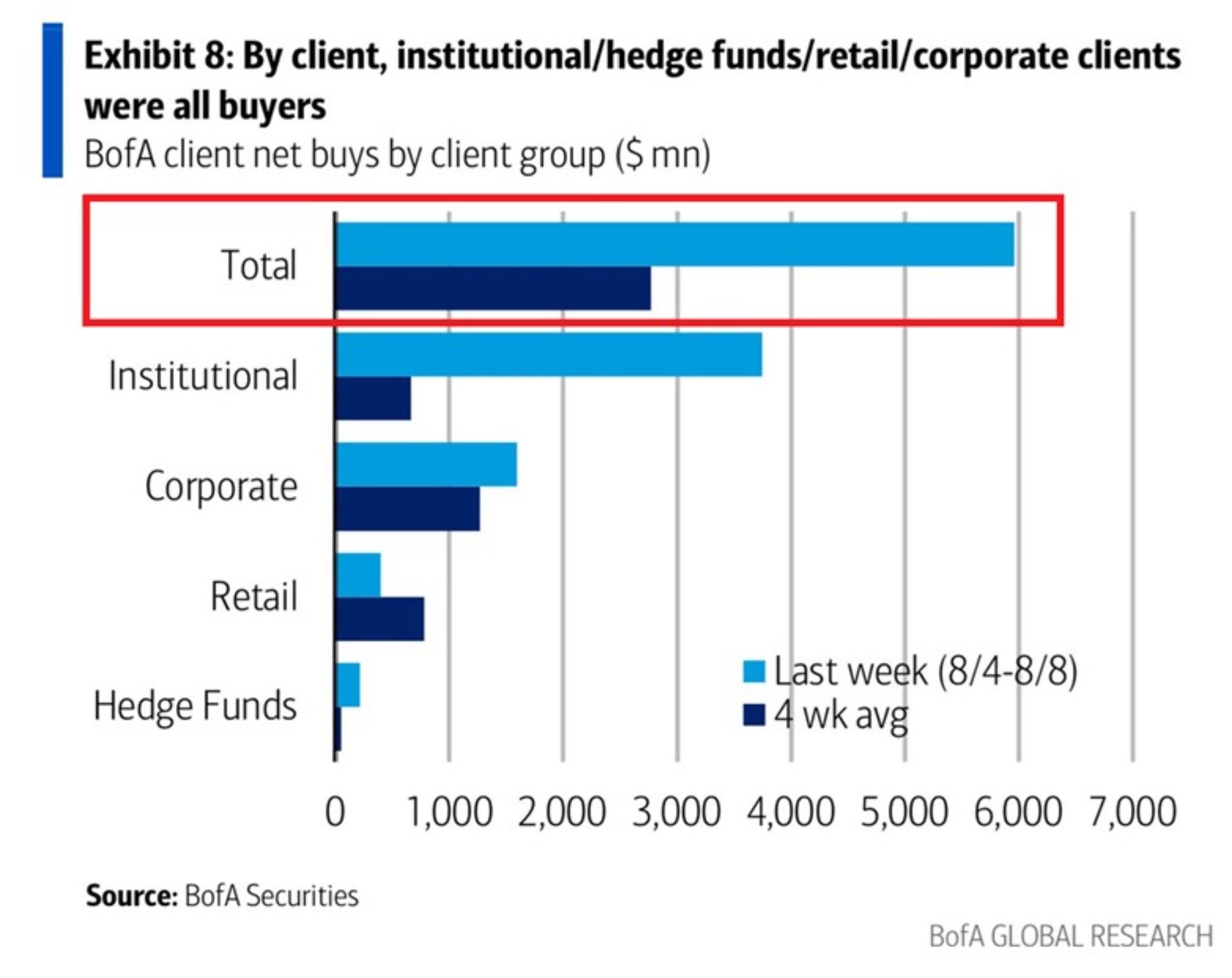

The equity buying spree: Total US ETF and single-stock purchases hit $5.9 billion last week, well above the 52-week average of $2.3 billion.

This lifted the 4-week average of purchases to $2.8 billion. Institutional investors drove the surge, buying $3.7 billion, the 10th-largest weekly amount in at least 17 years. Corporations followed with $1.6 billion in buybacks, while retail investors and hedge funds added $0.4 billion and $0.2 billion, respectively. Individual investors have now bought in 33 of the last 35 weeks. Market sentiment is incredibly strong. Source: The Kobeissi Letter, BofA

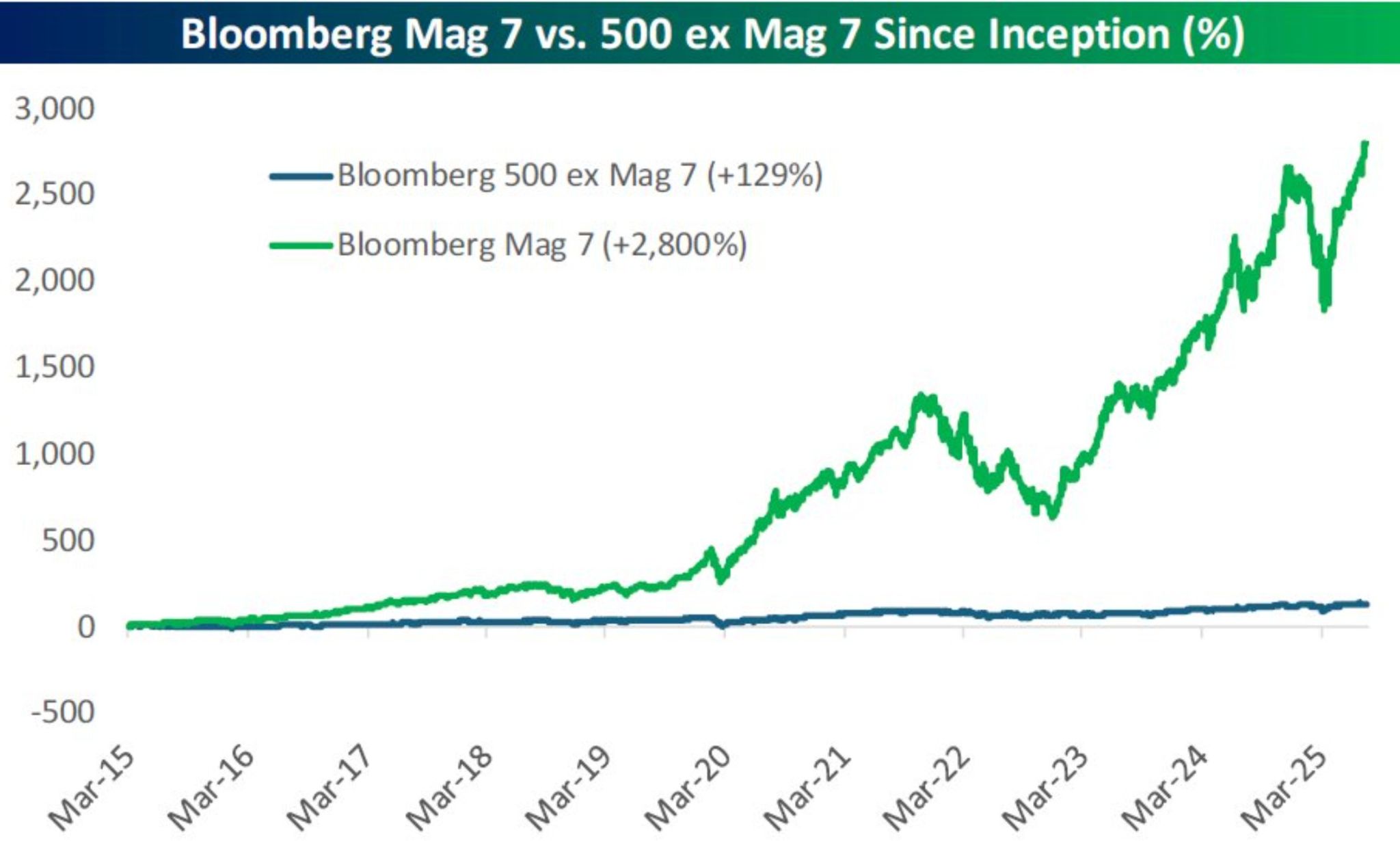

You can almost see the "Ex Mag 7" on this chart when looking at the Bloomberg Mag 7's gain of 2,800% since inception in 2015. Almost...

Bloomberg Mag 7 since March 2015: +2,800% Bloomberg 500 Ex Mag 7 since March 2015: +129% Source: Bespoke

Investors lost billions of dollars in July betting on a handful of small US-listed Chinese stocks that plunged in value shortly after being heavily promoted on social media.

Seven Nasdaq-listed microcap stocks — Concorde International, Ostin Technology, Top KingWin, Skyline Builders, Everbright Digital, Park Ha Biological Technology and Pheton Holdings — all dropped more than 80 per cent over a few trading sessions in recent weeks. The declines wiped a cumulative $3.7bn off their market value, according to price data analysed by predictive analytics firm InvestorLink. All seven stocks had surged before their sudden sell-offs, having been plugged to investors on WhatsApp groups and social media sites. Analysts and investors said the moves bore many of the hallmarks of pump and dump scams. There is no suggestion that any of the companies named were involved in the unusual share price moves. None of the seven responded to requests for comment. Source: FT

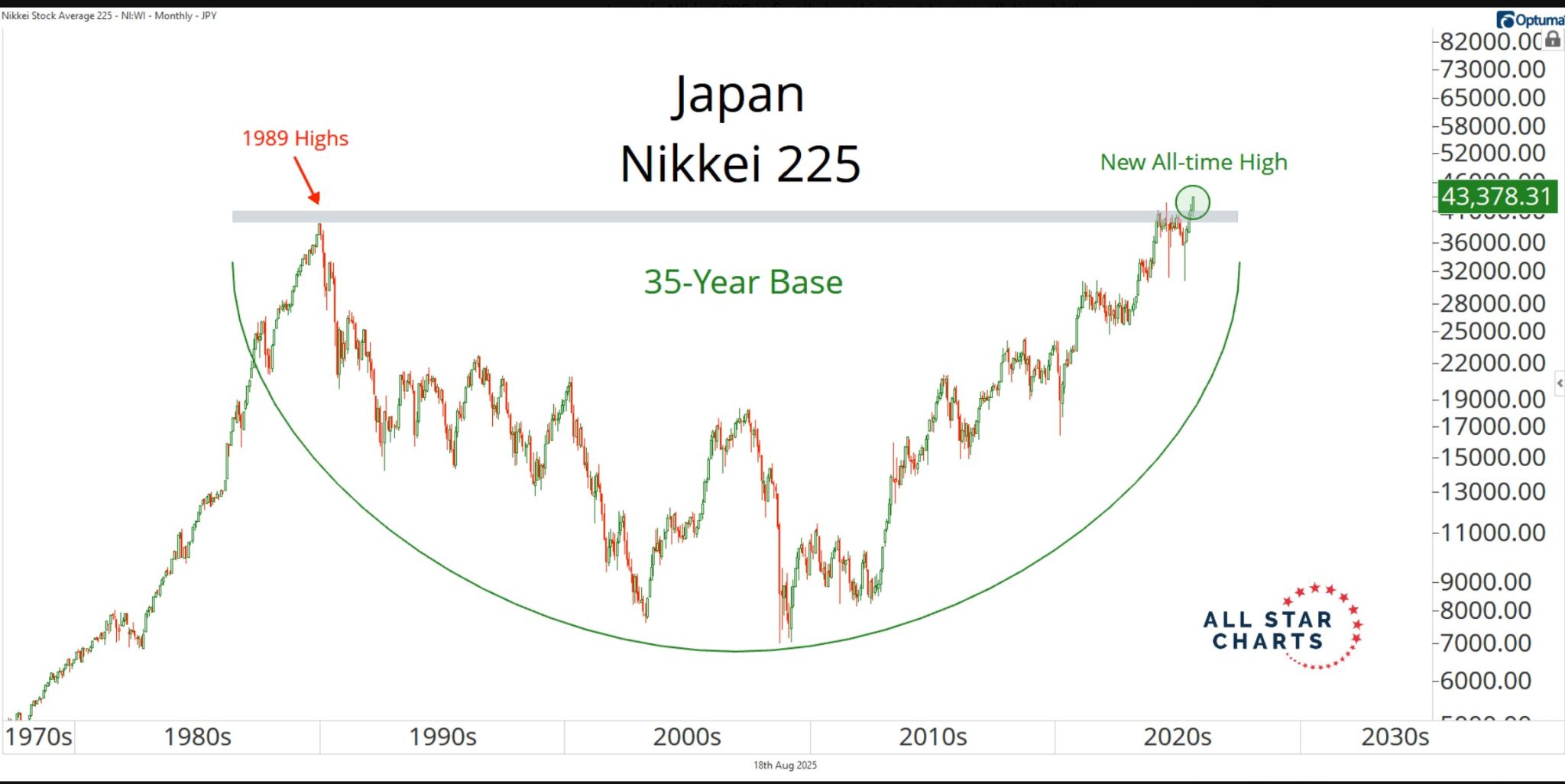

Japan’s Nikkei 225 is finally breaking out to new all-time highs.

It took 35 years to surpass the 1989 highs. Source: J-C Parets

Chinese Stocks jump to highest prices in more than a decade

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks