Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

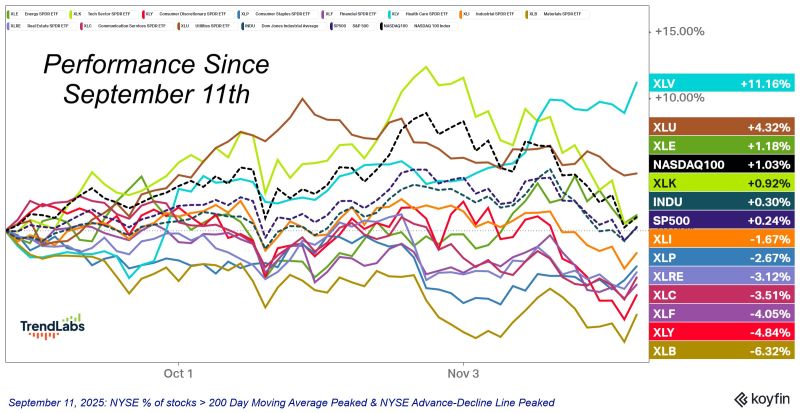

The correction of the US equity market turned 10 weeks old on Thursday.

Here's what the sector rotation we've seen looks like underneath the surface. Source: J-C Parets

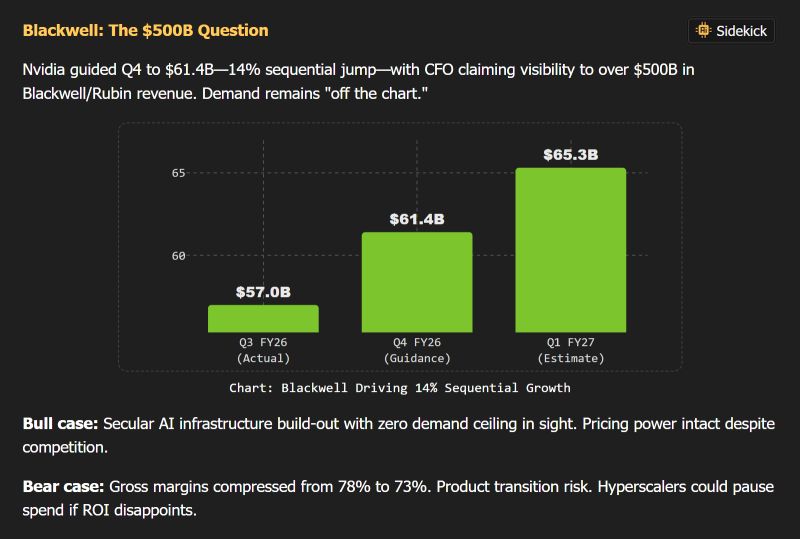

Nvidia: What’s the Bull Case? What’s the Bear Case?

🐂 Bull Case: The AI infrastructure boom is still in its early innings. Demand has no visible ceiling, and Nvidia continues to command extraordinary pricing power despite new entrants. Every major hyperscaler, enterprise, and startup is still rushing to deploy more compute. 🐻 Bear Case: Gross margins have slipped from 78% → 73%. The product transition introduces execution risk. And if hyperscalers don’t see the ROI they expect, they could slow down spending — even temporarily. What does Nvidia say? On the earnings call, the CFO addressed it directly: ➡️ AI demand remains extremely strong — strong enough that Nvidia is raising Q4 guidance again. Source: Bloomberg Activate to view larger image,

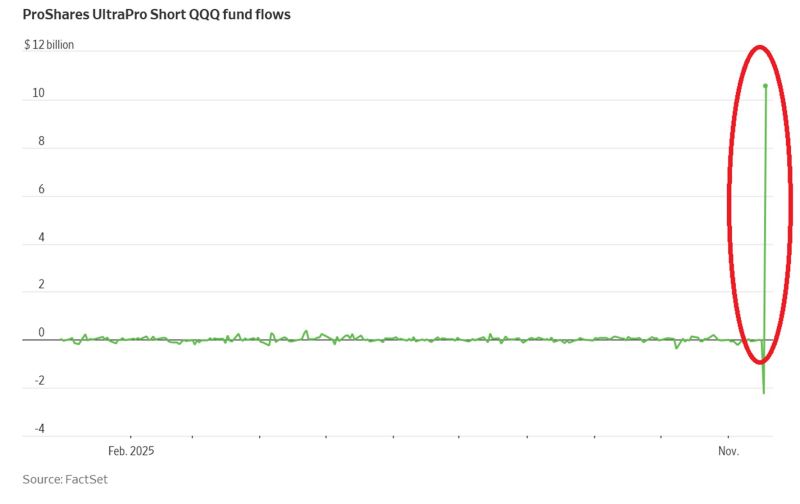

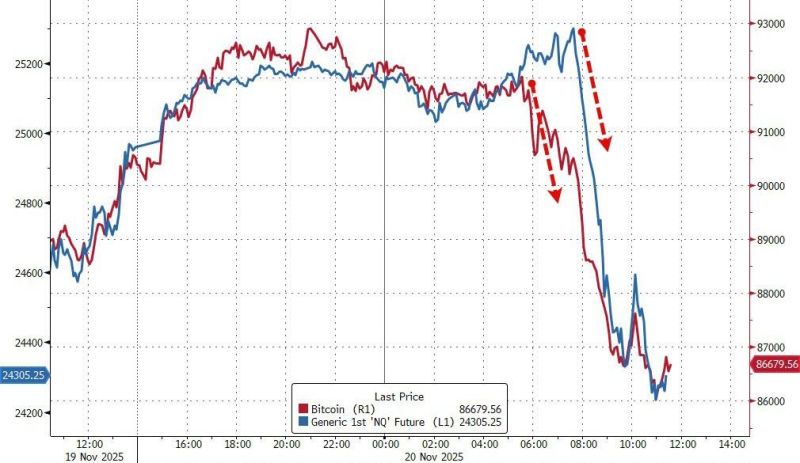

🔴The 3x leveraged short Nasdaq 100 ETF, $SQQQ, saw +$12 BILLION in net inflows on Thursday, the largest daily inflow on record in data going back to 2010.

This means some investors bet hugely that the tech stocks will decline. Many retail investors are piling into investment products they do not understand.. This will not end well. Source: Global Markets Investor

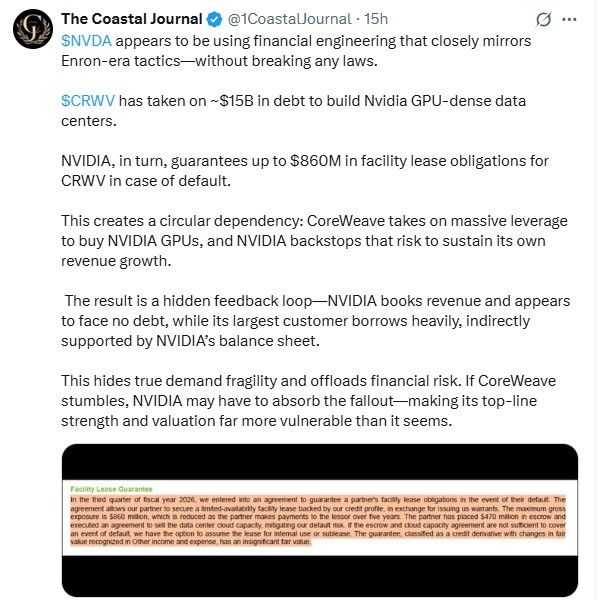

We are seeing a lot of threads on X talking about Nvidia using financial engineering to boost results.

See one example below from The Coastal Journal.

According to a Bloomberg article, Michael Saylor’s company, Strategy $MSTR, faces one of its most significant challenges yet:

the risk of being removed from major stock indexes like the MSCI USA and the Nasdaq 100, according to JPMorgan analysts. Such exclusions could trigger up to $2.8B in outflows from MSCI-linked funds alone and threaten nearly $9B of passive exposure tied to the company. A decision is expected by January 15, 2026. The threat strikes at the core of Strategy’s identity. The firm became a mainstream proxy for bitcoin by issuing stock to buy bitcoin, then using rising BTC prices to fuel more issuance and accumulation. At one point, the company traded at a large premium above its Bitcoin reserves — but that premium has now evaporated, reflecting weaker investor conviction. MSCI is reconsidering its index rules, proposing to exclude companies whose digital asset holdings exceed 50% of total assets, classifying them more like investment funds. This puts Strategy directly in the crosshairs. Meanwhile, both Bitcoin and Strategy’s share price have plunged, with the stock down more than 60% from its peak and Bitcoin down over 30% from its recent high—breaking the feedback loop that once boosted Strategy’s valuation with each BTC purchase. Its equity now trades only slightly above the value of its Bitcoin holdings. Despite the pressure, Saylor continues aggressively buying Bitcoin—adding 8,178 BTC this week, bringing total holdings to 649,870 BTC.

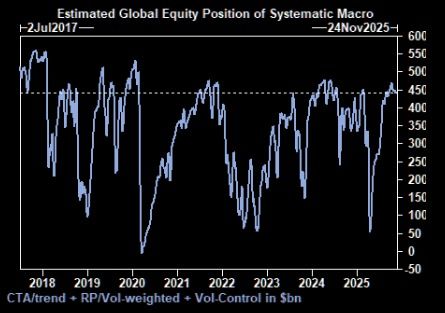

If markets keep sliding, Goldman’s “down big” scenario implies CTAs could unload ~$220bn of global equities over the next month.

Source: The Market Ear, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks