Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Billion dollar companies with no revenues.

$RGC Regencell Bioscience $QMMM QMMM $DGNX Diginex $TMC TMC the metals company $OKLO Oklo $TMQ Trilogy Metals $ASTS AST SpaceMobile $RGTI Rigetti Computing $QS QuantumScape $CRML Critical Metals $LAC Lithium Americas $PPTA Perpetua Resources $USAR USA Rare Earth $JOBY Joby Aviation $NNE NANO Nuclear Energy $NXE NexGen Energy $ACHR Archer Aviation $QUBT Quantum Computing $SERV Serve Robotics Source: Lin @Speculator_io

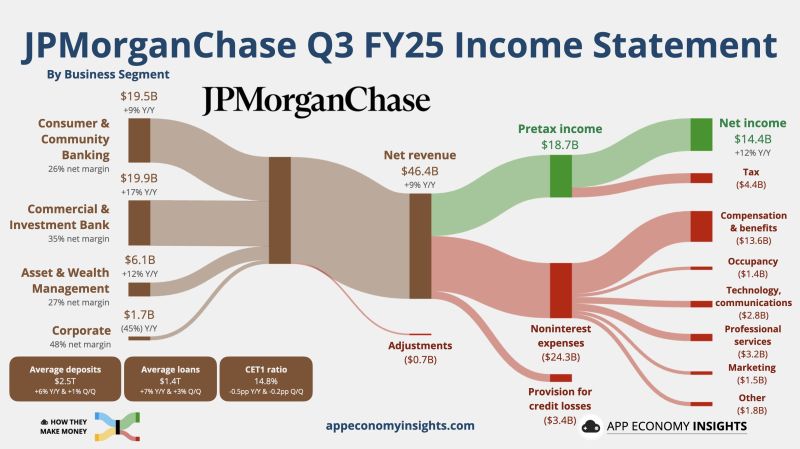

J.P. Morgan Crushed Q3 Earnings Estimates as Wall Street’s Dealmaking and Trading Revenue Explosion Drive Revenue Beat

JPMorgan just beat Q3 2025 earnings with net income jumping 12% to $14.4B ($5.07/sh), vs estimates of $4.85-$4.87 per share Revenue climbed 9% year-over-year to $46.4 billion, topping the $45.3-$45.5 billion Street expected. What Drove This? - Investment Banking: IB fees surged 17% to $2.6B as JPM stays #1 on the IB deal making tables for fees - Trading: Trading revenues were also up 25% this quarter to $8.94B despite Q3 being generally slower in markets - Loans: Net Interest Income (NII) came in at $24.1B, up from previous quarters, management raised guidance for 2025 The bank maintained solid capital ratios with ROE at 17% and ROTCE at approximately 19-21% What Happens from Here? - CEO Jamie Dimon noted the U.S. economy showed resilience during Q3 but cautioned about “significant risks” - These include tariffs, trade uncertainty, geopolitical tensions, fiscal deficits, and elevated asset prices - He mentioned that JPM was prepared for a variety of outcomes $JPM JPMorganChase Q3 FY25. • Net revenue +9% Y/Y to $46.4B ($1.5B beat). • Net Income +12% Y/Y to $14.4B. • EPS: $5.07 ($0.23 beat). • FY25 NII ~$95.8B ($0.3B raise). Source: App Economy Insights @EconomyApp Perplexity Finance @PPLXfinance

OKLO

One year ago: $OKLO $9/share, $0 in revenue. Today: $OKLO $175/share, still $0 in revenue. Source: Trend Spider

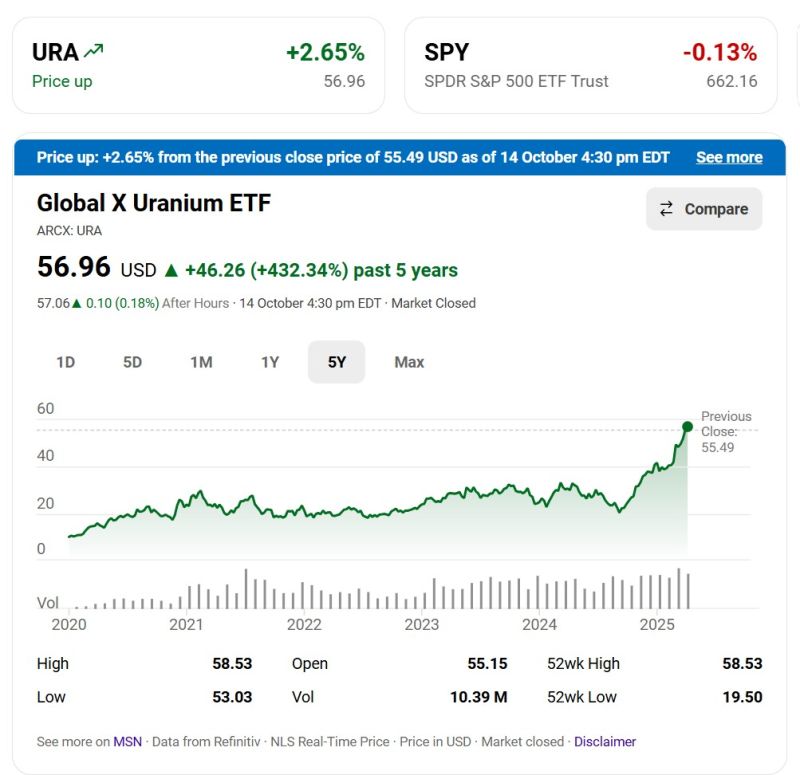

$URA Global X Uranium miners ETF was up another +2.7% yesterday.

It is up +432.34% over the past 5 years

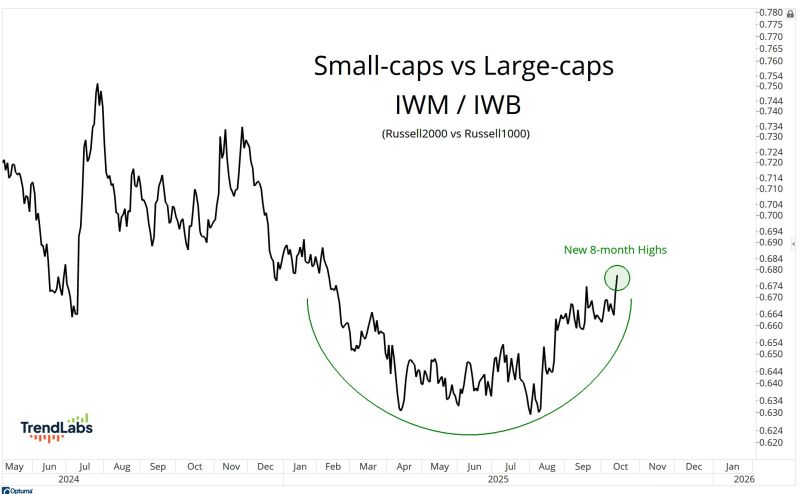

US small-caps yesterday hit the highest levels since February relative to Large-caps

Source: J-C Parets

Quantum stocks surged yesterday after @JPMorgan’s $10B strategic tech investment sparked institutional inflows.

Major movers like $RGTI, $QBTS, $IONQ & $QUBT are up today. Source: Vest @VestExchange

Goldman Sachs basket YTD performances:

1/ GS US Drones + 128.7% 2/ GS US Quantum Computing +124.7% 3/ GS Meme stocks +73.4% Source: RBC, GS

In case you missed it... A UBS fund has 30 per cent of its portfolio tied to the failed First Brands Group

UBS O’Connor, a private credit and commodities specialist owned by the Swiss bank, revealed that 30 per cent of the exposure in one of its funds is tied to the auto parts group. O’Connor recently told investors in its “Opportunistic” working capital finance strategy that the fund has 9.1 per cent of “direct” exposure and 21.4 per cent of “indirect” exposure. Overall, UBS has more than $500mn of exposure to First Brands’ debt and invoice-linked financing, according to bankruptcy filings. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks