Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

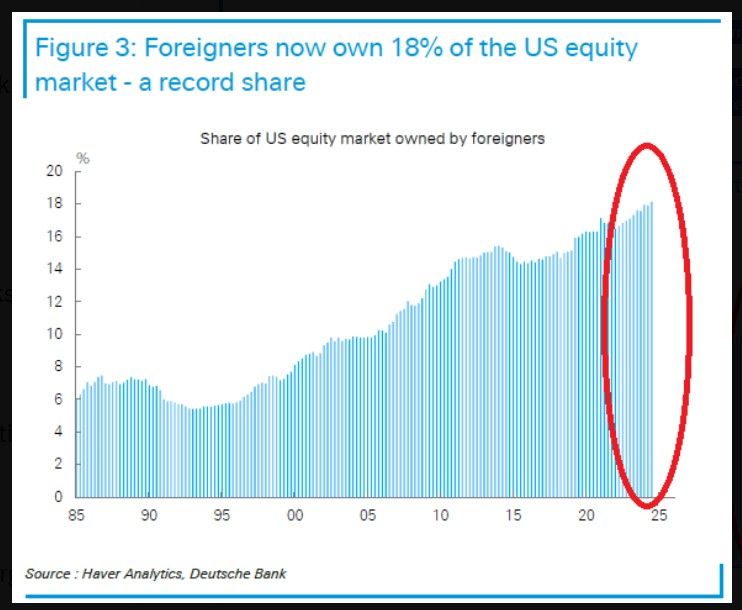

Foreigners own more US stocks than EVER

Overseas investors now own a RECORD 18% of the US equity market. Foreign investors collectively own ~$20 trillion of US stocks and ~$14 trillion in US debt, including Treasuries, mortgage and corporate bonds, according to Bloomberg. Source: Global Markets Investor, DB, Haver analytics

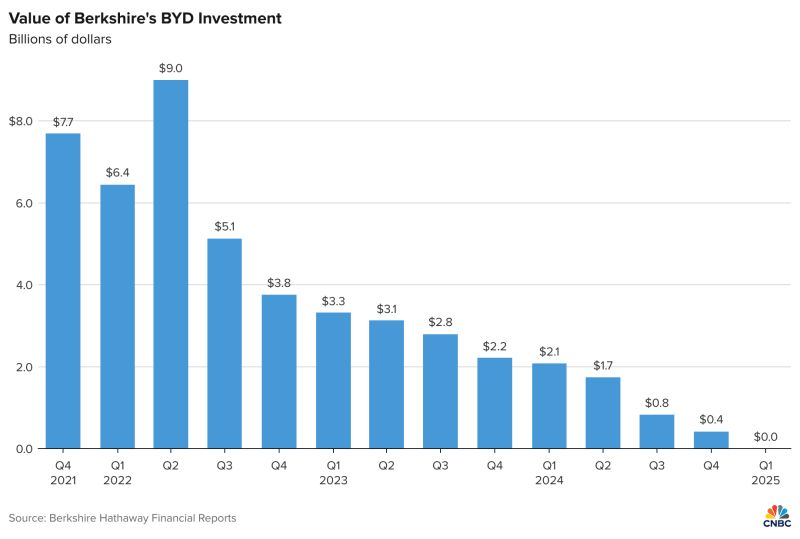

Warren Buffett and Berkshire Hathaway $BRK.B no longer own any shares of BYD - CNBC

Source: Evan

The Fed has cut rates by 25bps 47 times since 2000

Here’s how $SPY usually reacted the next week, month, quarter, and year. Source: Trend Spider

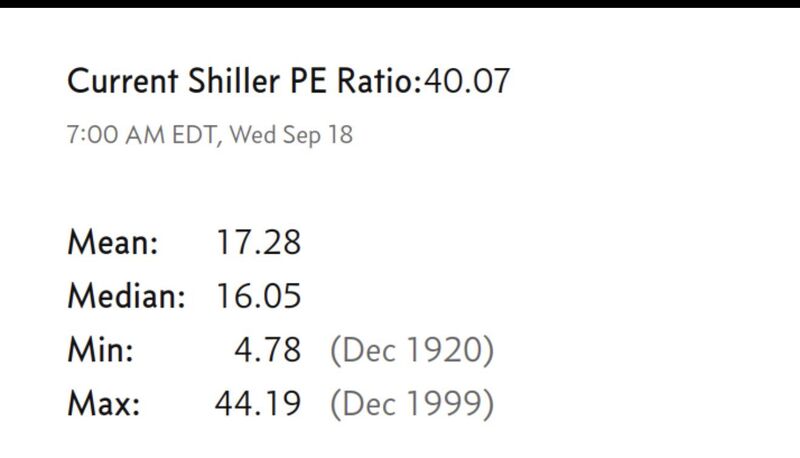

The Schiller P/E has hit 40 for the second time in history since the dotcom bubble.

Source: The Great Martis @great_martis

In case you missed it...

The Russell 2000 has joined the Dow, S&P 500, and Nasdaq 100 in hitting a record high – its first since 2021. That ends the longest drought without a new high in Russell 2000 ETF history. Source: J-C Parets

Yesterday's Russell 2000 heatmap by Finviz

That's a lot of green...

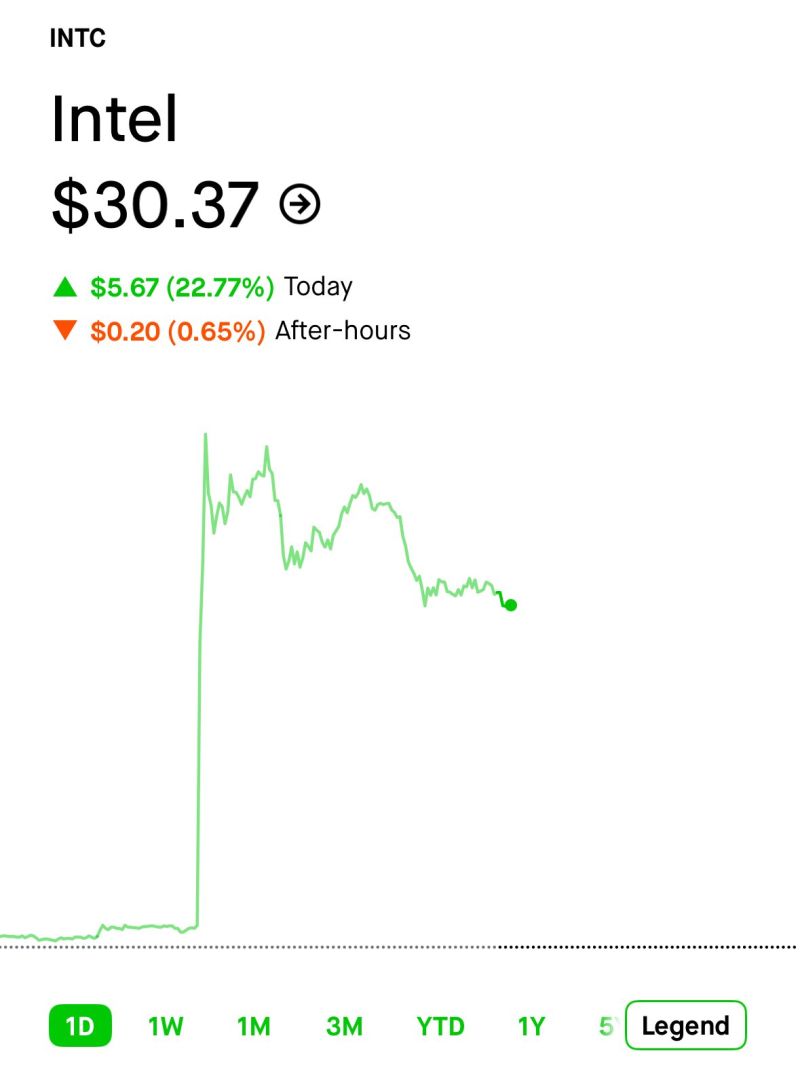

Intel $INTC stock just had its best day since OCTOBER 1987

Nvidia said it will invest $5 billion in Intel as part of a deal to co-develop data center and PC chips with the troubled chipmaker. The Trump administration brokered a 10% stake in the chipmaker in August. The investment, which is subject to regulatory approvals, does not appear to include the manufacturing of Nvidia chips with Intel's foundry. Source. CNBC

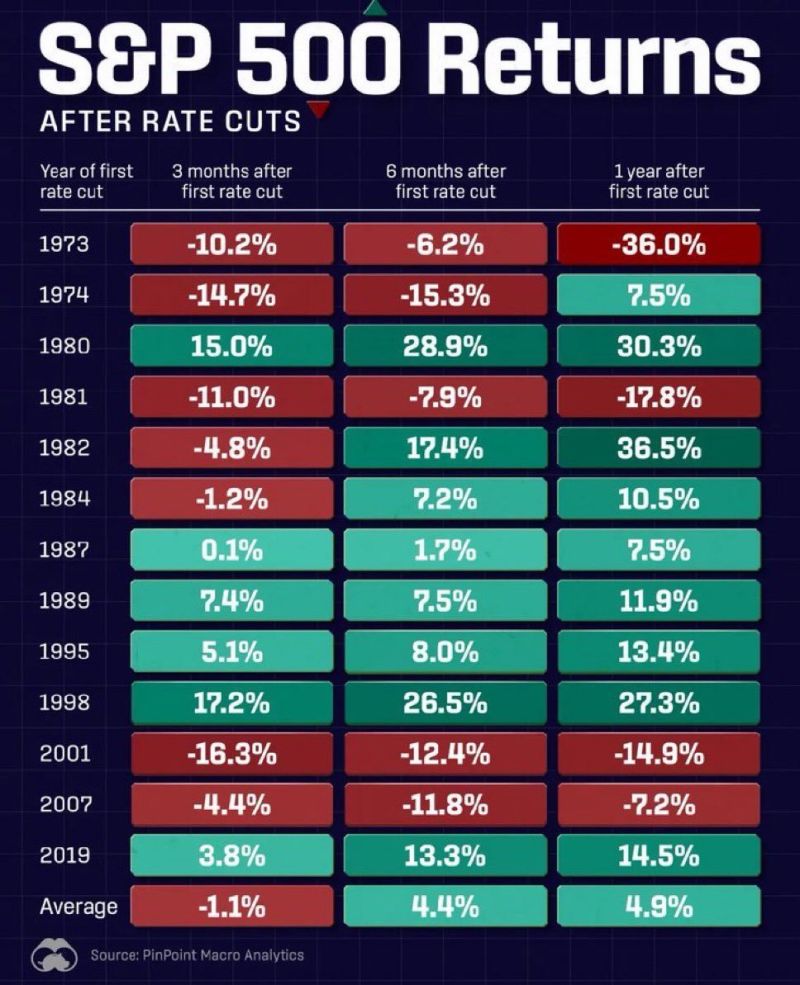

Here's how the S&P 500 has performed in the past after the Fed starts cutting rates

Source: Evan @StockMKTNewz

Investing with intelligence

Our latest research, commentary and market outlooks