Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Based on futures market positioning, hedge funds and asset managers have been missing the rally

Source: Trend labs

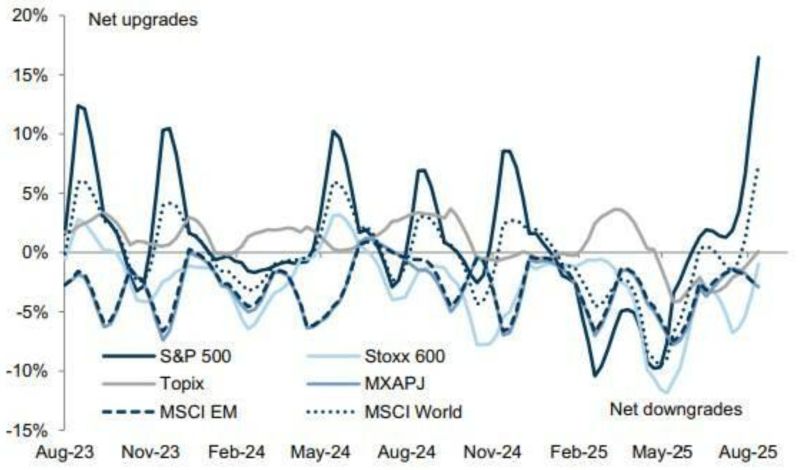

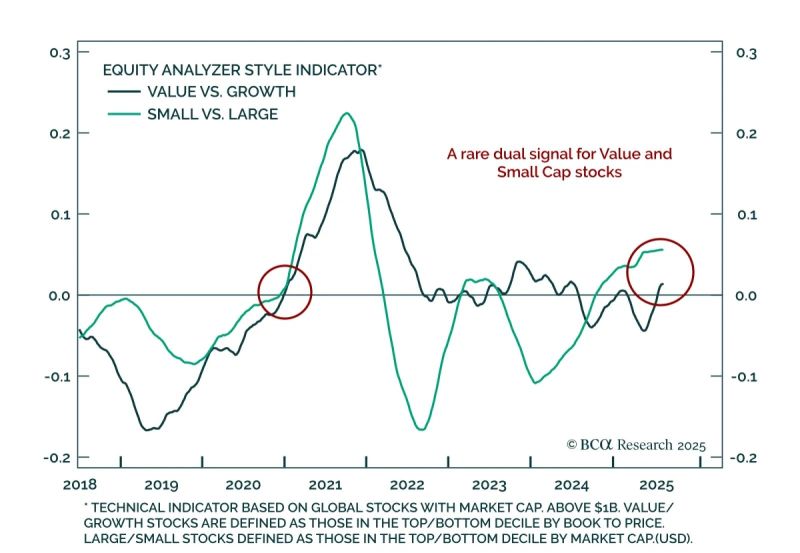

This is BCA's "Chart Of The Week": Has momentum turned in equities?

Two momentum signals: 1) Value vs. Growth just flipped positive for the first time since mid-2024. 2) Small vs. Large has been rising since late 2024. BCA team noted this rare alignment has historically fueled multi-quarter cyclical outperformance. Source: BCA

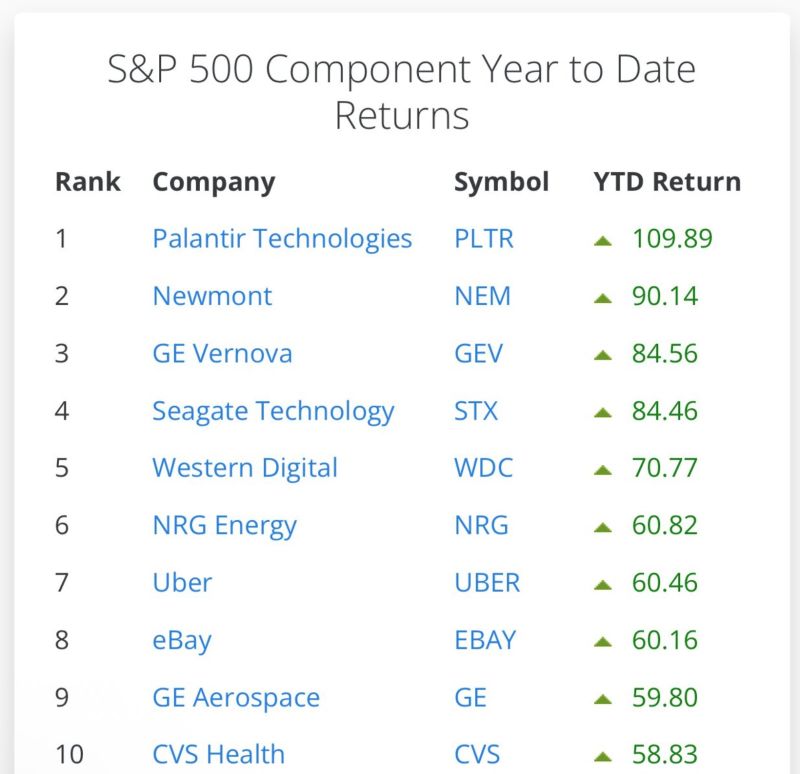

This is a composite of stocks that trade on the world's most important stock exchange.

After consolidating for about 10 months, the NYSE Composite Index just closed at the highest levels ever. Source: J-C Parets

SP500 market breadth has been improving

Indeed, 68% of S&P 500 stocks are now trading above their 200-day moving average, the most this year 📈 Source: Barchart

Chinese stocks are on 🔥

- Turnover nearly 2 trillion yuan in the morning session - CSI 300 within 1% of 2022 high - Technicals signaling short-term overheating. Meanwhile, HSBC lifts China index targets: "We lift our end-2025e target for SHCOMP to 4,000 (from 3,700), CSI300 to 4,600 (from 4,300), and SZCOMP 13,000 (from 11,500) given the abundant liquidity" Source: David Ingles, Bloomberg

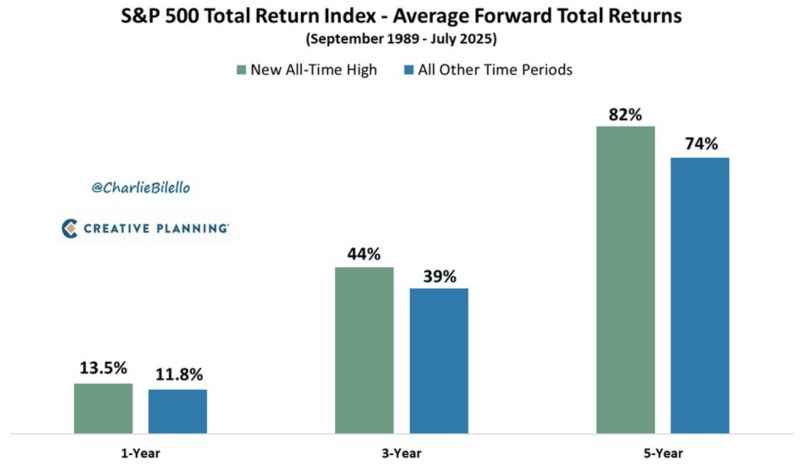

😨 Worried about investing at all-time highs?

History says you shouldn’t be. Since 1989, forward returns after new highs have actually been better than at other times: 1yr: +13.5% vs +11.8% 3yr: +44% vs +39% 5yr: +82% vs +74%. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks